Americans Are Worried About Tax Debt in 2021 As a Result of the Pandemic Recession

This post was contributed by Mike Brown of LendEDU.

From record unemployment numbers to regret amongst homebuyers who have taken out a mortgage, the coronavirus pandemic and subsequent recession have created a deluge of financial problems in the United States.

Chief among those problems has been just the everyday financial grind faced by countless Americans, especially those who have gotten laid off as a result of the pandemic.

Since the pandemic hit home here in the U.S., households throughout the country have had to figure out how they are paying for rent, groceries, bills, and student loans in the midst of a massive economic crisis.

As a result, many folks had to take drastic financial measures in order to stay afloat and get by. People had to draw from retirement accounts early or sell stocks prematurely to access additional funds to keep going.

Additionally, millions of Americans began receiving unemployment benefits after losing their jobs during the coronavirus pandemic.

Even during a pandemic when extraordinary consumer protections have been put in place, all three of the actions mentioned above likely lead to extra taxes once tax season rolls around.

Couple that with the fact that many Americans are still out of work and struggling mightily with their finances and you have a recipe for another looming financial disaster stemming from the coronavirus pandemic and recession.

Tax debt.

When 2020 taxes become due in 2021, there is the potential for a record-breaking amount of tax debt as many Americans simply won’t have the finances to pay all of their extra pandemic-related taxes on time.

LendEDU, a personal finance comparison site, decided to look more into this potential tax debt issue by conducting a survey of 1,000 American taxpayers with the help of survey platform Pollfish.

More Than Half of Taxpayers Worried About Tax Debt in 2021 Due to the Coronavirus & Its Economic Impacts

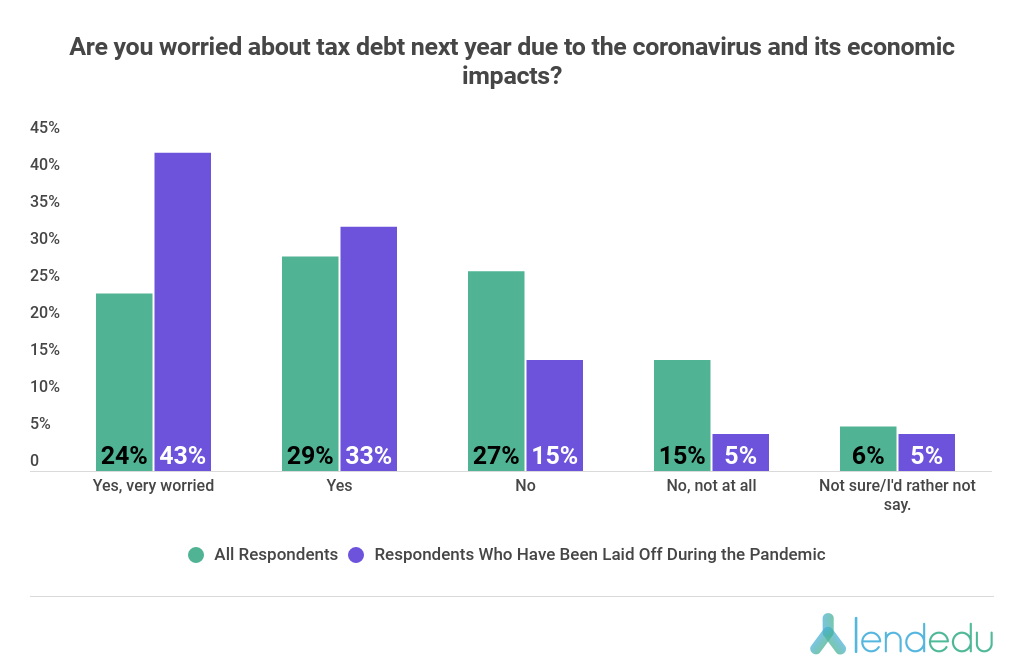

The tax study from LendEDU first asked all 1,000 poll participants the following: “Are you worried about tax debt next year due to the coronavirus and its economic impacts?”

Here’s how they answered: LendEDU found that a combined 53% of taxpayers are worried about having tax debt next year when 2020 taxes are due because of the coronavirus pandemic and recession that followed. Specifically, 24% of respondents are “very worried” and 29% are worried.

LendEDU found that a combined 53% of taxpayers are worried about having tax debt next year when 2020 taxes are due because of the coronavirus pandemic and recession that followed. Specifically, 24% of respondents are “very worried” and 29% are worried.

By comparison, a combined 49% are not concerned about tax debt next year with 15% answering “no, not at all.” Just 6% of respondents are not sure either way.

When LendEDU filtered results to include only respondents who have gotten laid off due to the pandemic, a combined 76% are worried about tax debt in 2021 while only a combined 20% are not.

If you do find yourself in tax debt next year as a result of the coronavirus pandemic, it’s important to understand all of your available options, like the ability to settle your tax debt with the IRS through something like an installment agreement or offer-in-compromise.

Or, you could consider tax relief options, which could include any number of things to help you relieve tax debt. There are a number of tax relief companies and tax resolution services that may be able to help you in your quest to eliminate or reduce tax debt.

Diving back into the data, LendEDU then looked into possible reasons why taxpayers are quite worried about tax debt in 2021 stemming from the pandemic.

70% Concerned That Unemployment Benefits Collected During Pandemic Will Lead to Larger Tax Bill in 2021

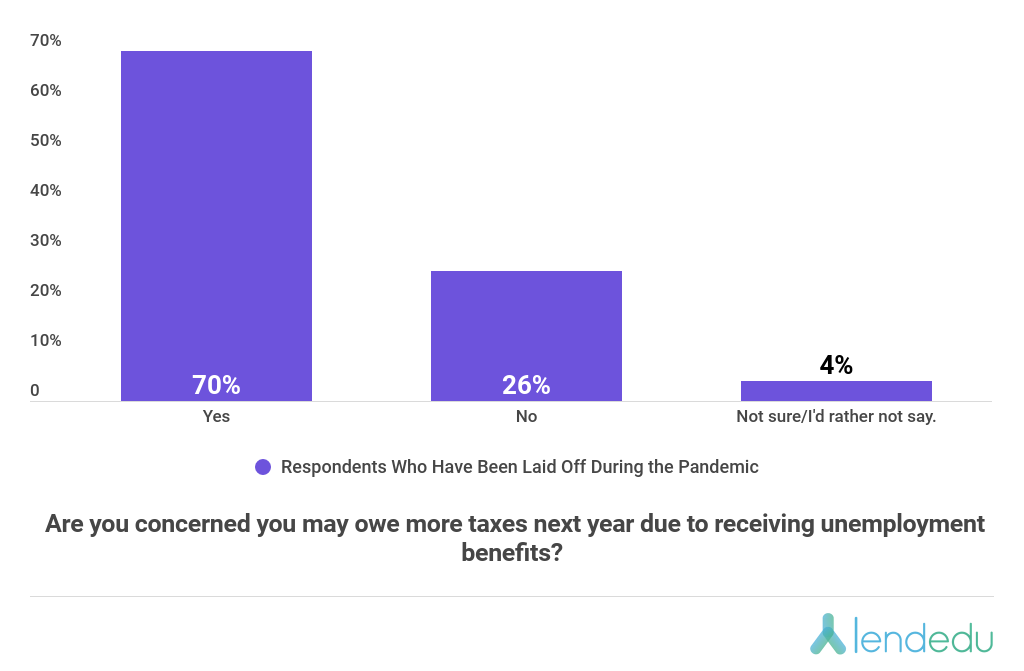

As mentioned above, taking unemployment benefits usually means a heavier tax burden as they are taxable on the federal level and in most states as well.

The vast majority of respondents that took on unemployment benefits are indeed concerned about a heavier tax burden in 2021:

70% of poll participants that received unemployment benefits as a result of the pandemic recession are worried about having a larger tax bill come tax season next year, while just 26% are not concerned.

70% of poll participants that received unemployment benefits as a result of the pandemic recession are worried about having a larger tax bill come tax season next year, while just 26% are not concerned.

78% That Drew From a Retirement Account During Pandemic Worried About Larger Tax Bill Next Year

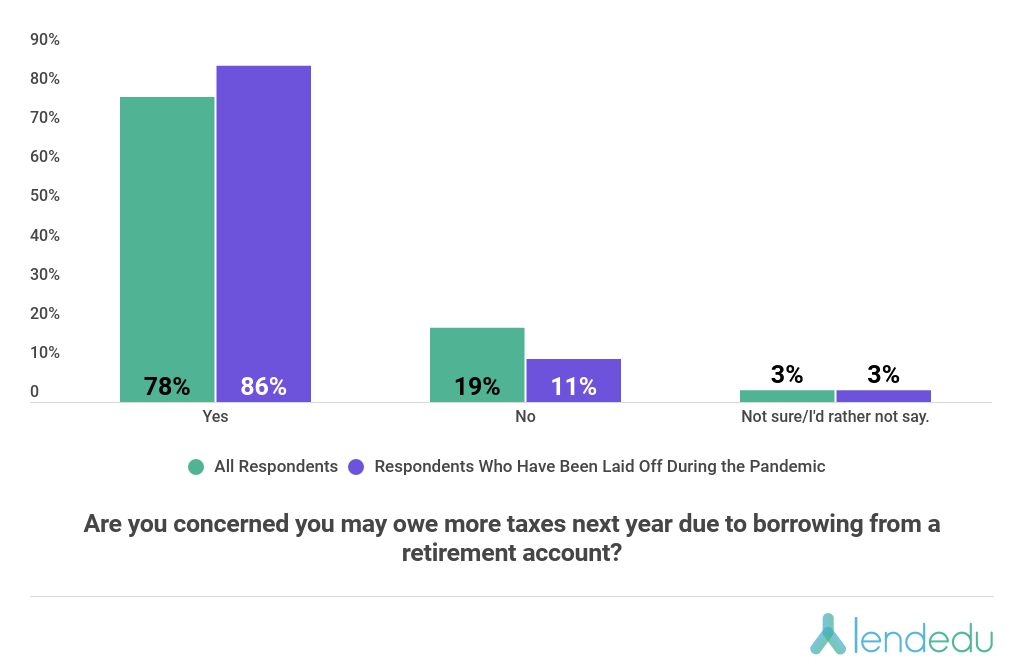

Next, LendEDU asked respondents that drew from a retirement account prematurely to stay afloat during the pandemic recession if they are worried about owing more taxes next year.

Here’s what the data said:

78% of respondents are indeed stressing over a larger tax bill in 2021 as a result of drawing from a retirement account early to maintain their personal finance health. Only 19% are not.

Amongst just respondents that were laid off and drew from a retirement account, 86% are concerned over having more taxes to repay next season.

While the IRS did make changes, like waiving the penalty tax for early withdrawals up to $100,00, to make it easier for Americans to use money from their retirement accounts, there is still likely going to be additional income tax that will need to be paid.

It’s possible that legislators make changes to tax credits or tax deductions which could change how early withdrawals are taxed so its important to stay updated on any news regarding tax policy.

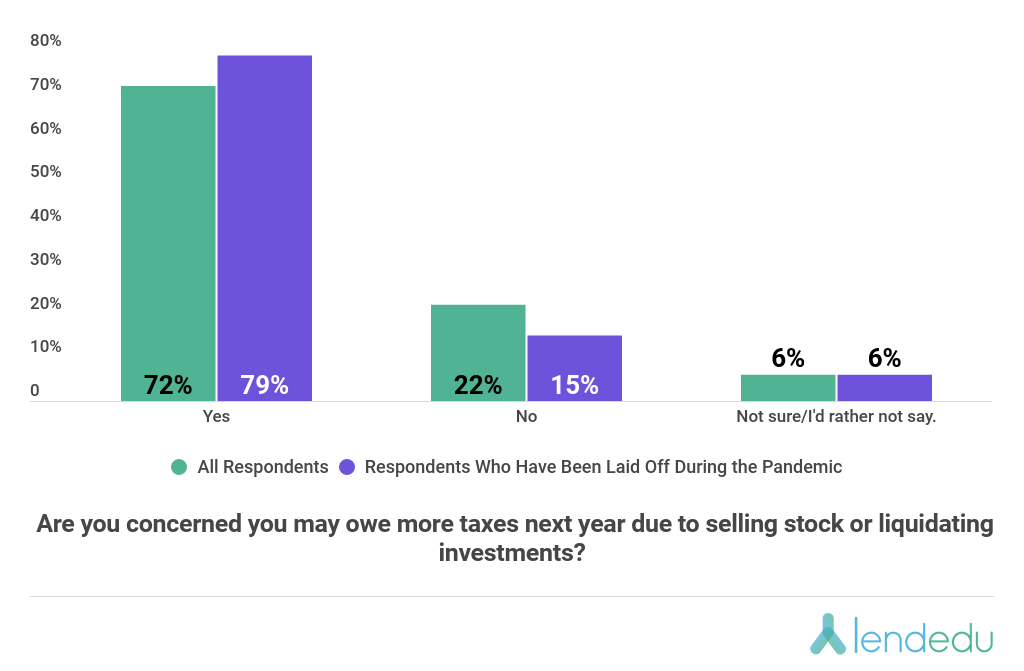

72% Worried About Early Stock Sales Leading to More Taxes

Finally, LendEDU asked respondents that had to sell stocks early because of the pandemic recession if they are worried about more taxes.

And the results came in like this:

72% of applicable poll participants are concerned that liquidating their stocks during the pandemic is going to lead to a larger 2020 tax obligation in 2021, while just 22% are not.

When only counting respondents that have been laid off, 79% are worried about having more taxes to repay in 2021, while just 15% are not.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…