Consumer Survey: 63% of Americans Are Now Facing Record Credit Card Debt Due to Both the Holidays & the Pandemic

This post was contributed by Mike Brown of LendEDU.

It’s not breaking news that Americans have struggled mightily with their finances since the coronavirus pandemic began.

Whether you were one of the millions of people who lost their job or a small business owner who can’t generate business without foot traffic, it’s been a brutal year to maintain a healthy financial lifestyle.

As a result, many consumers have had no other choice but to rack up debt, whether it be from a credit card or personal loan, in order to keep up with expenses from groceries to rent during the coronavirus pandemic and recession.

Making matters worse, the holiday season, which is typically the most expensive time of the year, just took place smack dab in the middle of this unprecedented pandemic that has been characterized by the immense human and financial struggles.

This horrendous timing has led to many Americans taking on a record amount of credit card debt to cover gift expenses during a holiday season marred by the coronavirus pandemic and recession.

That’s according to a new consumer survey conducted by Pollfish and commissioned by LendEDU, a personal finance website operating out of New Jersey.

More Than Half of Americans Took on Record Amount of Credit Card Debt to Cover Holiday Expenses During a Recession

According to the consumer survey that was published by LendEDU, 67% of adult Americans indicated they were reducing holiday shopping this year due to the coronavirus pandemic and recession.

This includes 86% of Americans who lost their jobs due to the pandemic and are still out of work.

LendEDU’s survey on credit card debt also found 33% of respondents were taking on credit card debt to cover those expenses, including 51% of people still out of work.

And within that group of survey participants, 63% said the credit card debt they take on will be a record amount of credit card debt. Amongst those who are without a job because of the pandemic and recession, 75% indicated they are taking on a record amount of credit card debt to cover costs.

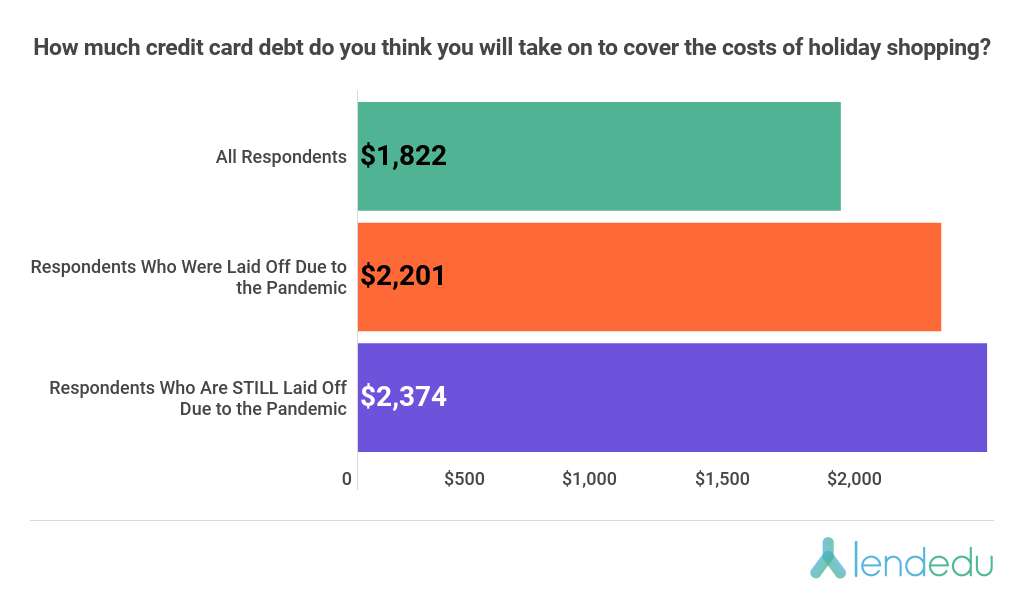

The consumer survey from LendEDU then found out how much credit card debt exactly these folks will be taking on…

The average respondent was taking on $1,822 in credit card debt just from holiday shopping during the pandemic. Amongst folks who have been without a job, the average amount of credit card debt was $2,374 according to the consumer survey.

But the credit card debt numbers got even worse from LendEDU’s consumer survey when poll participants were then asked how much debt they had incurred because of the pandemic and before the holidays.

For 74% of Consumer Survey Respondents, Holiday Debt Just Getting Piled On Top of Earlier Debts

Unfortunately, the consumer survey from LendEDU found that many Americans were piling this holiday debt on top of earlier debts brought on because of the pandemic recession.

Specifically, 74% of respondents had racked up debt on their credit cards solely due to the coronavirus pandemic and before they had added even more debt when holiday shopping needed to be done.

That figure included 86% of consumer survey participants that were laid off due to the coronavirus pandemic and still haven’t found employment.

And in terms of the amount of credit card debt these consumers took on due to the pandemic and before the holidays, the average amount was $2,150. For folks still unemployed, the average amount was $2,443.

All the Debt is Causing Consumers to Lose Sleep

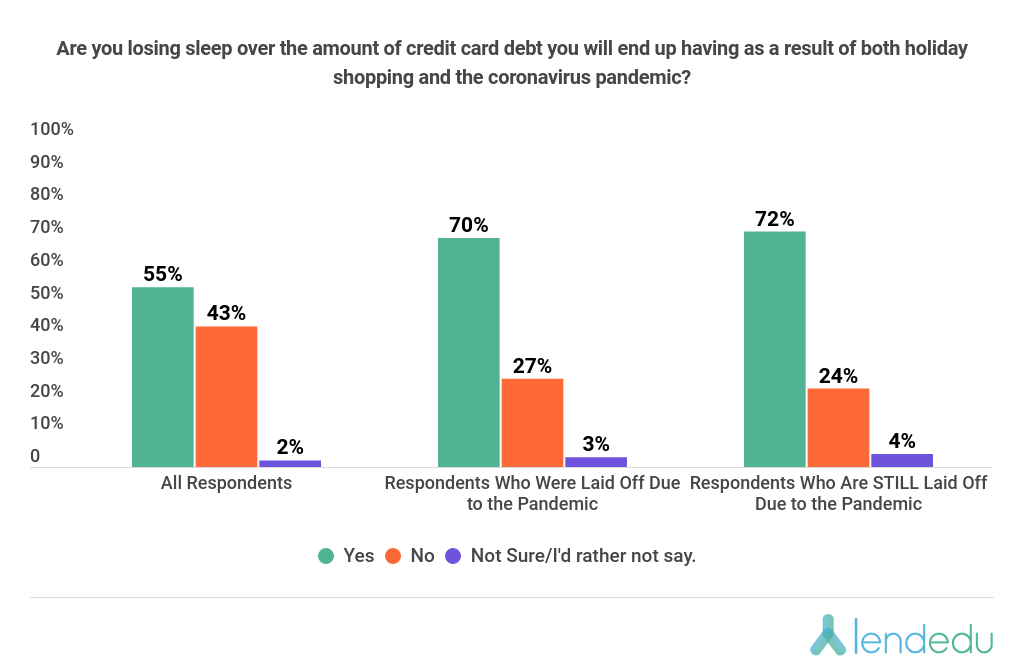

When the consumer survey from LendEDU then asked respondents if they were losing sleep over the amount of credit card debt they have taken on from both holiday shopping and the pandemic, here’s what was revealed:

55% of all respondents indicated that they are losing sleep over their credit card balance, including 72% of consumers who were laid off due to the pandemic and still haven’t gone back to work.

How to Pay Off Credit Card Debt When You Have It

If you find yourself with a heap of credit card debt in 2021 because of both the holidays and the pandemic, there are a few strategies that you can try that may help you payoff the debt faster

The first of these being taking out a balance transfer credit card, which allows you to transfer your existing credit card debt balance onto a new card that ideally has an introductory interest rate of 0% so that all of your payments can go to your principal debt balance and not interest.

Or, you could try implementing the debt avalanche method, which is a debt paydown strategy in which you prioritize paying off your credit cards with the highest interest rates first and then work down from there. This way, you can get rid of the costliest debt right off the bat, which should save some cash in the long run.

Then there is the debt snowball method, which means you first pay off the credit cards with the lowest balances and then work up from there. This method allows you to quickly knock out debts, which can give you the confidence and momentum you need to continue paying off the rest.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…