Christmas 2021 Consumer Trends – Omicron Impacted Plans for Over 50% & Omnichannel Shopping Rules

With the holiday season in full swing, we at Pollfish sought to discover Christmas 2021 consumer trends, plans, fears and shopping habits in the midst of the new coronavirus variant called Omicron.

With our state-of-the-art market research platform, we conducted a survey across the US to uncover just that. We gathered a slew of insights into the impact of Omicron on Christmas shopping, plans and more.

Our data shows the consumer trends that will continue, as omnichannel shopping has not merely formed a tight grip over Christmas shopping, but customer behavior in general.

In addition, Covid peaks due to emerging variants tend to have economic effects on people across the globe that last. After all, the US economy is still currently reeling from the Covid-19 pandemic and is bound to undergo difficulties as cases surge. This is especially common during the colder period.

Our survey shows the impact of Omicron on consumers during the holiday season, particularly examining it in relation to Christmas. This study is useful for retailers and other kinds of businesses and marketers, along with curious consumers.

You can view the full Christmas 2021 consumer trends survey in the link provided.

Christmas 2021 Consumer Trends Survey Methodology

Our methodology involved running an online survey via our vast network of publishers, across the United States. The survey was deployed across various digital properties, including websites, apps and mobile sites.

We surveyed 600 people, across different geographic regions in the US. The study included responses from a wide range of age groups, spanning from 18 to over 54. We studied consumers of various employment status, including those employed for wages, homemakers, students, retirees and those who are unemployed but searching for work.

The survey had quotas in order to receive an equal amount of responses across different demographics. For example, we set quotas for employment status; as such, we preset them so that we receive 120 responses from each group of the 5 kinds of employment statuses.

We also set gender quotas, so that we got an equal amount of responses from both genders. In addition, we set the same quotas (120 responses per group) in the age range category.

Over 51% of Consumers Expect Omicron to Impact Christmas Plans

Our first question to respondents on whether they expect the new Covid variant to impact their Christmas, received mixed views. The most popular answer was “no, it didn’t change anything for me,” at 30.5% of the vote. However, the question paints a dual narrative, in that two of the other highest selected answers express a different perspective.

The second most popular vote found that 23.5% of consumers said that Omicron will, indeed, impact some of their Christmas plans. The third most popular answer continued bolstering the opposition to the narrative of Omicron having no impact, as 21% of consumers said that Omicron changed all of their Christmas plans.

In total, that brings the narrative to be one in which Omicron has impacted and will continue impacting the majority of consumers’ Christmas plans, as it brings those affected by it to almost 45% (44.5%). When you tally in those who responded with “yes, but only one thing,” at 6.7%, it rounds out those who expect Omicron to have changed their Christmas plans to 51.2% — over half of all respondents.

As such, over half of consumers have already or will change their Christmas plans due to the new coronavirus variant. Almost one-third of respondents remain completely unaffected in terms of their plans and a considerable 18.33% aren’t yet sure.

Regardless, the fact that over half of all respondents are impacted by Omicron shows retailers and other businesses to take this new variant into consideration, whether it’s in their marketing, pricing and sales, or their own Christmas-related plans involving consumers such as in-store events, promotions, etc.

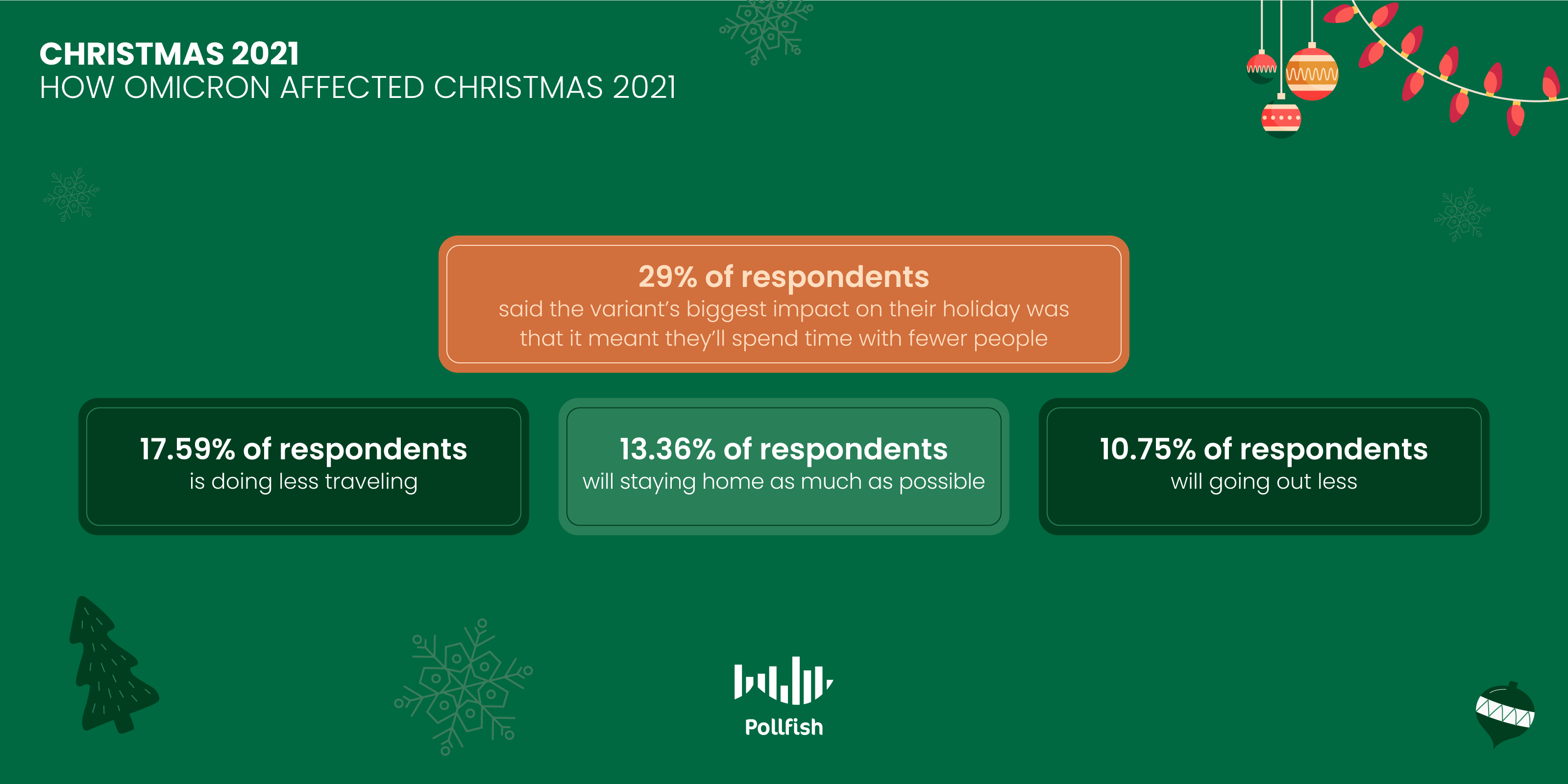

How Omicron Affected Christmas 2021

We asked those who said that Omicron impacted their Christmas how it affected their holiday the most. The majority of respondents said the variant’s biggest impact on their holiday was that it meant they’ll spend time with fewer people. This answer received roughly 29% of the vote.

Coming in with the second most chosen answer at 17.59%, is doing less traveling. The third most selected answer was staying home as much as possible, at 13.36%. Similar options were avoiding tourist and entertainment attractions at 11.4%, followed by going out less at 10.75%.

In total, these 4 similar answers sum up to 53.1% — over half of respondents will avoid going out in some way due to the new Covid variant.

Businesses that offer home entertainment can profit off of this reality. In addition, all businesses can take advantage of this, in that staying at home often means spending more time on electronic devices, such as tablets, desktops and laptops. This gives brands the opportunity to reach more people, whether organically or through SEM (paid search).

Businesses that offer home entertainment can profit off of this reality. In addition, all businesses can take advantage of this, in that staying at home often means spending more time on electronic devices, such as tablets, desktops and laptops. This gives brands the opportunity to reach more people, whether organically or through SEM (paid search).

A meager 5.21% of consumers said the biggest impact on their Christmas this year is the fact that they’ll spend less money. On the contrary, 12.7% of consumers said that spending more money is the biggest effect of Omicron.

More spending power is obviously a positive aspect for businesses, who can increase revenue during this holiday, should they maintain a steady brand visibility. They must come up with creative marketing campaigns to stay visible over their competitors.

Christmas 2021 Consumer Trends in Shopping and Spending

We quizzed respondents on several questions regarding shopping, spending and customer buying behavior. We discovered what consumers are most intent on buying, how they’re going to shop and how Omicron affected their spending capabilities.

How Consumers Shop During Christmas 2021: Omnichannel & Online Shopping Reign Supreme

Omnichannel shopping rules, as the most popular answer to how consumers are going to do their Christmas shopping this year is via in-store and online, at 32.33%.

The second most selected answer was “mostly online, but if I find something I need in-store, I’ll consider buying it that way,” at 24.33%. This shows a significant chunk of almost one-fourth of consumers being more comfortable doing Christmas shopping online, as a new virus variant rears its head.

Bolstering the preference for online shopping for Christmas is the third most highly selected answer of “online only,” at 14%. Together, these two stats show that over one-third of consumers, specifically 38.33% of consumers intend to shop online for their Christmas expenditures.

Alternatively, two other popular answers show that many consumers still prefer going to physical stores to shop, even as a new variant emerges. 13% of respondents said they’ll purchase “mostly in-store, but if I find something I need online, I’ll consider buying it that way.” 12% of respondents said that they will shop in-store only.

Combined, these two stats show another critical narrative, which is that a considerable chunk of consumers still prefer in-store shopping over digital, as they round out to 25% of consumers. Thus, one-fourth of consumers will shop in physical stores during the season.

Only 4.33% of consumers will make Christmas purchases at a tradeshow or event. Omicron may certainly have contributed to this small figure, along with the convenience and larger availability of stores and digital shops.

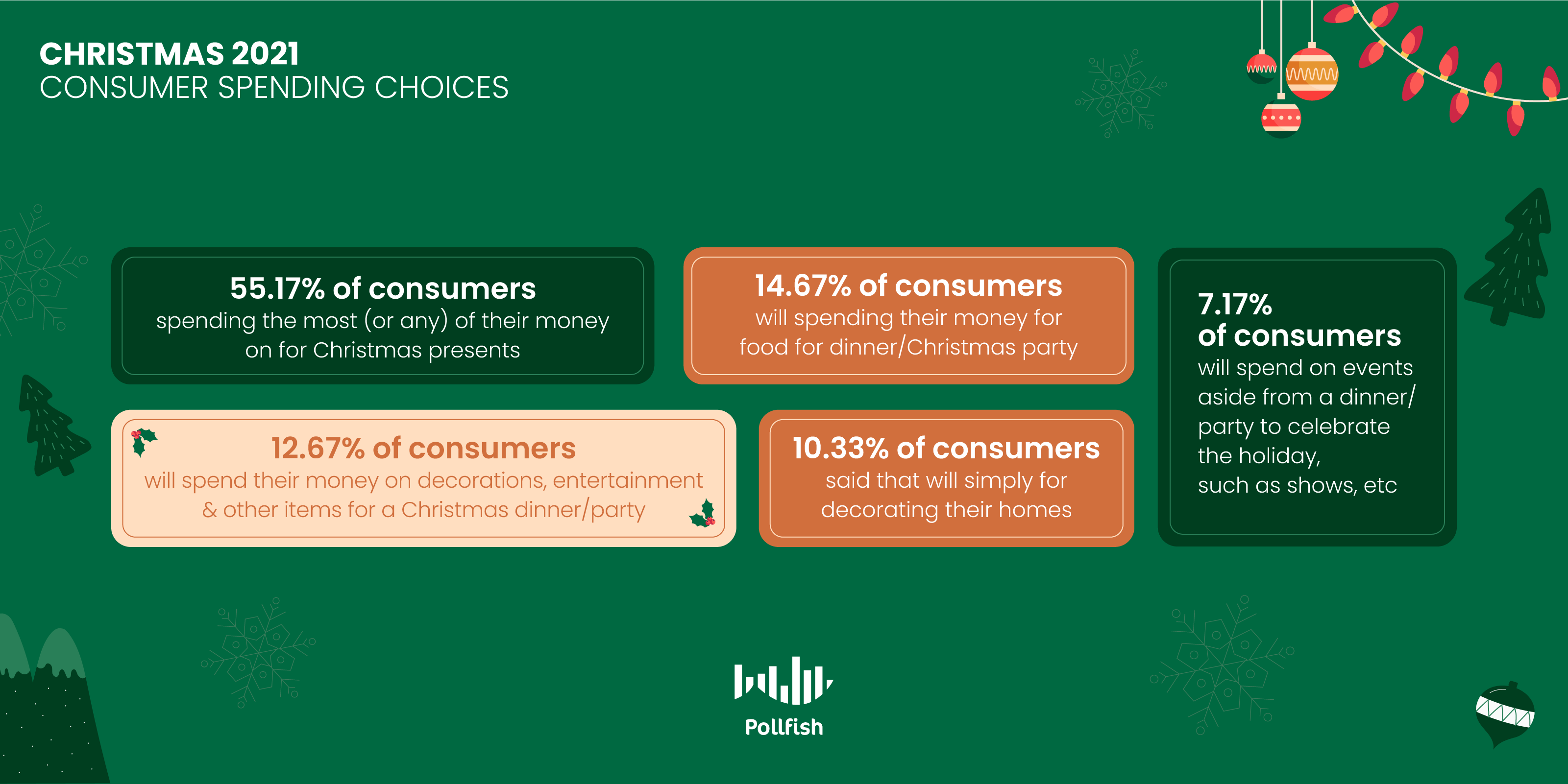

Christmas 2021 Consumer Spending Choices

Next, we asked what consumers anticipate spending the most (or any) of their money on for Christmas. At 55.17%, the landslide answer was Christmas presents, showing their continued importance as a Christmas tradition, regardless of a new virus strain.

It is key for businesses to capitalize on this by showcasing their best products and partaking in marketing campaigns to boost their sales, as consumers are more than willing to buy gifts.

The second highest-selected answer was food for dinner/Christmas party, with 14.67% of the vote. As such, celebrating the holiday with others is still very much important for consumers, despite roughly 29% of them having said that they’ll spend time with fewer people.

Coming in with the third most popular answer, at 12.67%, consumers will spend their money on decorations, entertainment and other items for a Christmas dinner/party, supporting the tradition of hosting a celebration with others.

10.33% of consumers said they would spend the most on these items as well — just not for a dinner/party, but simply for decorating their homes. Thus, decking the halls still carries a lot of weight on Christmas spending.

10.33% of consumers said they would spend the most on these items as well — just not for a dinner/party, but simply for decorating their homes. Thus, decking the halls still carries a lot of weight on Christmas spending.

Only 7.17% of respondents will spend on events aside from a dinner/party to celebrate the holiday, such as shows, etc. With virus cases slated to rise in colder temperatures and a new variant, it is understandable why most consumers won’t spend money on Christmas events aside from their own in-home celebrations.

With these insights in mind, businesses ought to present their offerings as excellent gift options, as consumers will spend most of their money on gifts.

Omicron Effect on Christmas 2021 Consumer Spending

When it comes to spending money, we lastly asked respondents if and how Omicron has or will affect their spending. The answer with the most selections, at 31.05% said the variant has “not really” affected their spending for the holiday.

This points to almost a third of consumer spending being unaffected by the new variant. This means they will not spend any more or less on Christmas due to Omicron. In fact, 12.33% of consumers said this explicitly, which brings those who said Omicron has little to no effect on Christmas spending to 43.38% — nearly half of all consumers.

Thus, with many consumers being willing to spend money on this holiday, especially on presents, businesses don’t have much to worry about. However, given that many intend on saving money or spending less, to begin with, most businesses (namely, non-luxury purveyors) ought to offer discounts to attract purchases.

19% and 17.67% of consumers gave the following answer, respectively: “yes, I’ll spend much less than I originally planned” and “yes, I’ll spend slightly less than I originally planned.” In total, 36.76% of consumers have or are going to spend less on Christmas, due to Omicron.

At over one-third of responses, this makes the dominant narrative to this question being that most consumers are going to spend less on Christmas 2021 due to the new variant. As such, to draw in consumers, businesses will need to up the ante on bargains and discounts, should they expect higher profit margins.

For some consumers, the onset of the new variant meant spending more money; 9.83% said Omicron will make them spend much more than they had originally planned and 9.67% said they would spend slightly more than they had planned previously.

This brings the number of consumers who will spend more on Christmas shopping to 19.5% — almost a quarter of consumers will spend more thanks to Omicron. From this segment of the population, businesses can expect to see more purchases, should they be interested in what you’re selling. These consumers also tend to be less wary of spending more per single product.

Even with this segment of the population, businesses ought to focus on brand awareness, especially in regards to making consumers aware of their products. With so many sales and promotions active during this time of year, businesses should prioritize bringing visibility to their offerings and avoid being drowned out by competitors’ offerings.

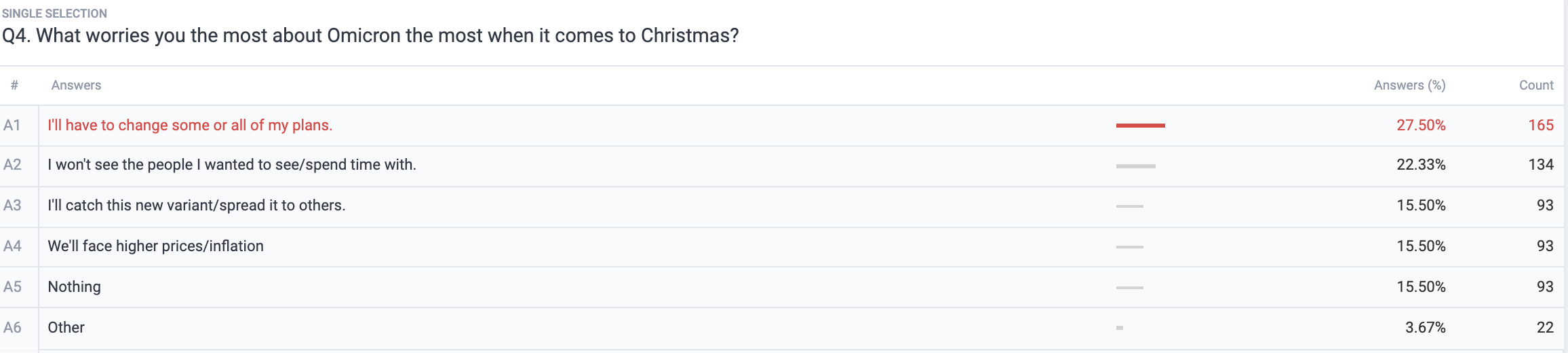

Omicron Worries and Christmas Excitements

In search of consumers’ biggest worries over Omicron this Christmas, our survey discovered that the biggest fear is having to change plans, at 27.5%. Supporting the narrative observed in the third section of this article, 22.33% of consumers worry about having to see fewer people than they thought they would.

The third most popular answer came in as a three-way tie, as 15.5% of respondents chose the following three answers: catching the variant/spreading it to others, facing higher prices/inflation and absolutely nothing.

The dominant worry is the change of plans, followed by not being able to spend time with others. The less popular answers show an array of concerns that pester consumers the most. As such, brands can reach out to consumers in a more personalized and kind way during this holiday (and others).

The dominant worry is the change of plans, followed by not being able to spend time with others. The less popular answers show an array of concerns that pester consumers the most. As such, brands can reach out to consumers in a more personalized and kind way during this holiday (and others).

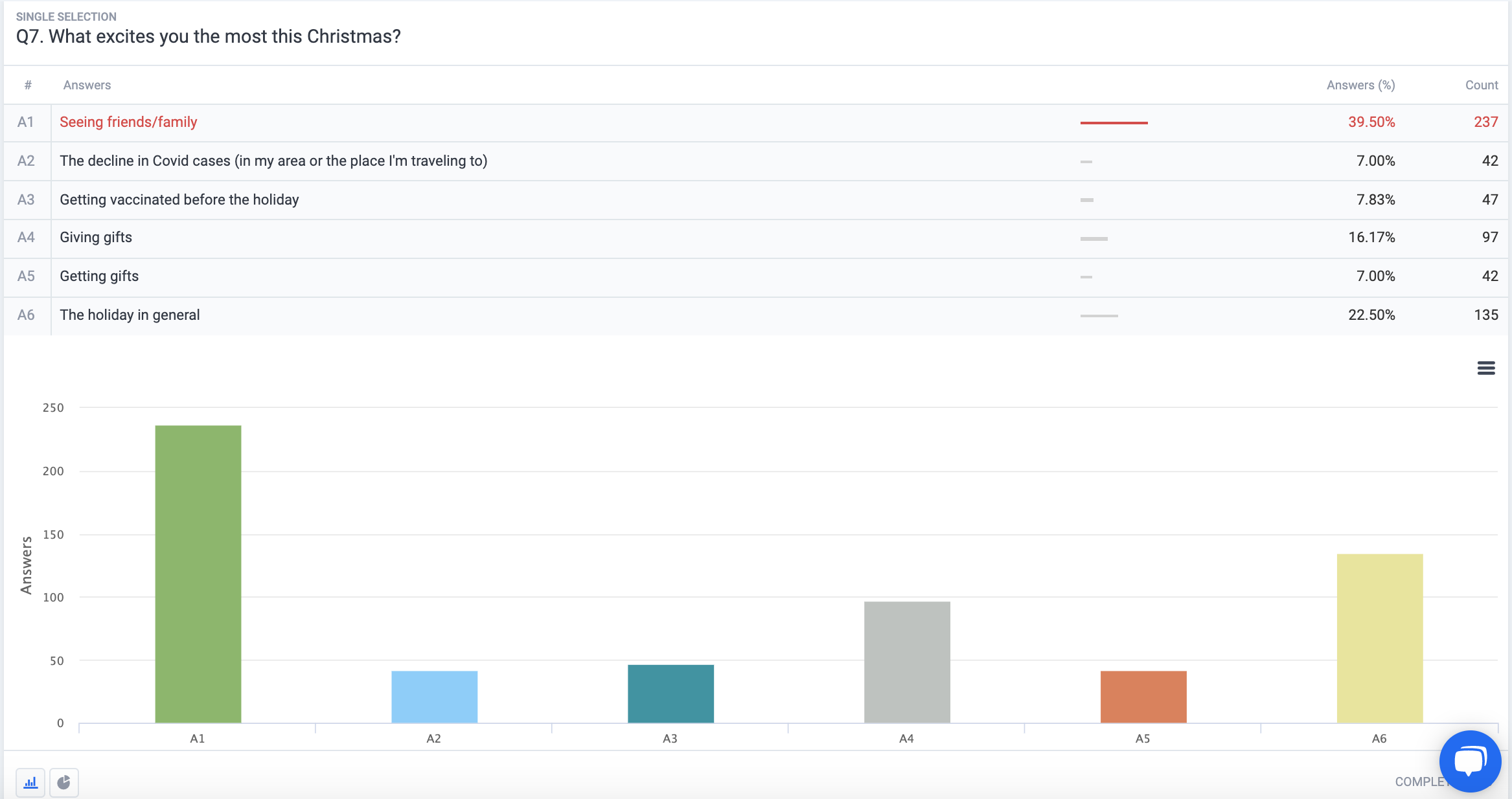

Finally, we shifted to a more positive topic, asking respondents what excites them the most about Christmas this year. Playing neatly into previous narratives of being saddened by not being able to see loved ones, 39.5% of consumers are most excited about seeing friends and family.

Over one-fifth of respondents, 22.5% said that the holiday, in general, excites them the most, followed by giving gifts (16.17%) and getting vaccinated before the holiday (7.83%). Getting gifts and the decline in Covid cases tied at 7%.

Exceeding Consumer Expectations for Christmas and Beyond

There are plenty of things that consumers worry about and delight in when it comes to Christmas this year, in the wake of the new Omicron variant.

As such, brands can win over consumers by exciting them and quelling their worries with their offerings and customer experience.

Most importantly, to continuously delight consumers beyond Christmas and well into the next year, brands ought to study them regularly. To do so, they must conduct survey research, as this allows them to ask their target market specific questions most pertinent to their company directly.

No other digital tool can provide this kind of direct insight, not least at speed and scale. You should therefore choose a strong online survey provider to demystify all your consumer curiosities.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…