Looking Back at the Biggest Financial Challenges Created by the Coronavirus Pandemic

This post was contributed by Mike Brown of LendEDU.

Unfortunately, the coronavirus pandemic continues to ravage the global community, and many of the unprecedented changes that were necessarily implemented to help combat the spread of the virus, like social distancing and reduced business capacities, are still in effect today.

That being said, the intensity by which the coronavirus pandemic dominated our everyday lives has certainly decreased from its high point in mid-March to May.

From those challenging months up until today, LendEDU has been conducting a series of surveys using Pollfish to gauge how COVID-19 has impacted the everyday lives of Americans, especially as it pertains to their finances.

The surveys from LendEDU ranged from asking student loan borrowers how close they were to student loan default before the CARES Act was enacted to surveying recent homebuyers to see if there was any regret after taking out a mortgage during the pandemic.

Between the series of surveys from LendEDU, the common theme was that the coronavirus pandemic has had a devastating financial impact on countless Americans, and it will take quite some time for many of them to recover from the challenges they have faced during this uncertain time.

Keeping Up With Growing Expenses Without Running Out of Money Was a Major Concern

When the coronavirus pandemic first began seriously impacting the U.S., LendEDU conducted three surveys of 1,000 adult Americans within roughly a 45-day window.

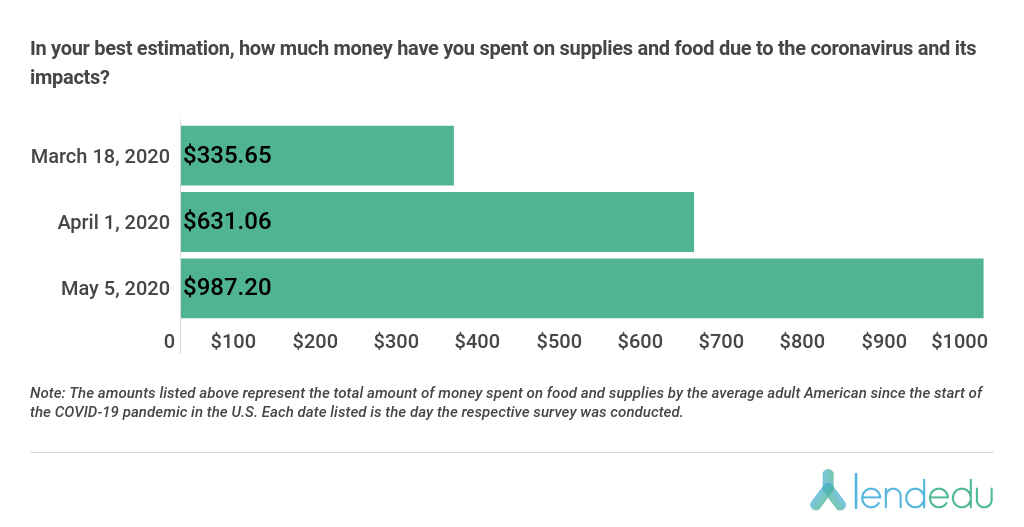

As one survey led to another, it became clear that American consumers were dealing with rapidly rising expenses as a result of preparing for the pandemic by stocking up on things like food, toilet paper, and most likely alcohol.

By the time of LendEDU’s third survey, which was conducted on May 5th, the average adult American had racked up a $987.20 bill due to pandemic preparations. This represented a 94% increase from LendEDU’s initial survey on March 18th.

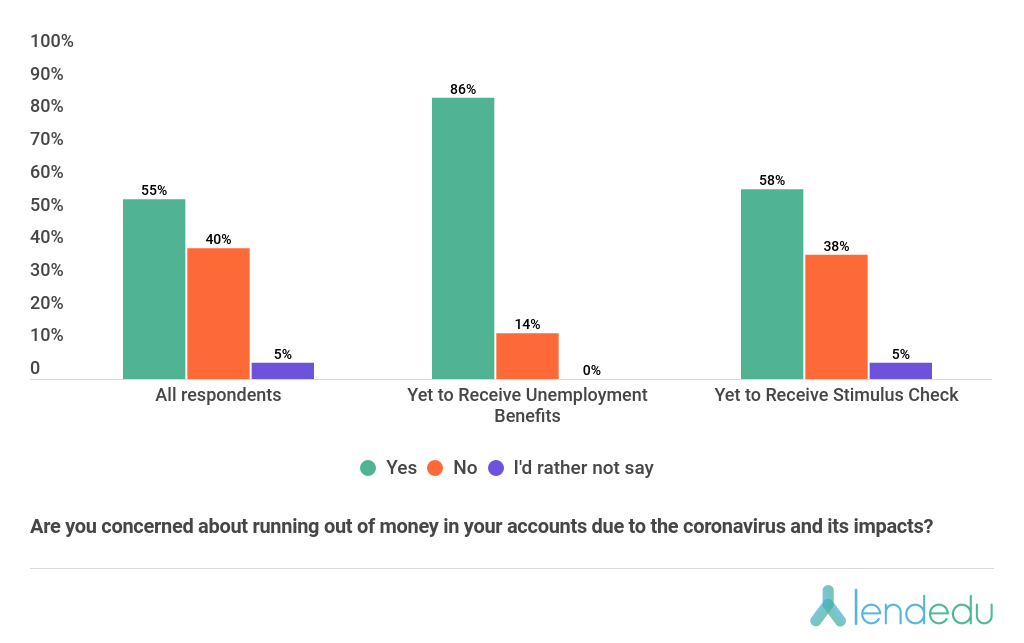

Not surprisingly, LendEDU found that the rising expenses due to COVID-19 led to many Americans being concerned about running out of money or taking on too much debt from credit cards.

Not only were 55% of Americans worried about running out of money in their accounts due to COVID-19 expenses and preparations, but 45% had to draw upon funds from an emergency or savings account, while 33% had to take on more credit card debt than they would have liked in order to meet bills.

In the coming months, it will be crucial to monitor how Americans recover from this sudden and heavy financial commitment that left many of their accounts severely depleted.

Retirement Savings Were (Or Still Are) in Jeopardy

Another fallout from the early days of the coronavirus pandemic was a historically bad performance from the stock market.

When markets began plummeting in late February, the financial crash was the fastest fall for global stock markets in financial history, while also being the most devastating crash since the Wall Street Crash of 1929.

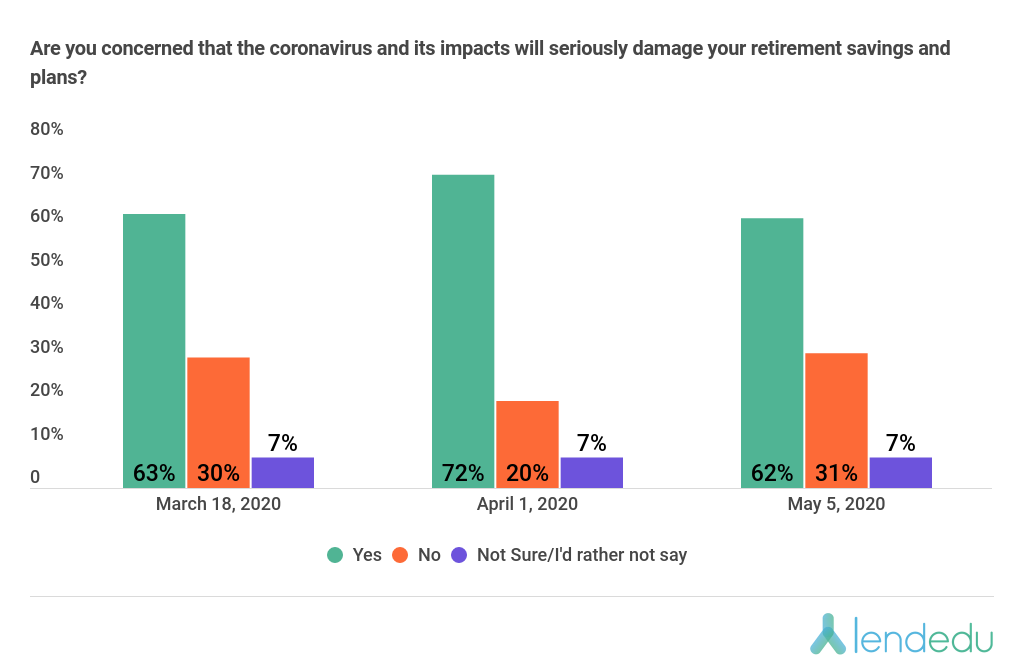

LendEDU surveyed adult Americans with retirement accounts and asked them if they were worried that the pandemic would seriously damage their retirement savings and plans.

As the above graphic depicts, more than half of all adult Americans with retirement accounts were concerned that their retirement savings might be in jeopardy. Specifically, 62% of Americans had this fear on May 5th.

Student Loan Borrowers Were Saved by the CARES Act

With or without the coronavirus pandemic, the U.S. faces a major student loan debt crisis that has the average student loan borrower owing $29,076 upon leaving a college campus.

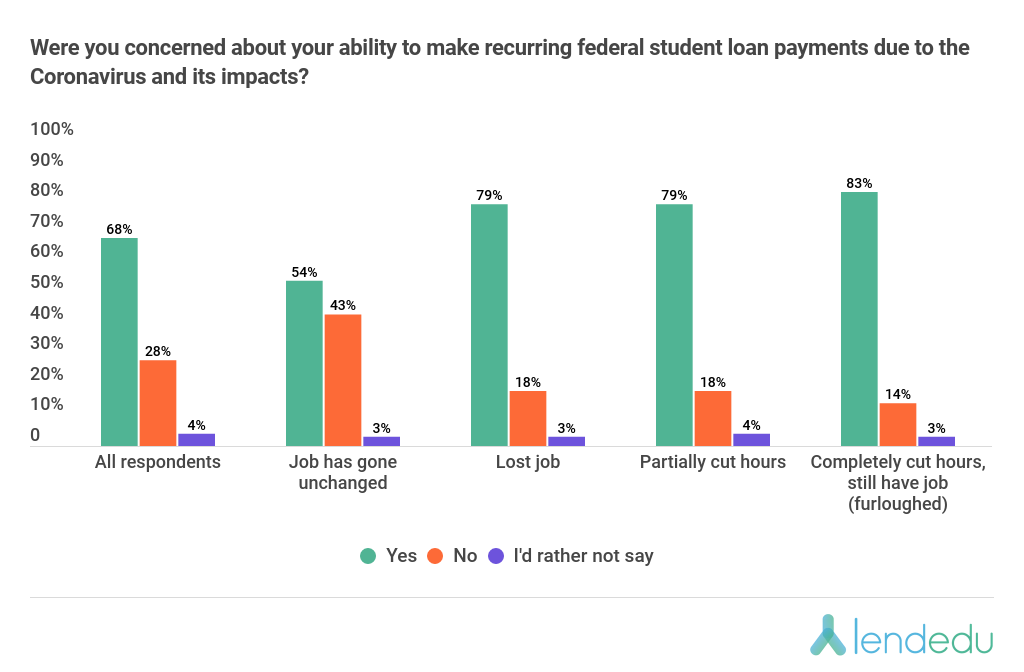

Now throw in the economic impacts of the coronavirus pandemic and LendEDU found that many student loan borrowers in repayment were concerned over their ability to make monthly payments.

68% of all adult Americans with some amount of federal student loan debt were worried they could not make their recurring student loan payments according to the LendEDU survey.

And when it came to private student loans, 78% of respondents with private student loan debt were unsure they could continually make monthly payments.

Thankfully, lawmakers in Washington D.C. were able to pass the CARES Act on March 27th, which placed all federal student loan borrowers in pandemic forbearance until the new year so that no student loan payments were not required and interest would not accrue.

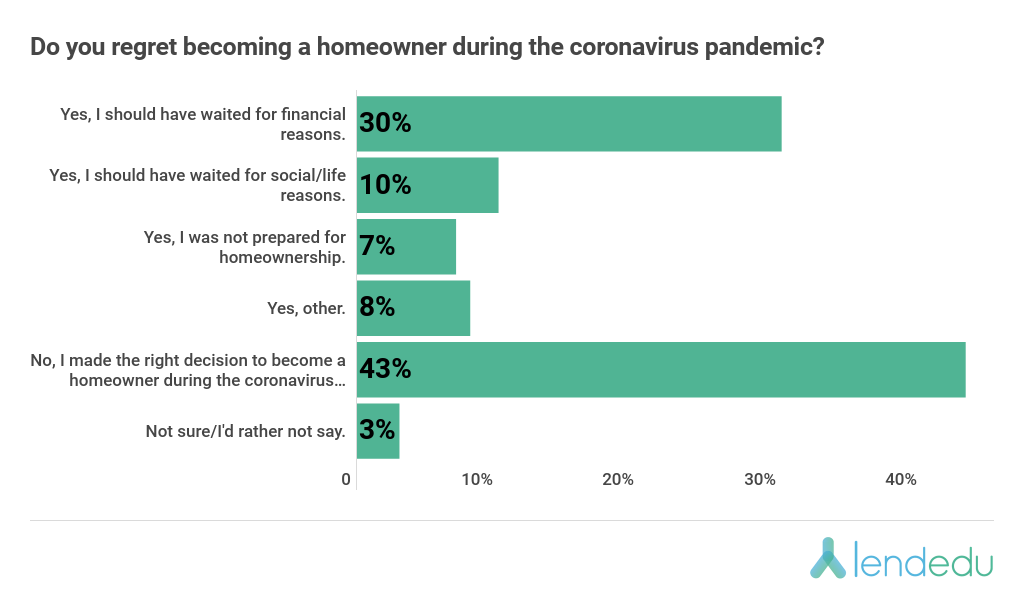

Regret Runs High Amongst Pandemic Homebuyers

One of the more interesting developments during the coronavirus pandemic has been that mortgage rates have been at record-lows which has led to an uptick in home buying despite being in an official recession.

LendEDU conducted a final coronavirus-related survey of 1,000 American homeowners that are currently repaying a mortgage to find out if there has been any buyer’s remorse as a result of the pandemic.

Not surprisingly, LendEDU’s mortgage study found that there is plenty of regret amongst those who took out a mortgage and bought a home during the pandemic.

A combined 55% of new homeowners now regret their decision to purchase a home during the pandemic; 30% of this cohort cited financial struggles, while 10% attributed social or life reasons, and 7% said they were not prepared for homeownership.

A combined 55% of new homeowners now regret their decision to purchase a home during the pandemic; 30% of this cohort cited financial struggles, while 10% attributed social or life reasons, and 7% said they were not prepared for homeownership.

While there certainly has been a number of financial challenges during the coronavirus pandemic, in addition to all of the other challenges we have faced during this time, things will always get better eventually and that’s what consumers should remember.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…