Over Half of Americans Couldn’t Cover $1,500 Emergency Expenses — Pollfish Survey Finds

This post was contributed by Mike Brown of Breeze.

This post was contributed by Mike Brown of Breeze.

Who’s kidding who? Money really does make the world go round.

It’s true on a macro level with countries and corporations, but it’s painstakingly true on a micro level with everyday people.

We need money to live everyday life. Without it, there’s no paying the rent or mortgage, the cable or utilities, the groceries or social outings, or even more critical, emergency expenses .

This was unfortunately seen en masse when the coronavirus pandemic struck the entire world in March 2020. As a result of the global outbreak, millions upon millions of Americans were out of work as the turn of a switch.

That meant millions of Americans were also without the regular income they depend on to get by each and every single day.

The world stopped, the work stopped, but a lot of life’s bills kept on coming.

And as a result, millions of consumers were on the brink of financial ruin. A lot of them were living paycheck to paycheck and had very limited personal savings to cover emergency expenses.

The federal government had to interject and provide the majority of Americans with stimulus checks so that bills could keep getting paid.

Not once, not twice, but three times.

The coronavirus pandemic exposed the extreme financial fragility that so many American consumers must contend with every day. Most don’t have much, if anything at all, saved up in the bank in the event of an emergency like a global pandemic.

They need every dollar from every paycheck, and if that’s not enough, it’s onto the credit cards and personal loans.

It’s an unfortunate financial cycle and now that the coronavirus pandemic is maybe somewhat in the rearview mirror, Breeze wanted to take a deeper dive to see if anything has changed.

To do this, we designed a survey and then ran an online survey of 1,500 adult Americans through survey platform Pollfish.

Here’s what we found…

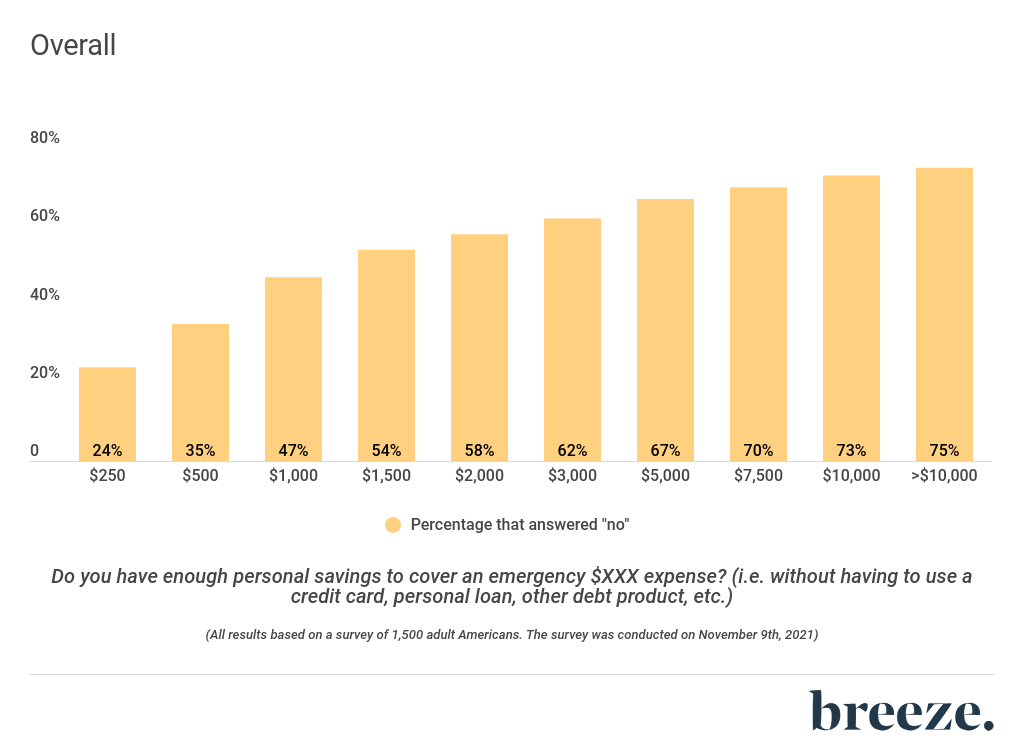

24% Couldn’t Cover $250 Emergency Expense, 47% Couldn’t Cover $1,000 Emergency Expense

The main component of the study from Breeze was asking the 1,500 adult respondents if they could cover increasing dollar amounts with just personal savings.

Debt from financial products like a credit card or personal loan could not be used. Only what these people had in the bank.

The question for each increasing amount was phrased like this: Do you have enough personal savings to cover an emergency $XXX expense? (i.e. without having to use a credit card, personal loan, other debt product, etc.)

24% were unable to cover a $250 emergency expense with just personal savings, including 34% of female respondents and 15% of male respondents.

35% couldn’t pay a $500 emergency expense, while 47% could not afford a $1,000 emergency expense, including 57% of females and 38% of males.

58% could not pay a $2,000 emergency expense, including 67% of women and 50% of men. 67% were unable to cover a $5,000 expense, while 75% couldn’t cover an emergency expense over $10,000, including 83% of females and 67% of males.

When the data was presented in bar chart form, it took the resemblance of a staircase as more and more consumers were unable to afford the emergency expenses as they got higher.

Take a look…

The gender breakdowns were also of note, as female respondents seemed to have a significantly less amount stowed away in personal savings compared to their male counterparts.

Regardless, the results revealed the concerningly low level of cash that so many American consumers are working with.

Having such little in personal savings can be inescapable as the paychecks are going back out as fast as they are coming in.

And as a result of minimal savings, many will have to resort to debt, which will then take on a life of its own. Once debt starts building, the monthly minimum payments will only start going up with interest and it becomes just another large bill to prevent any savings from being built.

The impacts of limited personal savings are not just confined to taking on a lot of debt, however. They are far-reaching and hit every corner of a consumer’s everyday life, as Breeze found with the next couple of questions.

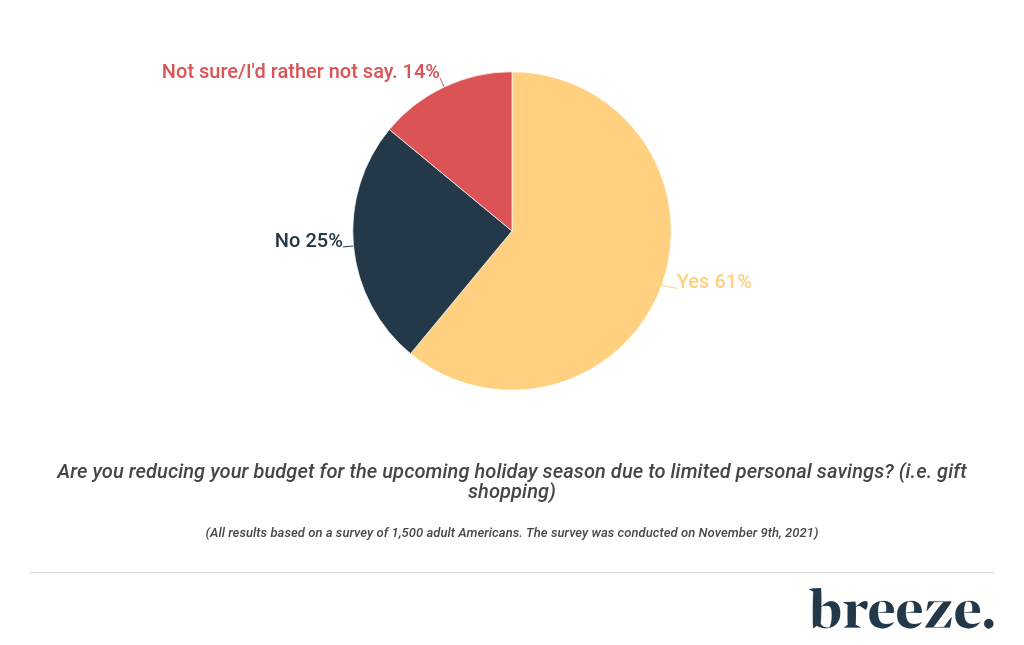

With No Savings for Emergency Expenses, Americans Are Reducing Holiday Budgets

62% of the poll participants were deemed to be living paycheck-to-paycheck as they were unable to cover emergency expenses totaling $3,000 or less.

This group of respondents were then asked a couple of questions so that we could better understand all of the impacts of living with very limited personal savings.

For example, the holidays are around the corner.

Here’s what we found on that…

61% from this group indicated they are reducing their respective holiday budgets this year as a result of having next to nothing saved away in the bank. Also note this percentage may be even higher in reality as 14% opted not to answer this question.

Only 25% definitely said they are not reducing their holiday budgets in 2021.

Knowing this group doesn’t have much cash on hand, we also asked them how much of their 2021 holiday budget will be financed by debt (i.e. credit card).

The average respondent will be financing 38% of their holiday purchases with debt this year.

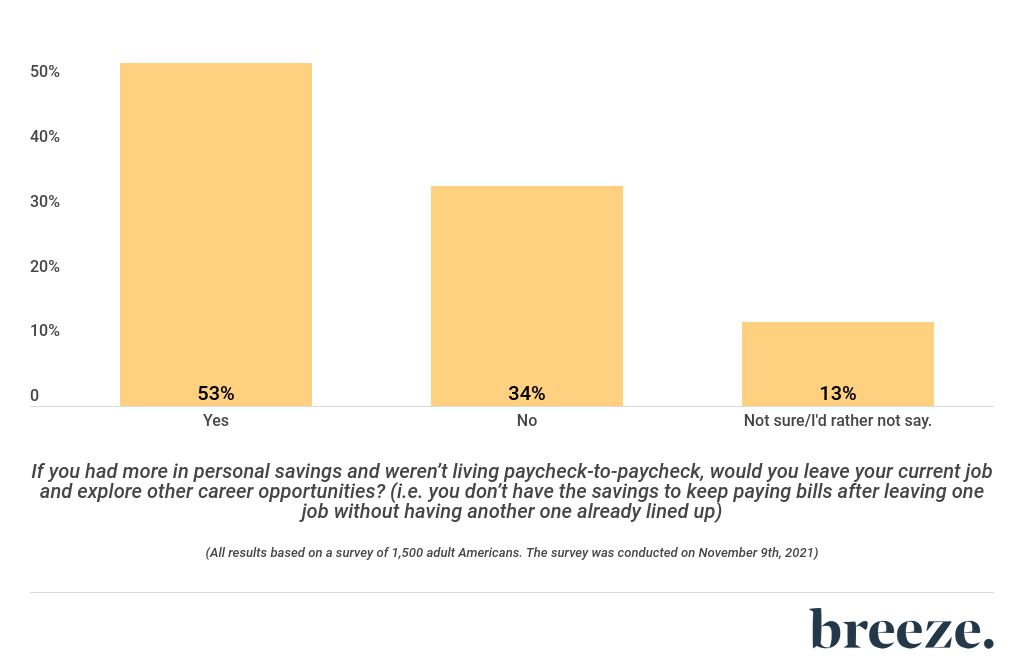

Career Development Damaged Due to Having Little Saved For Emergency Expenses

While reduced holiday budgets is more of a material consequence of limited personal savings, we also found it’s having more serious, professional consequences.

Amongst employed respondents living paycheck-to-paycheck, we asked them if living paycheck-to-paycheck has hurt their career development…

The majority of these poll participants, 53%, said they would have left their current job already to explore other career opportunities if they had more in personal savings and weren’t living paycheck-to-paycheck.

In other words, they don’t have the financial strength to quit one job without already having another one lined up.They need their paychecks and might not be able to make it even a month if the paychecks stopped while conducting a job search.

Also note that another 13% of respondents opted not to answer this question so the actual percentage of consumers that are begrudgingly remaining at their job due to limited savings may be way higher than 53%.

Back to the Pandemic…

This report started with the coronavirus pandemic and how it severely exposed the rocky finances of so many Americans.

We also talked about how Breeze wanted to conduct this study now to see if anything has gotten any better since the start of the pandemic in terms of personal savings.

So it’s only fitting to conclude with some data we collected related to pre and post pandemic savings.

All 1,500 respondents were posed the following question: Do you have more or less personal savings today (November 2021) than you did before the coronavirus pandemic started? (March 2020)

Interestingly, 44% of respondents indicated that they have more saved in the bank now compared to before the pandemic, while 25% said less, 26% said about the same, and 6% opted not to answer.

When asked why they have more saved in the bank today, 70% said they spent less on social outings during the pandemic, while 42% took on freelance work, 40% made better stock market investments, and 33% stopped making student loan payments.

The fact that the plurality of poll participants have more in personal savings now than before the pandemic started and still they have very little saved according to the rest of our findings, is a testament to just how little many Ameicans had saved away when the pandemic hit the world in March 2020.

One final thing worth noting is that the survey revealed the majority of American consumers do not have disability insurance, and 67% of those that don’t have it have never even considered it. Disability insurance replaces a portion of your income in the event injury or illness leaves you unable to work and earn an income for an extended period of time. It can be a useful financial safety net to cover life’s expenses, especially considering so many have barely anything saved up and would not last long without regular paychecks.

Ultimately though, consumers will need to try to build up as much personal savings as they can through a more frugal lifestyle and smarter financial decisions.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…