Americans Grow Increasingly Worried About Finances Due to Coronavirus, While Unemployment Doubles

This post contributed by Mike Brown of LendEDU.

At the time of this writing, the latest numbers from Johns Hopkins University of Medicine report over 1,381,000 cases and 78,200 deaths worldwide due to the Coronavirus outbreak.

With the COVID-19 outbreak shaping up to be one of the worst global pandemics in a century, the economy has acted accordingly. Stock indexes like the S&P 500 and Dow Jones are plummeting to record lows, and a recession is looking like a near certainty.

And as federal guidelines keep people sheltered in place to slow the spread, small businesses have had to shutter their doors and lay off employees. In two weeks alone, a startling 10 million Americans filed for unemployment.

In such unprecedented and unstable times, managing your finances during the Coronavirus can be a highwire balancing act. LendEDU sought to evaluate how Americans are handling their personal finances during the pandemic by using survey platform Pollfish.

Over the course of two weeks, we conducted two separate surveys of 1,000 adult Americans. The questions remained the same in both surveys so that we could track how the financial situation for Americans has changed as the COVID-19 outbreak has worsened.

From the first survey on March 18, 2020 to the second one on April 1, 2020, we found that more Americans have lost their jobs due to the pandemic, while higher percentages of folks are concerned about their retirement savings and have had to dip into emergency accounts more often.

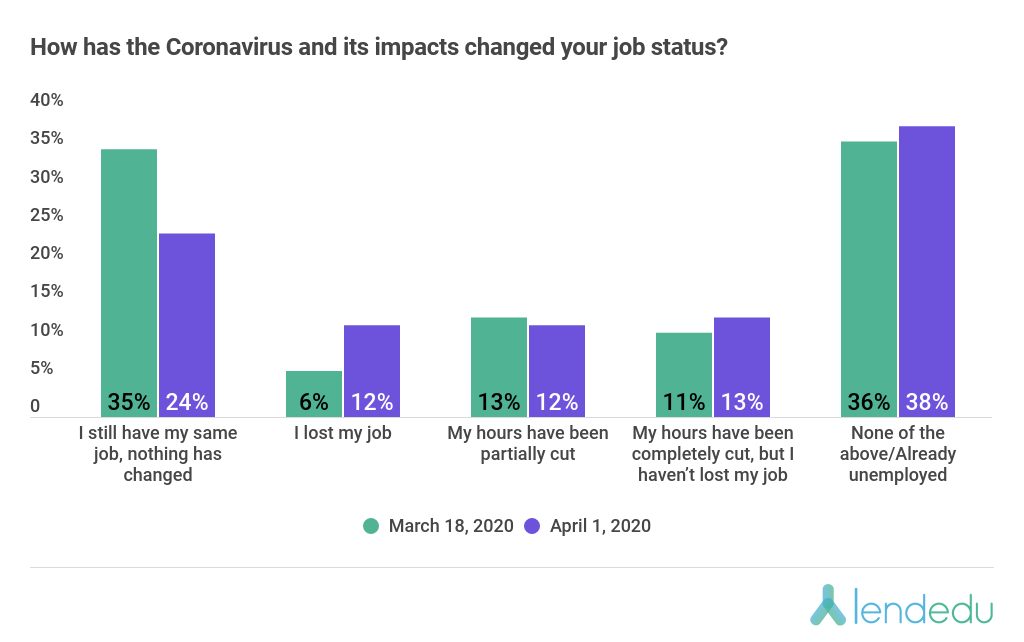

From Survey-to-Survey, Unemployment Doubles

LendEDU’s first Coronavirus survey found that 35% of adult Americans had maintained their exact same jobs without changes, while 6% had lost their jobs due to COVID-19, 13% had seen their hours reduced, and 11% had been furloughed.

That survey was conducted on March 18, and when we asked the same question again to 1,000 adult Americans two weeks later on April 1 the results changed quite a bit.

LendEDU’s second Coronavirus survey saw the percentage of people that have been laid off due to the virus double to 12%, while there was a drop of 11 percentage points in terms of people that have seen no changes to their jobs, and an increase of 2 percentage points in terms of people that have been furloughed.

Interestingly, there was actually a slight drop in the percentage of respondents that were worried about their job security going forward as the Coronavirus continues to have an impact in the U.S.

57% of applicable respondents had this concern in the first survey, while 55% had it the second time around. Perhaps, there is a feeling that if you have made it this far with your job then you will probably maintain it.

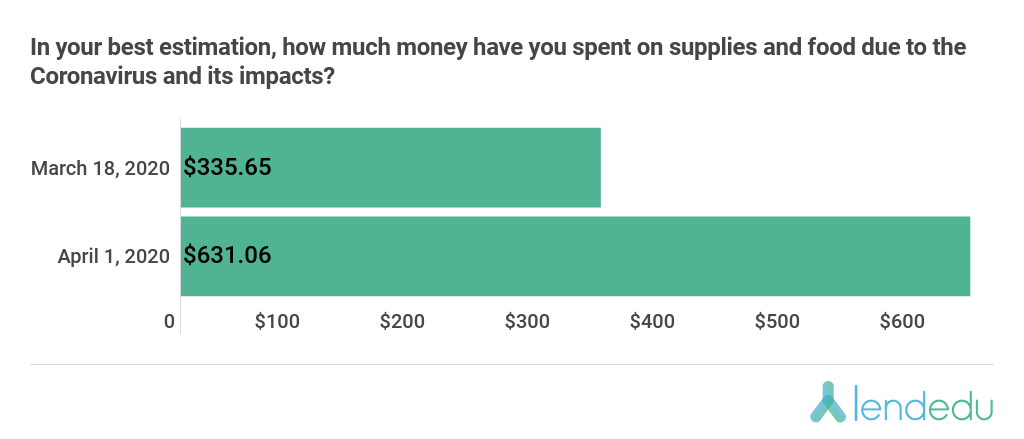

Expenses Have Doubled, While More Consumers Have Also Had to Utilize a Savings Account or Emergency Fund

When we first asked our poll participants how much money they have spent on food and supplies as a result of COVID-19 preparations, the average amount spent was $335.65.

That number nearly doubled the second time around.

From survey-to-survey, there was an 88% increase when it came to the average amount of money spent on food and supplies due to the Coronavirus.

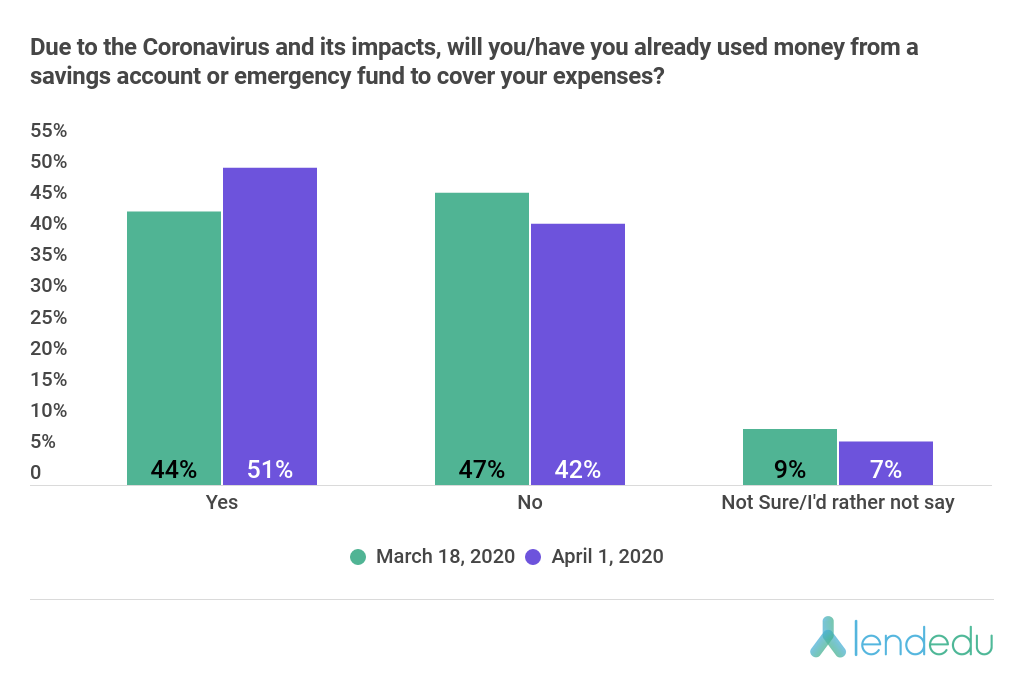

And as a result, we also saw a significant increase in the percentage of respondents that have had to use money from a savings account or emergency fund to cover expenses.

51% of adult Americans have had to dig into their savings account or emergency fund to cover their costs. Two weeks ago, that percentage was only 44%, which indicates that finances are getting tighter for many Americans as COVID-19 continues to impact our daily lives.

51% of adult Americans have had to dig into their savings account or emergency fund to cover their costs. Two weeks ago, that percentage was only 44%, which indicates that finances are getting tighter for many Americans as COVID-19 continues to impact our daily lives.

Additionally, one new question asked in the second survey revealed that 63% of poll participants are worried about running out of money in their accounts due to the Coronavirus and its impacts. This includes 88% of folks that have recently been laid off because of the pandemic.

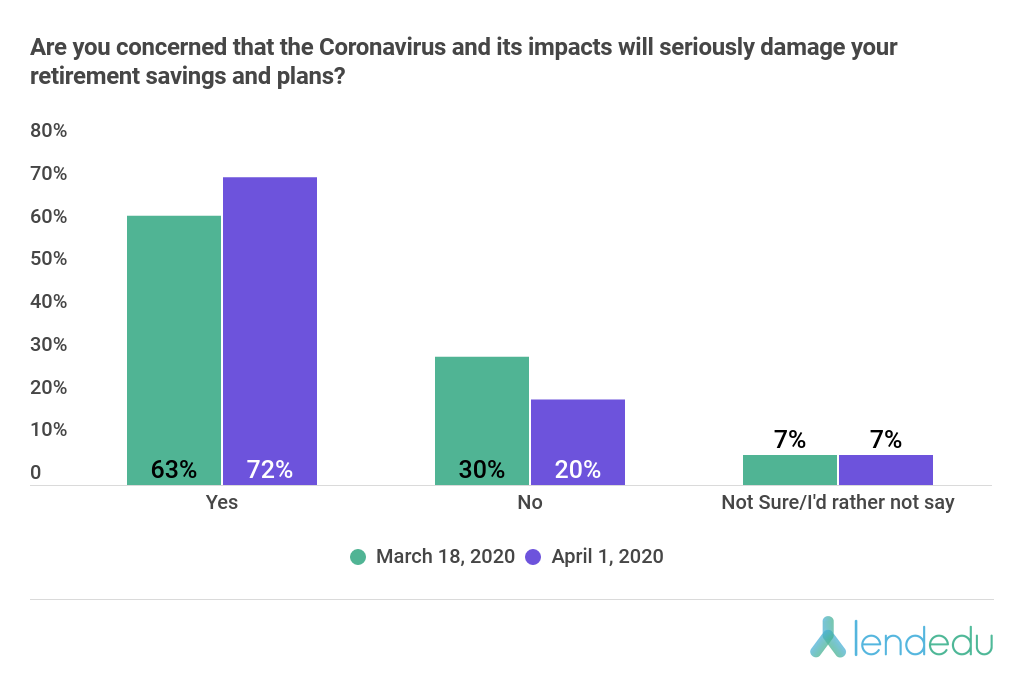

Concerns Over Retirement Savings Also Mount

As mentioned earlier, the stock market has not been spared by the Coronavirus pandemic, and with a recession looming, many Americans are worried about what will happen with their retirement savings.

This is especially true for older Americans who are so close to enjoying the fruits of their labor.

From survey-to-survey, we saw a notable increase in the percentage of Americans who are worried about their retirement savings.

While 63% of respondents from the first survey indicated that they are concerned about their retirement savings as COVID-19 continues to impact the U.S., that percentage jumped to 72%.

While 63% of respondents from the first survey indicated that they are concerned about their retirement savings as COVID-19 continues to impact the U.S., that percentage jumped to 72%.

Further, 67% of Americans ages 55 and up had this worry from the first survey, and that percentage for the same cohort increased to 71% two weeks later.

Ultimately, the next couple of weeks or months will be trying, especially as it pertains to personal finances, but it is always important to remember that this too shall pass and we will bounce back financially, mentally, and physically.

In response to COVID-19, Pollfish has been offering 50% off of surveys to help businesses gather original data to understand consumer sentiment, develop insightful reports, and offer solutions to their customer base that are right for them at this time. To learn more about this offer, contact customer support and create an account to begin gaining your own insights.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…