The Second Economic Impact Payment is Not Enough — Say 80% of Americans in a Study

The US Department of Treasury and the IRS have begun rolling out the second Economic Impact payments in late December 2020, as part of the subsequent stimulus bill to the CARES Act in March.

To gain firsthand insights into how Americans feel about the new Coronavirus relief bill (formally called the Coronavirus Response and Relief Supplemental Appropriations Act of 2021), Pollfish surveyed 1,000 people across the country.

We screened respondents of various educational, income and ethnic backgrounds to take part in the survey, centered on both the financial effects of the second Economic Impact Payment, along with the sentiment surrounding it.

Businesses can stand to learn the financial reality of Americans with this new stimulus bill in tow. The full survey is available here.

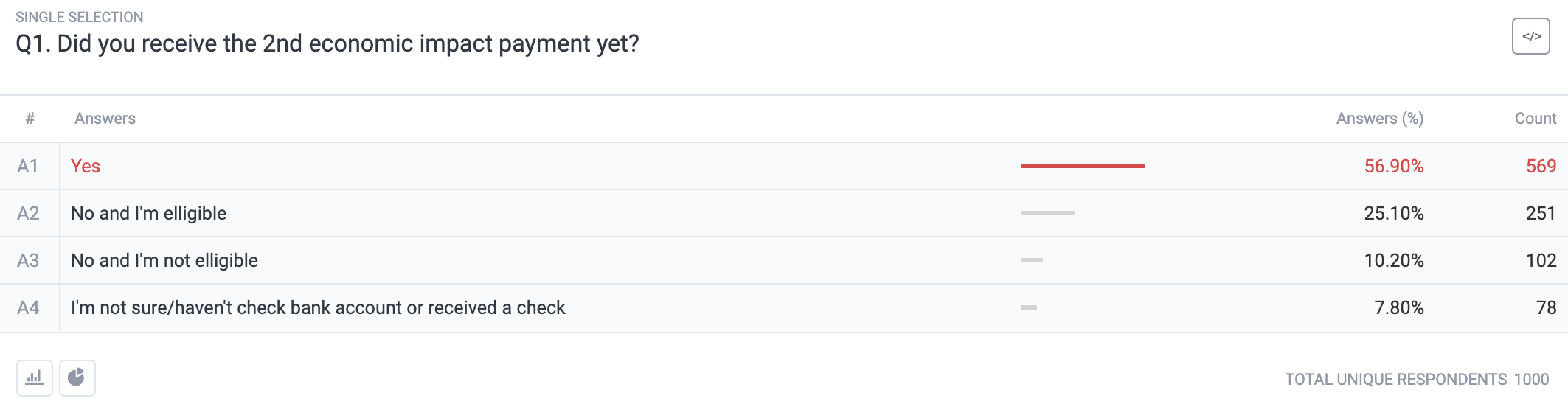

A Little Over Half of Eligible Payees Received the Second Stimulus Check

Before digging into the effects and attitudes of the new COVID stimulus bill, the survey sought to find who and how many received the payments. Over half of our survey respondents received their second Economic Impact payments at 56.9%. Only 10.2% of respondents said they are not eligible for it, while 25.1% did not yet receive it.

It is worth noting that this time around, the time between the announcement and receipt of the payments was far shorter than that of the first iteration, which took months to distribute.

As it stands, the IRS has roughly one week to send the checks to all eligible recipients. Thus, more Americans will make decisions on how to spend their funds sooner.

Next, we dig into the effects of the new payments, from those who received the check, those who have yet to receive the check and those not eligible alike.

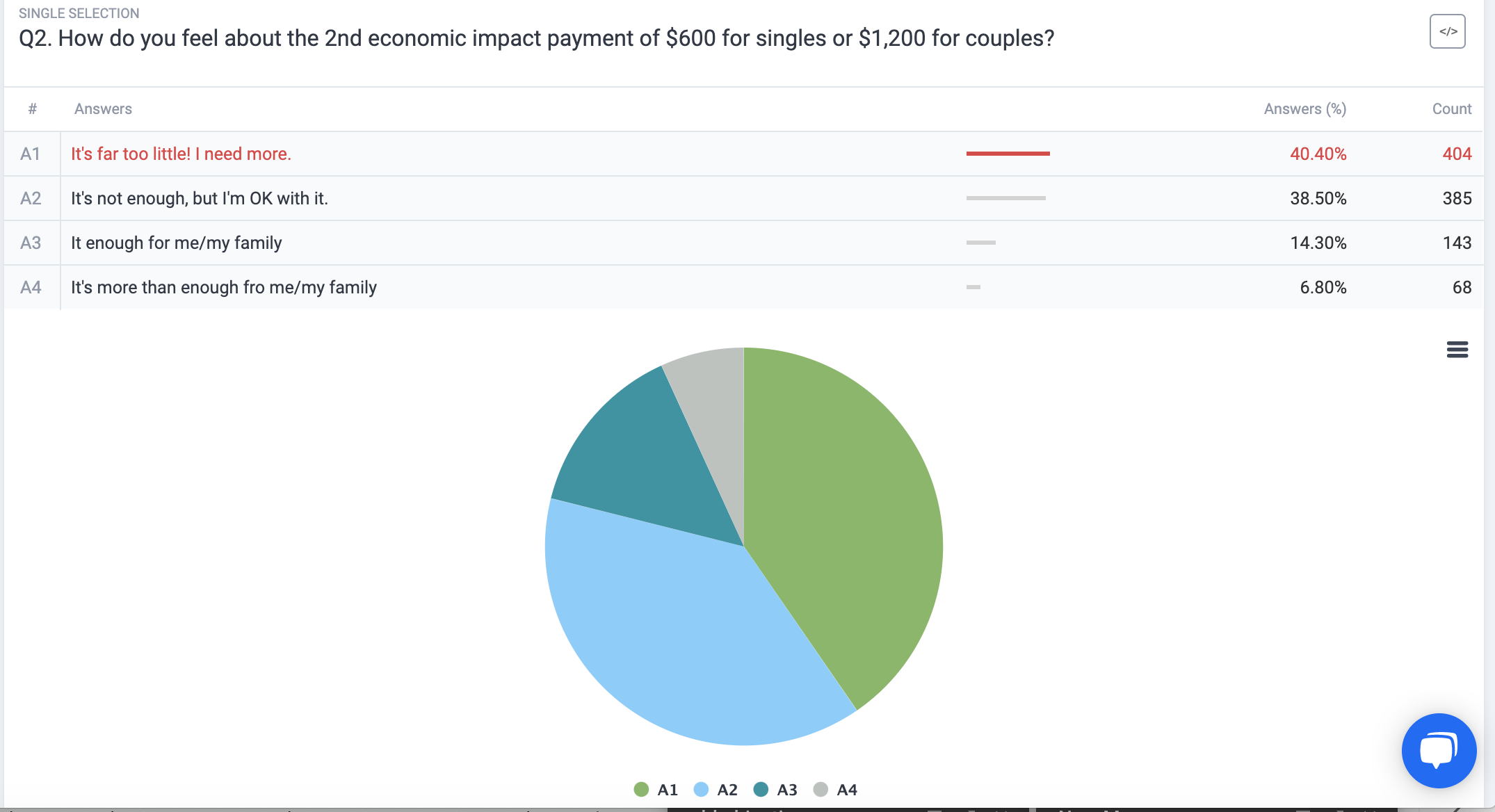

Vast Majority Consider the Second Economic Impact Payments Insufficient

Before delving into how the second stimulus check would affect respondents’ economic activity, we inquired into their standpoint on whether it is enough of an economic aid for them or not. Most respondents answered with a negative response.

The most popular answer with 40.4% of responses, exclaimed that the $600 amount for singles and $1,200 for couples was far too little. 38.5% said that the payments weren’t enough, but in a more accepting manner, as they answered with being fine with the payments.

Despite the latter’s acquiescent tone, it still reflects a negative answer, as the responders believe the amounts aren’t enough nonetheless. As such, when combined with the respondents who expressed the checks to be far too little, the total number of respondents who feel that the second stimulus check is insufficient swells to almost 80%, at 78.9%.

As such, we can infer that the financial situation of the responders isn’t going to significantly improve via the second Economic Impact payments. However, to fully understand how they’re going to deal with the new payments, we probed further.

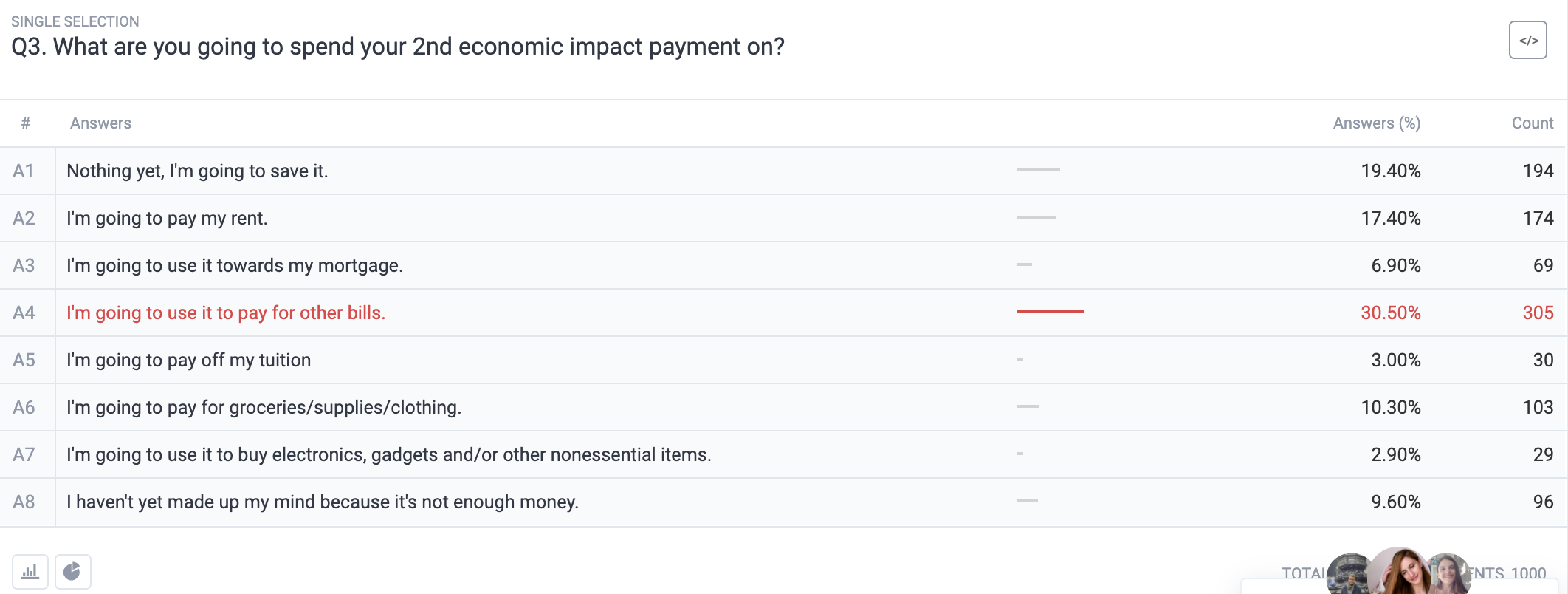

Bills, Savings and Rent — Oh My!

To understand the immediate effects of the second stimulus payments, we asked respondents what they would spend theirs on. In the first round of Economic Impact payments from March 2020, about 30% of recipients saved their check money and another 30% spent theirs on debts.

Consequently, the first bill did not significantly spur consumer spending. This can be due to a weakened economy and joblessness, which painted a grim picture of the financial realities of the present and near future. As such, Americans saved their checks.

Another theory is that the larger the stimulus checks, the more likely people are to save them, as part of the law of diminishing returns.

In this round of stimulus checks, the spending prognosis follows a similar fashion — 30.5% said they are going to use the money to pay bills, while the second-largest response was to save the funds, at 19%.

The bills category inflates to 47.9% when factoring in rent payments, which was the third most popular answer at 17.4%. Given the same emerging spending patterns as the first round of payments, we can infer that these three investments take precedence over other essential and nonessential expenditures from stimulus payments, especially during a pandemic.

However, the fourth most popular answer, yielding 10.3% of responses offers a slightly alternative narrative, as it was for groceries/supplies/clothing. Researchers can deduce that these items are essential, though some of these purchases may not possess the same dire need as others.

As such, there is the possibility that some of these items are not essential, which opens the opportunity for businesses to reel in more customers due in part to these stimulus payments. With this possibility in mind, we asked respondents about their online shopping plans in relation to the second Economic Impact Payments.

Online Shopping: A Tale of Stagnation & Change

The survey revealed two opposing responses to online shopping: one of stagnation, in which the stimulus checks will have no effect on how respondents shop online (54.2% of responses) and the second of a change in online shopping, a positive one to boot, as 17.5% said they’d make an online purchase and 15.2% said they will make plenty of online purchases.

These increases in online shopping expenditures represent a total of 32.7% of responses, thus bringing forth the counter-narrative of (positive) changes to online shopping. We can deduce that these purchases are likely connected to groceries, supplies and clothing options from the previous section.

Owing to the aforesaid dissatisfaction with the payments, 13.1% of responders said that the checks are going to change the way they shop online — but in a negative manner, as they answered with making less online purchases due to the need to save money.

This reason ties this question back to the previous one on spending, as 19% said they would save the money. As a result, spending less is to be expected —whether online or offline.

Regardless, ecommerce businesses can still take advantage of the consolidated 32.7% figure, which shows that respondents will in fact make online purchases after receiving their checks.

The Impact of the 2nd Stimulus Check on the US Economy

We rounded off the survey by asking if the second Economic Impact payment would improve the economy. The question offered six answer options and the most popular answer was a resounding “not at all, the economy won’t change,” at 31.1%.

This prevalent answer, along with the two other highest responses point to a lack of faith in the checks’ ability to make a positive dent — or any — in the US economy. The next two most popular answers were “just a little, nothing substantial”, at 29.8% and “somewhat” at 21.5%.

Combining all three of the negative answers brings the total to an overwhelming 82.4% of respondents who don’t believe the checks will bring any significant betterment to the economy.

These opinions correspond with the general sentiment that the second round of stimulus checks are inadequate.

While the state of the economy appears to be grim, businesses should rest assured that the Covid-19 vaccines will have some positive impact within 2021.

As far as the results of the survey, businesses can still capitalize on the smaller (yet significant) portions of respondents who are planning to use their checks to buy online, and on expenses besides bills and rent.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…