What are Gen Z’s financial priorities?

Gen Z (the generation born between 1995- 2015) is rapidly making their mark in society. Sometimes called Digital Natives, this is the first generation that has grown up with constant connectedness as a part of their daily lives.

They have had greater exposure to media and information than any generation before them, which influences their beliefs and preparation choices for their own futures and opens a new playing field for brands, agencies, and marketers to reach them where they are spending their time— across sites and apps on their devices.

As a market research tool that leverages this method to deliver surveys, we reach Gen Z respondents better than most. We released our Gen Z Survey Series to understand some of their beliefs and motivations to help uncover new opportunities for insightful campaign strategies.

Key Takeaways:

- Most Gen Z are not saving for retirement although over 90% say it is “somewhat important” to “extremely important.”

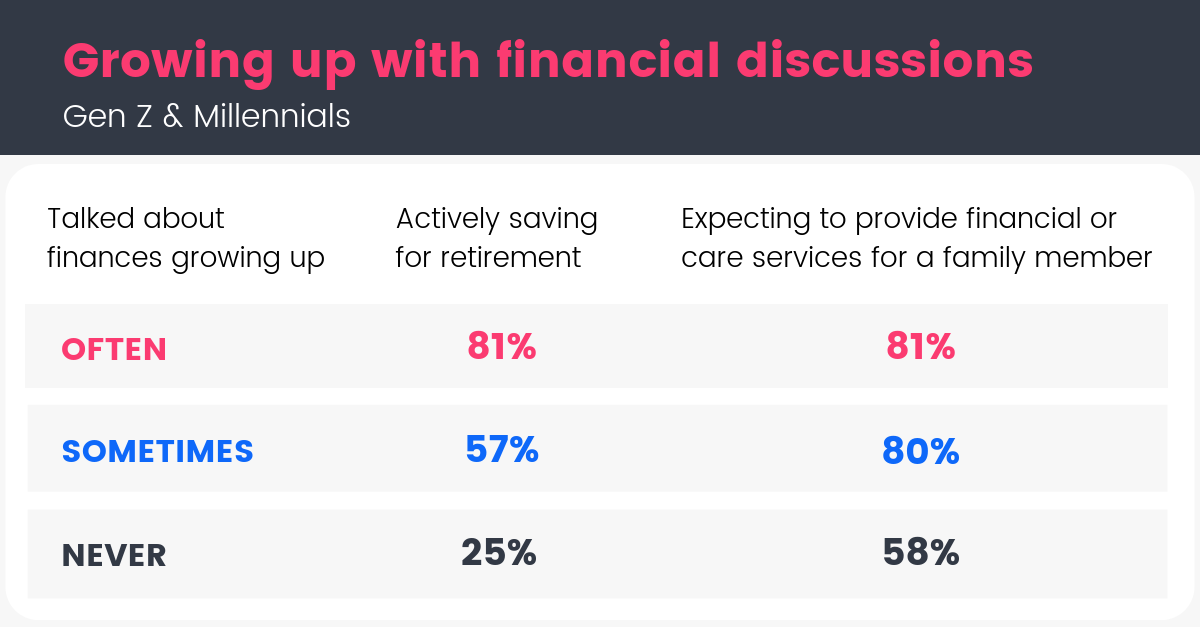

- Those who grew up in homes where finances and retirement were discussed were significantly more likely to be saving for retirement, as well as preparing to look after a family member.

- Home ownership is looking up! 70% of Gen Z expect to own their homes in the future.

- Birth rate beware. 40% of Gen Z respondents expressed either not desiring children or not expecting to have them even though they would like to.

Our findings—Financial Futures

A hallmark of Gen Z is their desire for financial security, however, rising costs of living and stagnating wages have been increasingly pressuring Americans to make trade-offs impacting their financial well-being.

Where does Gen Z place their priorities?

We found that while nearly all of Gen Z respondents believed that saving for retirement was “Extremely Important” (71%) or “Somewhat Important” (24%), most of them were not actively making any contributions to a retirement plan (58%).

Why aren’t they saving for retirement?

Of those who were not contributing, 49% cited “no disposable income” as their primary reason. Considering the oldest members of this cohort are 24 years old, this isn’t too surprising, as many are students and/or unemployed. The preoccupation with homework and college applications currently facing Gen Z might also be why 56% expressed that paying back student loans was more urgent than saving for retirement. However, another 24% of those not contributing to retirement suggested that they were instead saving for a different major life event, such as buying a home, getting married, or having a child.

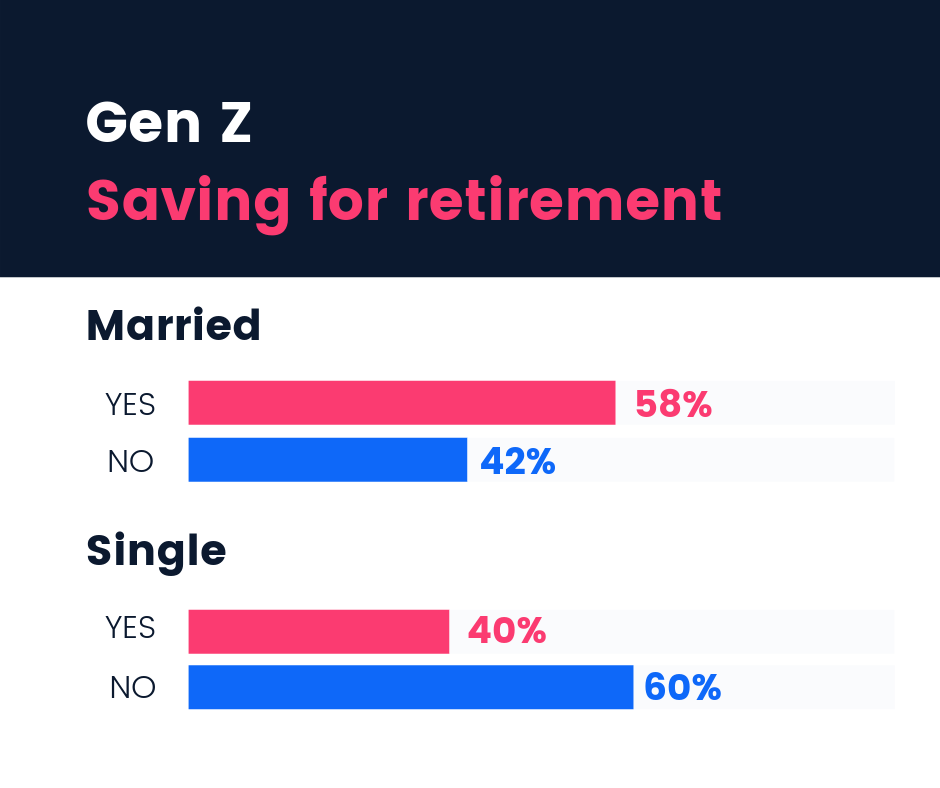

Among Gen Z who are already married, 58% report saving for retirement either by contributing to a 401K through their employer, a Roth or IRA individually, or another method of saving. In contrast, 60% of unmarried Gen Z are not contributing to a retirement plan of any kind.

Gen Z vs Gen Y (Millennials)

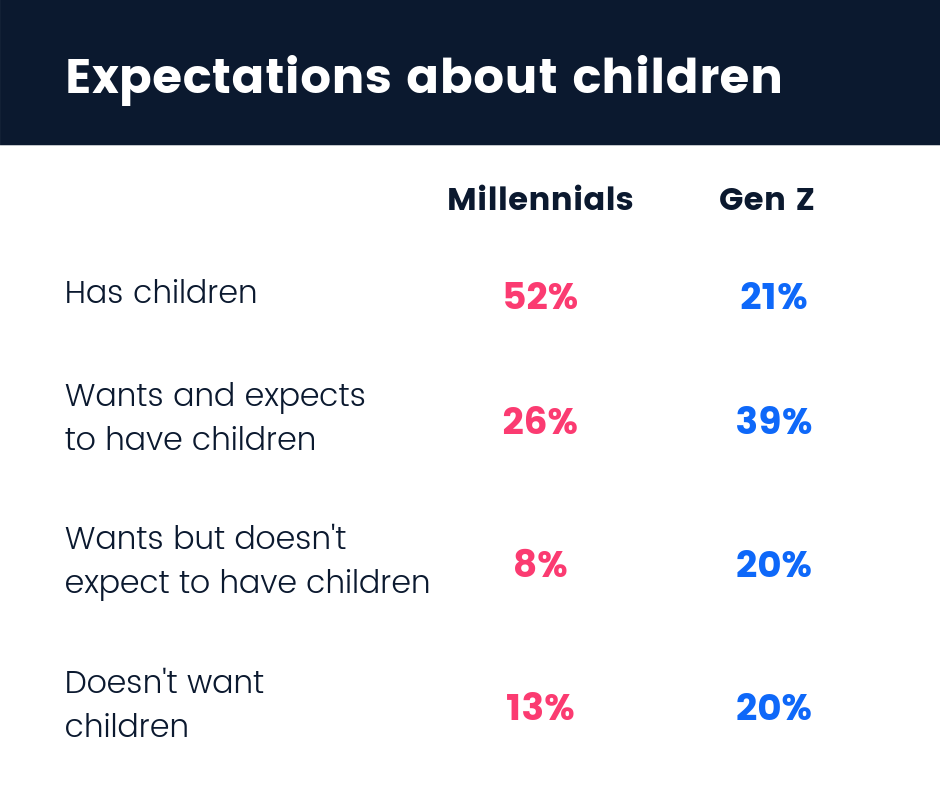

Most Gen Z respondents do not have children or own a home, but expect to do both in their lifetimes. However, significantly more Gen Z reported “wanting to have children, but not expecting to have them” in their lifetime than Millennials.

Where Gen Z is less optimistic about their parenthood prospects than the generation before them, they are more optimistic about the state of Social Security. 26% of Millennials do not believe that Social Security will be around by the time they reach retirement. Only 16% of Gen Z share this outlook, with 43% believing Social Security will be a supplemental part of their retirement, and 42% believing it will support them entirely.

Starting at home

Expectedly, those who discussed finances in their homes growing up were more likely to be contributing to a retirement plan of some sort. Among respondents who reported discussing financial planning or retirement “often” in their homes growing up, 81% are contributing to some form of retirement plan, and 81% are expecting to support family either financially or as caregivers. 57% of those who reported “sometimes” discussing finances in their home are contributing to some form of retirement plan, with 80% expecting to provide care or financial support to family. The majority of those who expressed “never” growing up with discussions around finances are not contributing towards retirement (75%) and only 58% expect to help support family members.

Our survey was distributed in the United States, nationwide, to 600 respondents and was completed in under a day. We implemented targeting quotas to gather an equal number of responses from Gen Z (age 14-24) and Millennials (age 25-37) about their beliefs and behaviors related to personal finance.

To see our full results, follow this link. If you have your own questions to ask Gen Z respondents, follow this one and launch your first survey.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…