Pollfish Client Discovers the Financial Impact of Unpaid Maternity Leave

This post was contributed by Mike Brown of Breeze.

When it comes to maternity leave in the United States, there is a glaring incongruity between public opinion and reality.

On the former, 82% of Americans believe paid maternity leave should be made available to mothers following the birth or adoption of their children according to Pew Research.

Despite that, here comes the latter: a mere 17% of U.S. workers have access to paid maternity or paternity leave according to the latest data from the U.S. Bureau of Labor Statistics.

While getting into the pros and cons of the government implementing a nationwide paid maternity leave policy is a debate for another time and place, we can dive into what the data tells us about unpaid maternity leave.

And that data comes from Breeze, an online insurance broker specializing in disability insurance and income protection, who conducted a survey through Pollfish of 1,000 American women who recently went on unpaid maternity leave.

Breeze’s findings on the financial impacts of unpaid maternity leave can be found below.

Before Unpaid Maternity Leave, Some Expecting Mothers Turn to Short Term Disability Insurance

The average mother will typically take around ten weeks of unpaid maternity leave or two and a half months.

That’s a long time to go without income, especially when you are simultaneously dealing with the challenges and expenses of nurturing and raising a newborn baby.

One possible way to potentially mitigate the loss of income on unpaid maternity is to take out a short term disability insurance policy, which will usually replace between 40% and 60% of one’s income for between three to six months or for however long the policyholder is physically unable to do their job.

So for expecting mothers, short-term disability insurance might keep some of their income rolling in even while they are out of work on unpaid maternity leave.

Breeze found 40% of respondents took out such a policy, while 35% did not, and 25% did not reveal their answer.

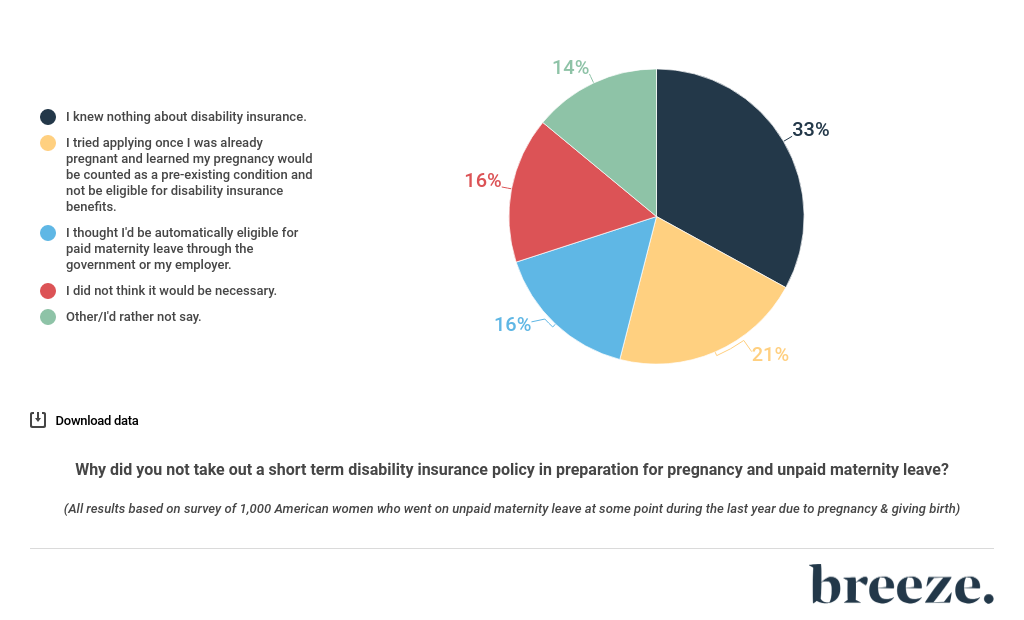

Amongst the group that did not take out a policy, it seems the biggest reason why was a lack of education on the product. 33% of them said they knew nothing about disability insurance, while 16% thought they’d be automatically eligible for paid maternity leave through their employer or the government.

Another 21% tried applying when they were already pregnant, which is too late because the pregnancy will be counted as a pre-existing condition and not trigger a benefits payout.

Short & Long-Term Impacts of Unpaid Maternity Leave

Sticking with the mothers on unpaid maternity leave and without short-term disability insurance, this group really had a tough going for a couple of months with absolutely no income coming in.

So, what were the financial impacts of this?

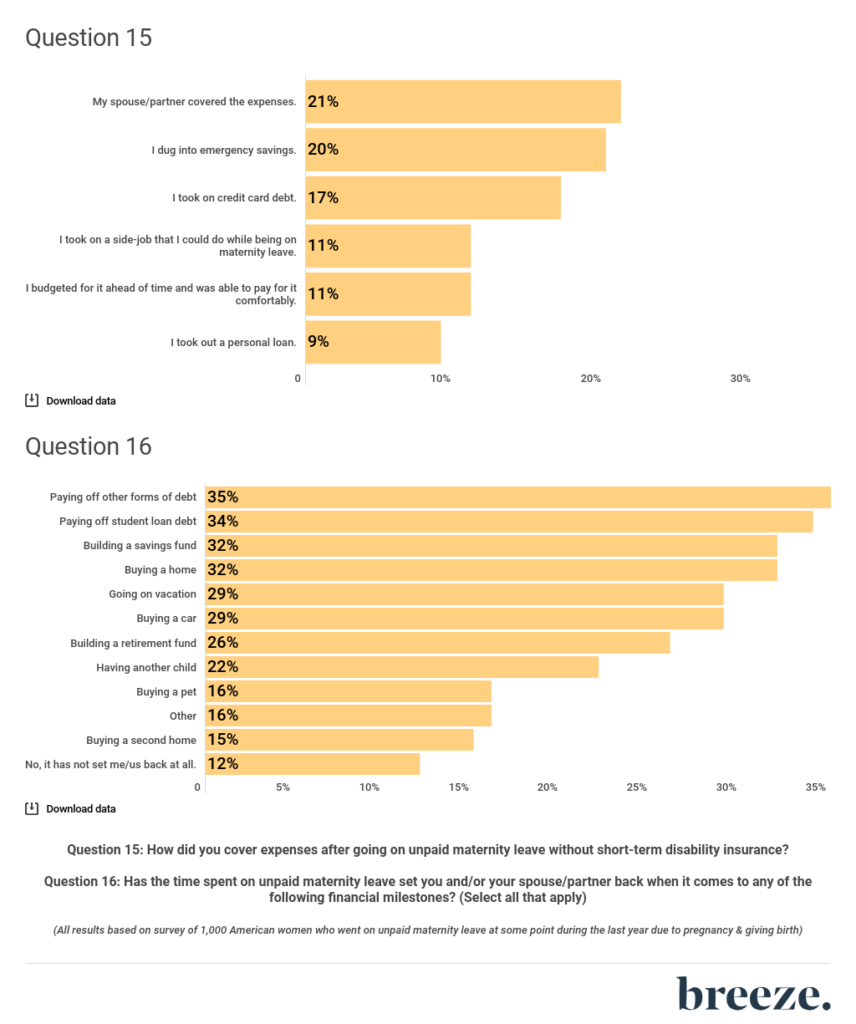

In the short term, Breeze’s study found many of these mothers had to turn to credit card debt, personal loans, side-jobs, and emergency savings to cover costs while on unpaid leave. Some turned to their spouse or partner to shoulder the added financial burden, while just 11% indicated they could handle costs comfortably.

In the long term, this same group of poll participants had to delay a number of usual financial goals as a result of taking a monetary hit while being on unpaid maternity leave. For example, 34% of respondents had to delay paying off student loan debt, while 32% delayed buying a home, 29% delayed buying a car, 26% put off building a retirement fund, and 16% had to delay purchasing a pet.

Unfortunately, the negative impacts of unpaid maternity leave didn’t stop with personal finances.

The Breeze study found there was a significant concern amongst mothers who went on unpaid maternity leave in terms of the development of their children.

Unpaid Maternity Leave & the Impact on Child Development

As mentioned earlier, the average American mother goes on unpaid maternity leave for nearly three months.

That’s a quarter of the year without income at a time when expenses are at an all-time high due to diapers, baby food, and everything in between.

Breeze found that many mothers actually had to return to work sooner than they would have liked due to the financial squeeze of unpaid maternity leave.

Amongst respondents who took out a disability insurance policy beforehand, 65% still had to return to the office sooner than they would have liked due to financial reasons.

And amongst respondents who did not take out that insurance product beforehand, 51% still had to get back to work and cut their unpaid leave time short.

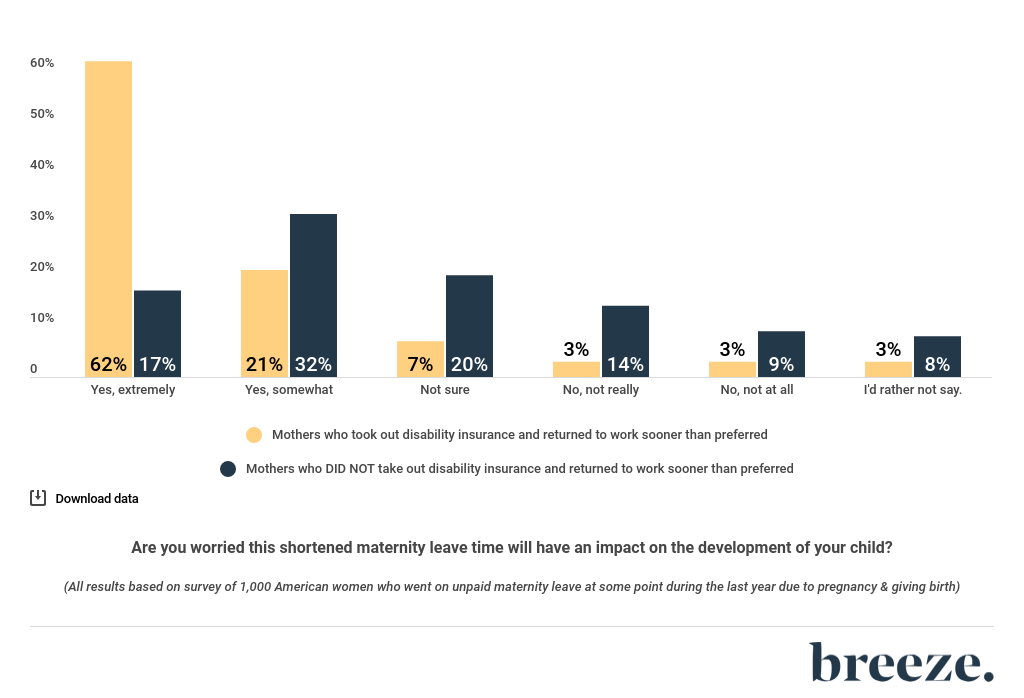

Not surprisingly, most mothers from both of these groups are concerned this early return to work will have an impact on their child’s development, with concerns ranging from “extremely” to “somewhat.”

Hindsight

Aided by hindsight, we here at Breeze asked our respondents how they would handle unpaid maternity leave a second time around. The data here could be useful for those who are planning on pregnancy and maternity leave.

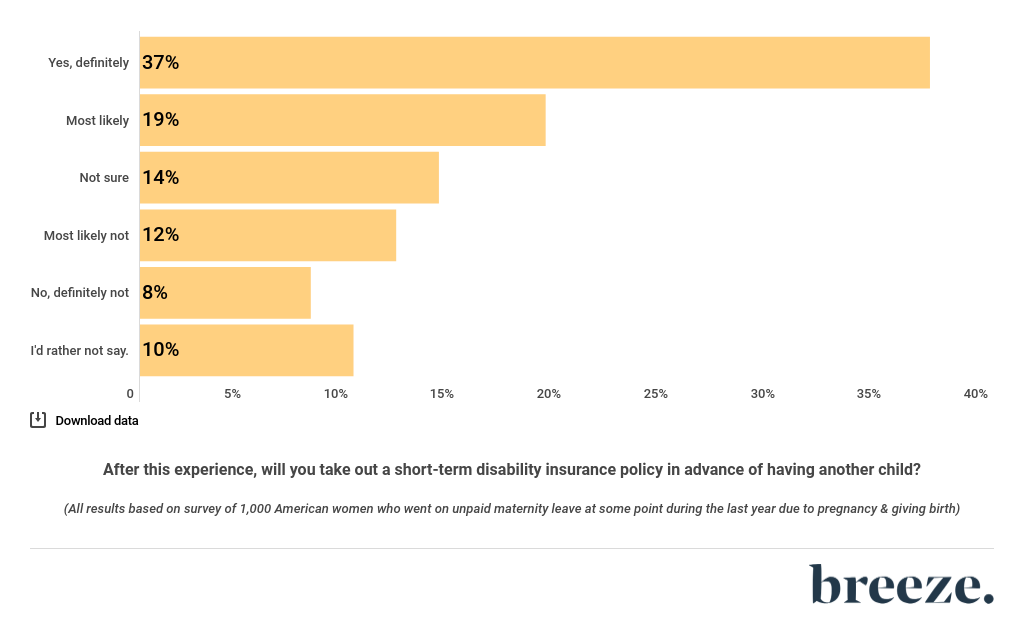

Respondents were first asked if they would take out a short-term disability insurance policy if they were planning on going through pregnancy and unpaid maternity leave again.

37% said they definitely would, while 19% answered most likely, and 14% were unsure either way. Conversely, 8% said definitely not and 12% said most likely not.

Circling back to just the mothers who took out a policy beforehand, we then asked them if they would recommend other expecting mothers to do the same.

And the results of that?

60% said, “yes, the replacement income helped me in a lot of ways.” Additionally, 12% said yes but for another reason not listed, and a combined 17% answered that they would not recommend such a policy to other women.

For Employers

Finally, what can employers take from this Breeze survey that was conducted through Pollfish?

It’s clear most mothers going on unpaid maternity leave face certain financial troubles for at least a couple of months. What can employers learn from this?

We asked all 1,000 respondents the following question:

If you were to begin a new job search, would you give an advantage to any prospective employer that offers paid maternity leave?

To this, 57% of respondents answered “yes,” while 23% answered “no,” and 21% opted not to answer one way or the other.

Next, we asked a bit more of a deeper question to poll participants:

If you were to begin a new job search, would you give an advantage to any prospective employer that offers a short-term disability insurance plan but still has unpaid maternity leave?

To this, 49% answered “yes,” while 28% answered “no,” and 23% preferred not to say.

From just these two questions and the subsequent results, it’s clear that employers would gain an advantage to some degree if they offered either paid maternity leave or a short-term disability insurance employee benefit.

Either of these could not only help employees attract the best talent, but also retain their current talent.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…