Global Customer Expectations Survey: 41% of Global Customers Think International Businesses Are Getting it Right

Fulfilling customer expectations on a global level can be a challenging objective — that’s why we at Pollfish surveyed customers from across the globe and in the United States to discover exactly how customers throughout the US and worldwide feel about foreign companies marketing to and serving them.

Given that according to Salesforce, 66% of customers expect companies to understand their unique needs and expectations, yet 66% say they’re treated like numbers. As such, we sought to understand how this kind of sentiment played out on a global scale.

Our global customer expectations survey is a study with roughly 1,500 respondents from the US, Canada, the UK and Germany. The survey covers people from most age groups, as it includes customers from age 18 to over 54. The respondents range in education, occupation, income level and other demographic categories.

The results were mixed, giving businesses and marketers ample opportunity to hone in on their marketing and targeting efforts.

Understanding Customer Expectations and Needs

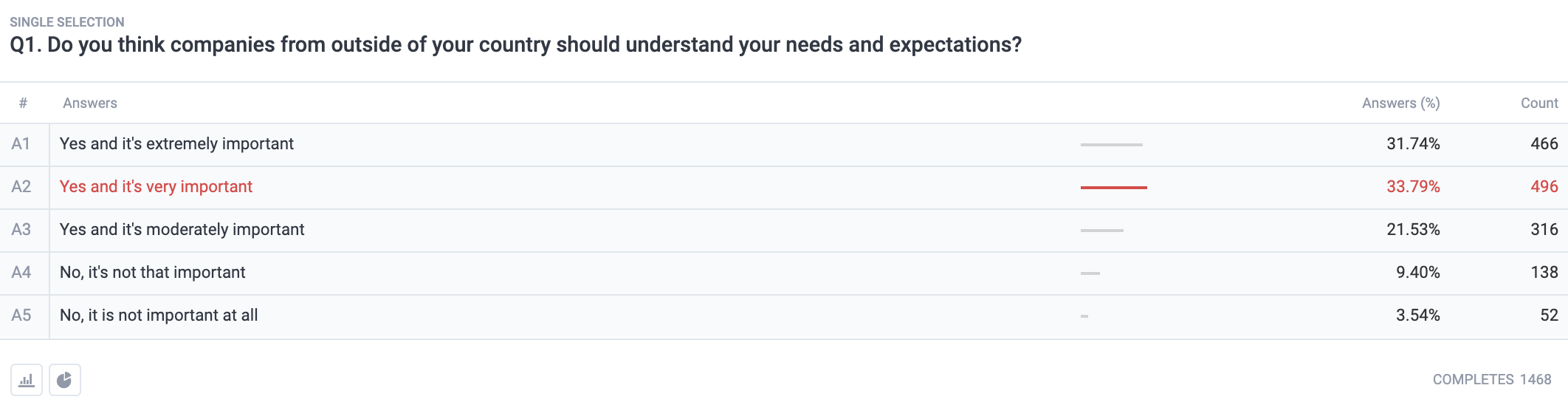

First, we quizzed global consumers on the basic, yet crucial question regarding customer expectations, asking how important it is for companies outside of their country to understand their needs and expectations.

Collectively, the US, Canada, the UK and Germany gave the majority answer of “yes, and it is very important,” at 33.79%. The second most popular answer collectively was the most intense one of “yes, and it is extremely important” at 31.74%.

When combined, these two most popular answers bring the total to 65.53% — which indicates a strong need for businesses to understand their international customers. This statistic lines up almost exactly with the above study from Salesforce.

Out of all four countries, customers from the United States were the most bent on businesses from abroad understanding their expectations and needs, as their majority answer, at 39.17%, was “yes, and it is extremely important.”

Out of all four countries, customers from the United States were the most bent on businesses from abroad understanding their expectations and needs, as their majority answer, at 39.17%, was “yes, and it is extremely important.”

Although customers from Germany were slightly less bent on the importance of abroad companies understanding them, as their most popular response was “yes, and it is very important,” they beat out the US in terms of the highest amount of respondents in the “very important” response at 50.53%.

These figures point to relatively heavy expectations of brands from abroad to understand their global customers. Customers from the US and Germany in particular, require global businesses to understand their unique needs.

The State of International Purchasing and Being Intrigued by Companies Abroad

Next, we questioned US and international customers on whether they have ever been amazed or intrigued by the advertising or marketing efforts from international companies.

Collectively, there are two dominant customer sentiments: those that were amazed by international marketing/advertising efforts and those who never were.

The most popular collective answer supports the former sentiment with “yes, I was impressed by a few international companies,” at 44.35%. The second most popular answer supports the first dominant group and is also the most positive answer: “yes, I was blown away several times,” at 20.84%. Together, the favorable sentiment towards this inquiry comes out to be a whopping 65.19%.

This dominant group of customers, which also make up the majority of answers, shows that the global and US-based opinion of international marketing and advertising campaigns is generally positive.

However, it also indicates that businesses that intend on marketing to global customers have ample competition when it comes to marketing and advertising to customers abroad.

The second segment of consumer sentiment is made of customers who have never or have only once been intrigued by international companies’ marketing.

The dominant segment in this group is those who have never been amazed by global marketing campaigns, at 25.89%. Another smaller segment lies in this negative category, with 8.92% of customers saying they’ve been intrigued by a global marketing campaign — but only once.

The juxtaposition of the positive and negative responses shows that although global and US customers have been amazed by several international marketing and advertising campaigns, there is still a significant chunk over a quarter of customers who haven’t and is therefore much more difficult to please.

Aside from finding which customers are most intrigued by international companies’ marketing efforts, we also set out to discover the percentage of customers who have actually made purchases from companies outside of their own country.

Collectively, a minuscule percentage answered with “no, and I don’t intend to buy from an international company,” at 3.81%. “No, never” was the second least popular answer at 9.54%.

The majority answer from all the countries surveyed was “yes, a few times,” at 40.87%. The second most popular answer was also the most positive: “yes, several times,” at 36.78%. These figures divulge that both US and global customers are more than willing to buy from international companies, as they have done so more than once and some at several occasions.

The United States leads in the amount of customers who have bought from international companies several times, at 43.5%. Canada comes in second with this answer as the most popular, at 41.88%. These statistics show that international companies fare better in the US and Canada, in terms of customers buying from them.

What Global Customers Would Change About International Companies

When it comes to understanding and more importantly, satisfying customer expectations on a global scale, it is important to know the things that the customers themselves would change. Thus, we fielded the following question to our sampling pool: if there was one thing that they could change about how international companies serve them, what would it be?

The most popular collective answer, with 42.51% of responses was “they would change their pricing to better fit the kind in my country.”

Customers in the UK who answered with this choice beat out all others, as this was not simply their most popular response, but the highest percentage of those who would change prices from global brands, at 52.92%, beating out customers from Canada who chose this answer with 51.31% of responses.

Creating ads that are more sensitive to the cultural aspects of the customers’ countries was the second most popular collective answer, with 23.37% of the vote. This choice was also the second most popular answer from customers in Germany, at 23.16%.

Out of all the surveyed countries, this answer received the most votes from customers in the US with 28.07% of them choosing this option as what they would change about international customers.

The third most popular answer was better appealing to customers’ expectations and personal needs, at 9.74%. This choice generated the most answers in Germany, with 21.05% of responses. Canada came in second with 20.42% of customers choosing this option.

These results pinpoint that global and US customers would change various things about international companies that target them. Pricing was the victor, with the collective popular vote and the majority vote in almost every country (ex: Canada, 53.31%; the UK, 52.92%) except the US.

However, brands seeking to gain or already have an international presence must also be more sensitive to the cultural aspects of their customers’ countries, given that this concern was the second most popular.

In addition, brands must change how they approach individual (or segmented) customer needs and expectations, as the respondents pointed out.

How Global Customers Rate International Companies

Finally, we posited questions that asked US and global customers to rate international companies on their performance in countries abroad, especially in the customers’ own country of residence.

When asked if they felt that international companies understood the needs and expectations of customers in their country, collectively, the four countries’ majority answer was “yes, some companies from abroad are,” at 36.58%. This shows that global customers do in fact feel seen and heard by some brands from abroad.

The second most popular collective answer was “yes, but only a few,” at 36.58%, revealing that to a large segment of customers, most international businesses must still work towards becoming better acquainted with their global customers’ expectations and needs.

The next question presents the heart of the survey: how global customers rank the performance of international companies in terms of how they serve and cater to global customers in their country. The collective majority answer at 41.17% was that some companies from abroad properly cater to the customers in their country.

The second most popular collective answer was also the most positive, that of “yes, most companies from abroad are excellent at it,” at 24.46%. This points to a very positive perception of international businesses serving their global customers.

Although less than half of global customers believe that some global companies are properly serving them, the combined positive answers still outweigh the negative ones. The combined answers that view global companies properly serving their global customers come out to 65.6%, a landslide over those who viewed global companies unfavorably at a combined 34.4%.

US customers ranked global brands serving them most approvingly, as the majority of US customers answered with “yes, most companies from abroad are excellent at it,” at 36.33%. The most popular answer among customers in all the other countries surveyed was also positive, as the majority answer in each individual country was “yes, some companies from abroad are.”

Given that across all the countries surveyed, 41% of customers felt that some brands from abroad properly cater to them, and this sentiment was even more popular in individual countries, such as Canada, which provided this response from 49.21% of customers, global customers’ perspectives of international brands serving them tend to be positive.

However, as the first statistics in this section reveal, international brands still have a way to go in terms of better understanding their customers from abroad.

When these two findings are coupled, we can conclude that although global businesses ought to work on better understanding their customer expectations, their customers in the global arena generally view international companies positively. As such, serving global customers isn’t as big of a feat that it is made out to be.

Providing Optimal Global Support for All Customer Expectations

This survey provided many positive insights, such as the fact that the sum of customers who were blown away by international marketing efforts and those who were impressed by a few came out to the dominant figure of 65.19%.

Thus, although brands can improve their understanding of their international customers, the state of global customers’ opinions allows companies to feasibly seize global opportunities.

As this survey proves, companies with a global footprint, along with those who seek to venture into the global arena must keep up with their customer expectations. In order to do so, they need to implement a solid tool for extracting customer data.

An online research platform that offers running global surveys at no extra cost is the most effective means of obtaining customer insights. Such a platform should apply RDE (random device engagement sampling) to capture respondents in their natural digital habitats and in a completely randomized manner, as well as include artificial intelligence that performs quality checks to ensure the highest quality of customer data.

The Pollfish platform offers all of these functionalities and more so that all businesses can seamlessly perform global market research.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…