33% of Americans Go Into Debt to Finance Extravagant Weddings

This post contributed by Mike Brown of LendEDU.

Using online polling platform Pollfish, LendEDU surveyed 1,000 recently married Americans and uncovered some interesting findings in regards to couples using debt to finance fancier weddings worthy of social media.

The study comes on the heels of a recent Washington Post story that detailed the surging trend of Americans using wedding-specific personal loans to afford extravagant weddings that will have people posting and sharing on Instagram. These loans will sometimes cover the entire cost of the ceremony and sometimes carry interest rates as high as 30%.

With so many young Americans hampered by student loan debt and with the tradition of parents covering the wedding bills dying out quickly, it appears that many engaged consumers have no other option but to turn to debt.

And, there is where the conundrum lay. If you don’t have the finances for a fancier wedding, should you really be taking on debt to extend your budget? Do recently-married Americans regret taking on wedding debt? Could they have had a simpler wedding for less?

The LendEDU report looked to answer those questions, while also figuring out just how much wedding debt recently-hitched Americans are taking on.

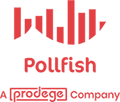

One-Third of Recently-Married Americans Took on Wedding Debt, Most of It From Credit Cards

Exactly 33% of Pollfish respondents indicated that they took on some amount of debt to cover wedding costs, while 64% did not, and 3% opted not to say.

And as expected, those that went into debt were having much more expensive weddings on average compared to the general respondent pool. Amongst all Pollfish survey participants, the average wedding cost out of their own pocket was $10,726. But, amongst only respondents that went into wedding debt, the average wedding cost ticked upwards to $17,908, nearly doubling the overall average.

How much debt did these recently-married folks take on? According to the survey data, the average amount of wedding debt incurred was a considerable $11,737.

Let’s take a look at what forms of financing were specifically being used by consumers that took on debt to afford the wedding of their social media dreams.

When it came to wedding debt, credit cards were the financial tool of choice for recently-married survey participants. Amongst those that went into debt, 86% went into credit card debt, compared to 37% that took on personal loan debt and 27% that went into another form of debt, like from a HELOC.

In terms of actual debt figures, the average amount of credit card debt incurred was $6,786, while the figure dropped to $2,874 when referring to personal loan debt. For other forms of debt that were taken on for wedding expenses, like HELOC debt, the average amount was $2,077.

With an idea of the scale of debt that is being utilized amongst recently-married Americans, LendEDU wanted to evaluate how wedding debtors were feeling about their financial decisions as they relate to affording a lavish marriage ceremony.

More Than a Few Wedding Debtors Express Financial Regret, Many Say the Wedding Debt Wasn’t Needed

As indicated above, wedding debtors spent an additional $7,182 on their ceremony compared to the overall average. And according to some questions LendEDU asked these consumers about repaying that wedding debt, the average answer was that it would take five years to repay the debt in full.

Further, 7% of debtors admitted that they have missed monthly payments associated with their wedding debt, which will have major implications on their credit score and thus their ability to qualify and receive favorable terms for other financing in the future.

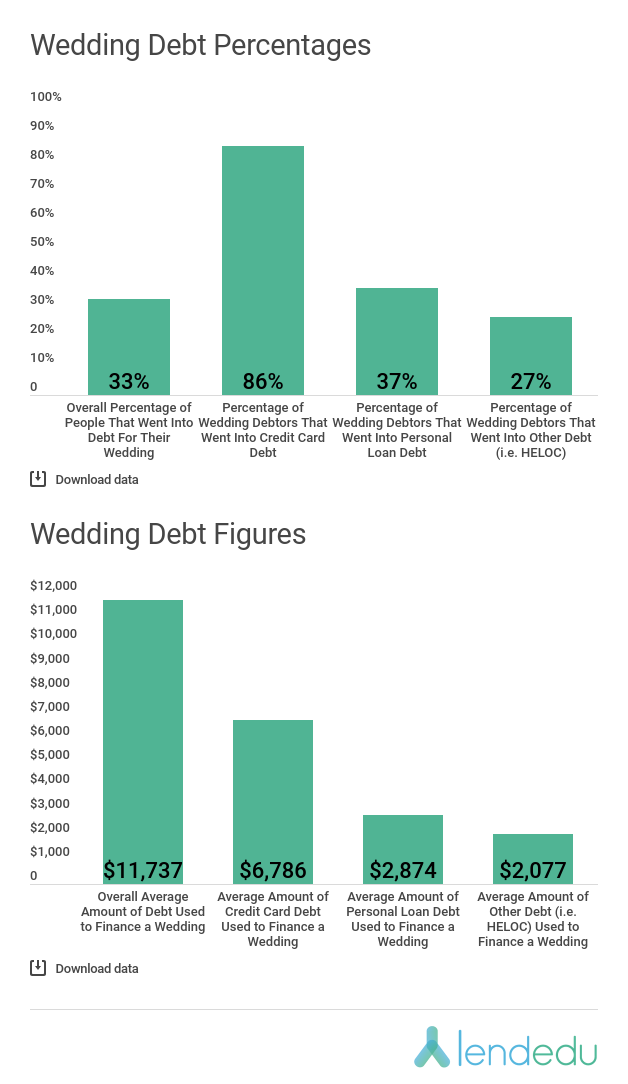

So, did these Pollfish survey participants have any feelings of regret for going into the red to jazz up their weddings?

More than one-third of respondents (37%) that financed some portion of their wedding costs with debt expressed regret over that financial decision, while 62% did not, and another 1% opted not to say. For these regretful survey participants, perhaps using debt to cover wedding costs seemed like a good idea at the time, but now that they have had at least a few months of making associated debt payments, regret appears to be setting in.

There is one subsection of respondents that more than likely regrets going into debt for wedding costs. According to the results, 14% of wedding debtors have since been divorced from the marriage that they used debt to finance. This is compared to only 9% of the general respondent pool that has experienced the same.

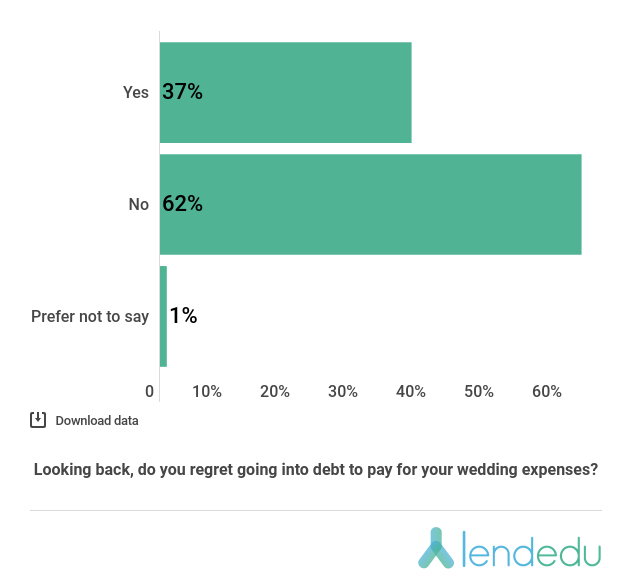

A solid contingent of recently-married consumers have had feelings of regret associated with their wedding debt, but was the debt at least necessary to have the wedding? We asked those indebted respondents.

Amongst Pollfish survey respondents that used debt to cover marriage ceremony costs, 72% of them indicated that they could have had a more simple wedding that did not require debt and could have been covered exclusively by cash savings.

In other words, these folks had to tap into debt financing to have a more extravagant wedding, which plays directly into the theme of the Washington Post story that explained how personal loans “are often marketed as a way to fund extras like custom calligraphy, doughnut displays, and ‘Instagram-worthy’ venues.”

Using Pollfish, LendEDU has gathered original data helpful to understanding consumers, developing insightful reports, and offering the right solutions to their customer base. Want great data of your own? Create an account and get started.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…