How Will Millennial Saving & Spending Habits Change as a Result of the Coronavirus Pandemic?

For whatever reason, millennials get a bad rap for a whole lot of stuff, especially their spending habits.

You’ve probably seen the articles before; millennials are spending too much darn money on their avocado toast and not saving enough for important things, like retirement.

But is this really true? Is the constant bashing of millennials and their financial decisions justified or not?

Financial services company LendEDU sought to get to the bottom of this by going straight to the source: millennials themselves.

With the help of survey platform Pollfish, LendEDU surveyed 1,000 millennials between the ages of 22 and 37 and asked them a series of questions regarding their retirement saving habits, in addition to their spending habits on things like Netflix and groceries.

Here’s what the survey from LendEDU found…

Millennials Saved an Average of $480 Per Month For Retirement Pre-Coronavirus

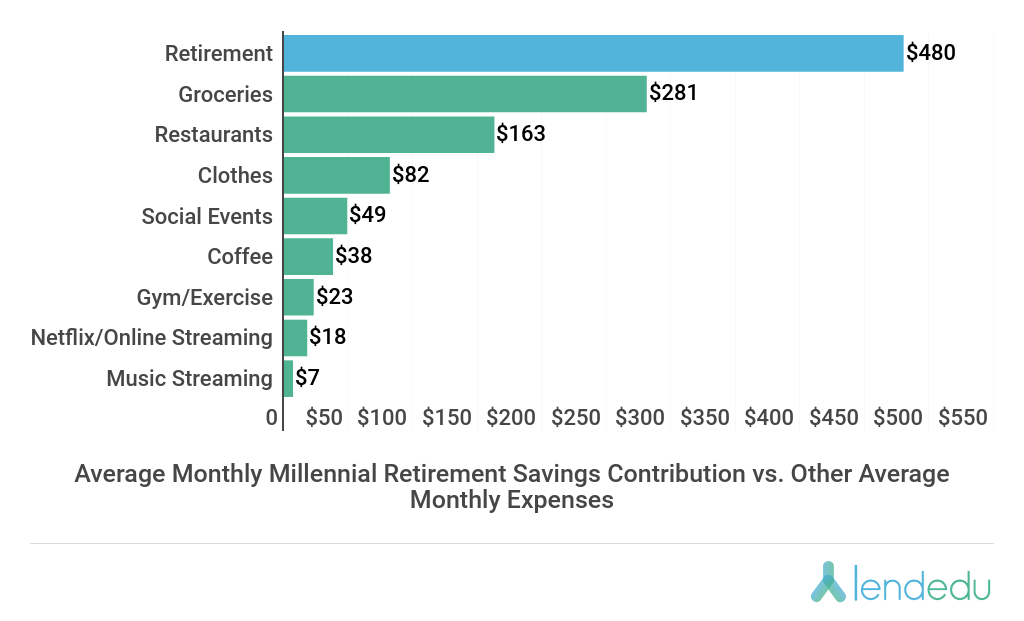

According to LendEDU’s report, the average millennial was saving $480 per month for retirement before the coronavirus, which is a very good start especially when one considers compound interest.

Moreover, the study from LendEDU also found that, on average, millennials were saving more for retirement each month than they were spending on things like groceries ($281), restaurants ($163), clothes ($82), and social events ($49).

Moreover, the study from LendEDU also found that, on average, millennials were saving more for retirement each month than they were spending on things like groceries ($281), restaurants ($163), clothes ($82), and social events ($49).

So according to the LendEDU survey conducted with the help of Pollfish, millennials do indeed have their saving and spending priorities in order despite what the common narrative may tell you.

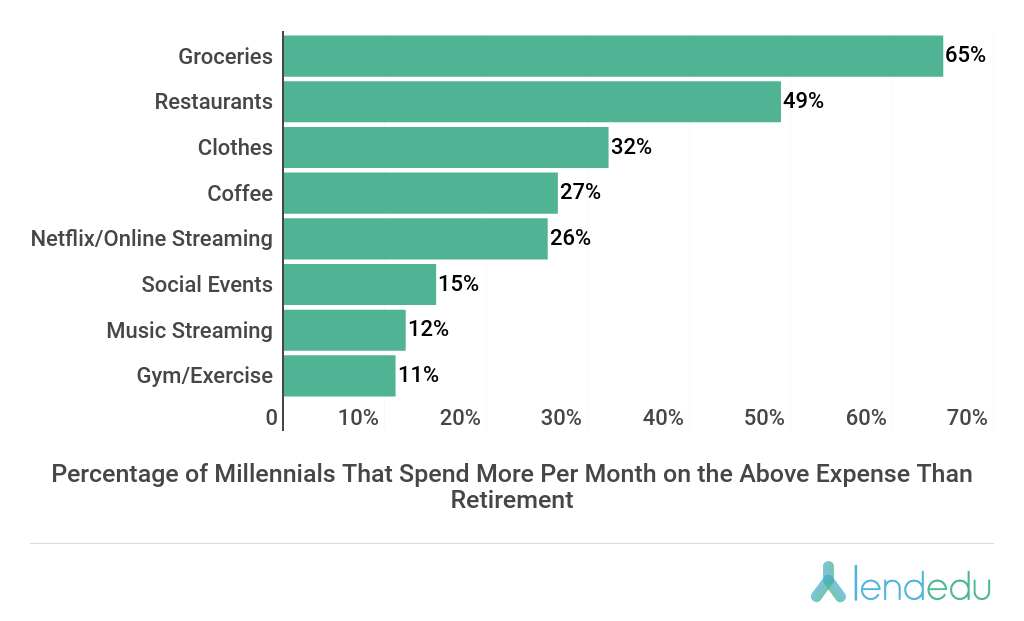

Further, LendEDU was able to line up the individual results of each Pollfish respondent to find out what percentage of millennials were spending more on certain things than what they were saving for retirement.

For example, if one specific millennial respondent spends $60 on online streaming services each month and only saves $40 for retirement, he or she was counted towards the percentage of millennials that spend more on online streaming services than what is saved for retirement.

Here’s what the data showed…

So, these numbers don’t exactly depict millennial retirement saving habits as favorably as the previous set, yet still, it’s important to note that the only monthly expense over 50% of millennials were spending more money on was groceries, a necessity.

In conclusion, millennial retirement saving behaviors were just fine, and they were on the right track to kick their feet up by the time they hit their sixties.

However, LendEDU conducted this survey before the coronavirus pandemic completely rocked the world and specifically the American economy.

What would these numbers look like today?

How Has the Coronavirus Pandemic Impacted Millennial Saving & Spending Habits?

In addition to the unimaginable and devastating loss of life brought on by the coronavirus pandemic, this deadly scourge has also wreaked havoc on the economy.

As countless businesses have closed their doors for good and millions of Americans have been laid off due to the pandemic, the U.S. officially entered into an economic recession in June 2020.

Such financial ruin has surely had an impact on the millennial saving and spending numbers discussed above. People are out of work and no regular income is flowing in, which means they have had to rely on emergency saving accounts and debt to cover expenses.

For example, a previous LendEDU survey found 45% of American consumers have had to dig into an emergency fund to cover expenses during the coronavirus, while 55% are concerned over running out of money, and 33% have had to take on more credit card debt than desired to meet costs.

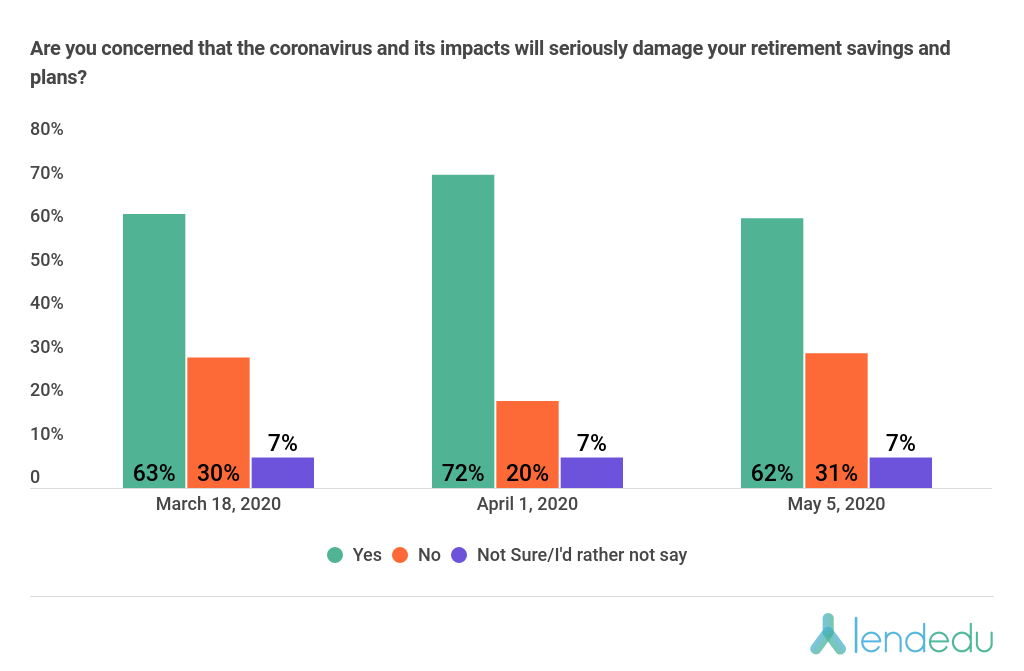

Additionally, 62% are concerned that the pandemic and subsequent recession will seriously damage their retirement plans.

With this data in mind, it’s reasonable to assume that millennials are now saving a lot less for retirement as they have had to redirect that money towards things like housing and groceries.

They are also likely spending a lot less at restaurants due to social distancing while forking over more cash for groceries as they continue to eat meals at home. In that same vein, millennials are likely spending less on gym memberships and social events because those things simply haven’t been allowed.

Spending on more unnecessary things like clothes and coffee is probably down, while spending on online streaming services like Netflix and music streaming services is likely up due to working from home and sheltering in place.

So, how can millennials adjust their everyday finances and spending habits to compensate for the current recession so that they don’t miss a beat when it comes to saving for retirement?

Get a Handle Of Their Student Loan Debt

Nearly all millennials have student loan debt, so this is a great place to start. The student loan industry has changed rapidly as a result of the coronavirus pandemic so it’s important for millennials to understand the changes so they can take control.

First, no federal student loan payments are required until October 1, 2020, so if millennials are out of work or struggling with expenses or both then it’d probably be wise to save the few hundred dollars each month that have traditionally been reserved for student loan payments.

This extra cash can be incredibly useful right now to make up for lost retirement savings or to cover additional costs.

Second, all federal student loan interest rates are frozen at 0% until October 1, 2020, so it’s not an ideal time to refinance student loans in the private market. If a millennial is fortunate enough to still have their job and still be able to make student loan payments, now is a great time to chip away at that debt because 100% of the payment can be used for the principal balance.

The main benefit of refinancing is receiving a lower interest rate, but with federal rates frozen at 0% and private student loan rates hovering around 11%, that benefit does not exist right now.

Stay on Top of Their Credit Scores

During the coronavirus, there’s been a massive uptick in the number of consumer finance complaints related to credit scores and credit reporting, according to LendEDU.

Right now, it’s important for millennials to stay on top of their credit scores to ensure that they are not getting negatively impacted for erroneous marks like a falsely reported missed or late payment. This can be done by signing up for one of the many near-instant credit monitoring services, like Creditwise.

By keeping track of this, millennials can have the credit health they need to successfully apply for low interest-rate credit cards or personal loans that may be necessary during this tough time when budgets are tight. Responsible debt financing can allow a millennial to maintain their retirement contributions while still meeting daily expenses.

Take on a Side-Hustle

Despite the coronavirus pandemic and recession, the gig economy is still strong so taking on a side-hustle can be a great way for any millennial to bring in some extra income that can be used to either cover expenses or increase retirement savings contributions.

Whether it’s delivering for DoorDash or walking dogs through Wag, there are countless side-hustle opportunities out there that cash-strapped millennials should turn towards if they want to maintain their personal financial health.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…