As the Pandemic Continues, Recent Legislation May Have Saved Student Loan Borrowers

This post contributed by Mike Brown of LendEDU.

It has now been more than two months since the coronavirus pandemic started seriously impacting the United States and President Trump declared a national emergency.

Since that time, more than 1.36 million Americans have been confirmed to have the COVID-19 virus and more than 82,000 have died due to the disease according to the latest numbers from the Centers for Disease Control and Prevention at the time of this writing.

Also over this timeframe, we have seen the American economy collapse at rates not seen since the Great Depression. Since mid-March, there have been 36.5 million Americans that have filed for unemployment; this number represents 22.4% of the March labor force in the U.S.

At the end of March, the Dow Jones had its steepest first-quarter drop in the 124-year history of the stock market index. Further, the S&P 500 had its worst first-quarter decline since the 2008 financial crisis.

And since the beginning of this pandemic here at home, the U.S. government has committed more than $6 trillion in an effort to stave off the economic downturn. This amount means the country is on pace to blow by World War II-era highs in national debt.

As expected, this macro-level financial collapse has spared no one and trickled down to impact the average, everyday American consumer as LendEDU has been finding out through a series of surveys.

Two Months into the Coronavirus Pandemic, Americans Continue to Struggle With Finances

With the help of survey platform Pollfish, LendEDU has conducted three separate surveys of 1,000 adult Americans each since the start of the pandemic to track how personal finance situations across the country are being impacted by the coronavirus.

The first survey was conducted on March 18, the second survey on April 1, and the third and final LendEDU survey was conducted on May 5.

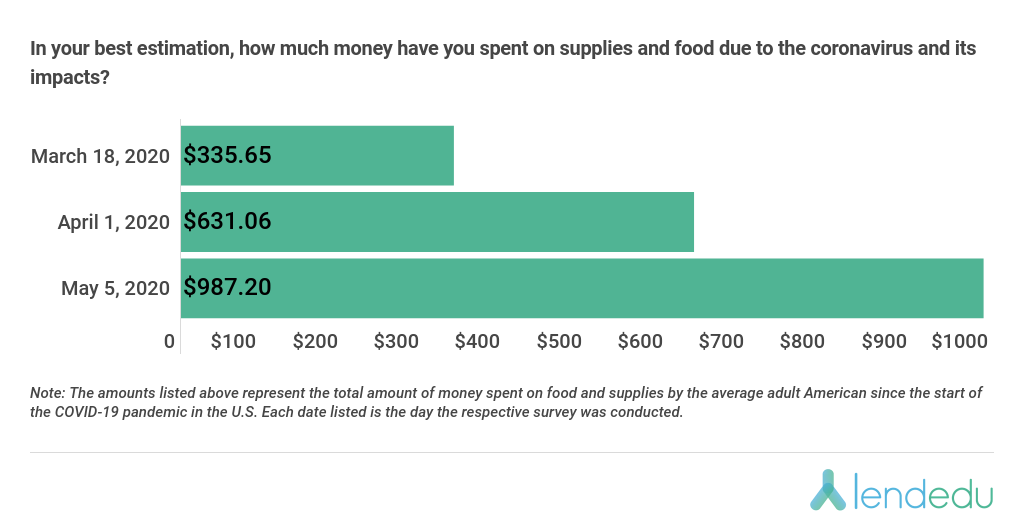

From the first to the third survey, LendEDU has seen expenses for everyday Americans consistently climb as it relates to buying food and supplies in preparation.

While only $335.65 was spent by the average American on March 18, $631.06 was spent by April 1, and $987.20 was spent by May 5. This means that from the first to the third survey, coronavirus-related expenses have increased by 194%.

While only $335.65 was spent by the average American on March 18, $631.06 was spent by April 1, and $987.20 was spent by May 5. This means that from the first to the third survey, coronavirus-related expenses have increased by 194%.

With expenses getting tight for so many households, the $1,200 one-time government payments as part of the coronavirus economic stimulus package were supposed to be of great assistance. One issue with that, however, is that 26% of eligible Americans have still yet to receive the payment according to LendEDU’s latest survey.

In addition to this dilemma, LendEDU also found that 54% of applicable Americans are still waiting to receive unemployment benefits after getting laid off due to the pandemic. With so many folks losing their jobs, statewide unemployment systems have been flooded which has caused delays.

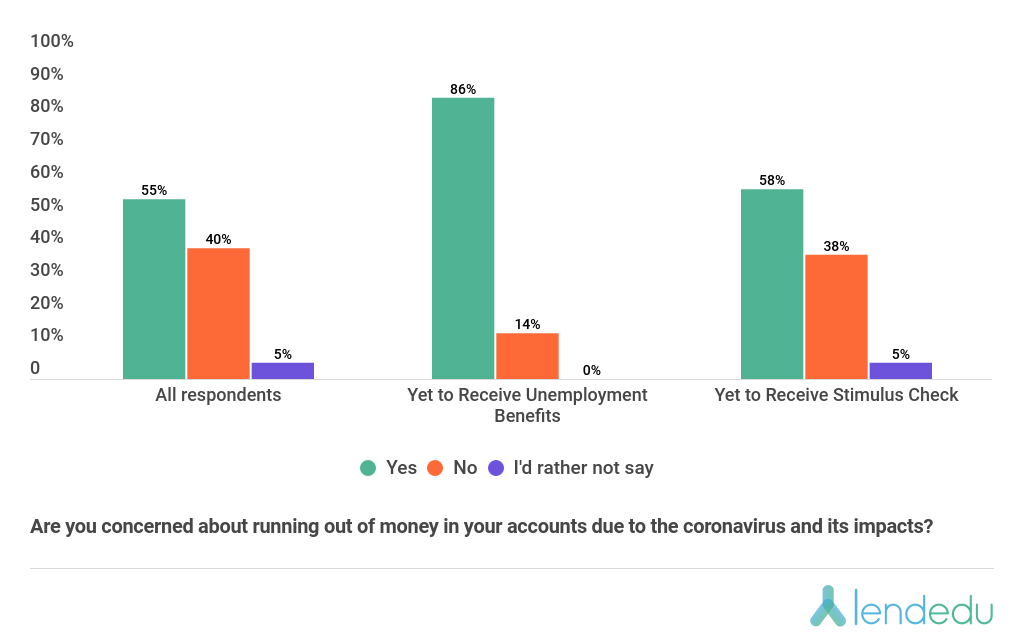

LendEDU’s latest survey found that 86% of Americans that have yet to receive unemployment benefits are concerned about running out of money in their accounts compared to 55% of standard respondents that have the same fear.

Additionally, 79% of those who have not yet received unemployment benefits have already had to use money from a savings account or emergency fund to cover expenses compared to 45% of standard poll participants. These numbers become especially tough to swallow when recent data shows that there might be a correlation between having a lower income and having higher chances of contracting the virus.

Additionally, 79% of those who have not yet received unemployment benefits have already had to use money from a savings account or emergency fund to cover expenses compared to 45% of standard poll participants. These numbers become especially tough to swallow when recent data shows that there might be a correlation between having a lower income and having higher chances of contracting the virus.

With finances tight for everyone, LendEDU wanted to look into how the coronavirus pandemic is impacting student loan borrowers specifically.

CARES Act May Have Saved Student Loan Borrowers From Financial Ruin

As part of the CARES Act that was signed into law on March 27, 2020 to help mitigate the financial destruction caused by the coronavirus pandemic, no payments on federal student loans will be required until September 30.

Additionally, no interest will accrue on federal student loan debt during this same time.

LendEDU conducted a survey of 1,000 federal student borrowers with the help of Pollfish on April 20 and found that these changes may have saved many federal student loan borrowers who are feeling the financial squeeze due to the virus outbreak.

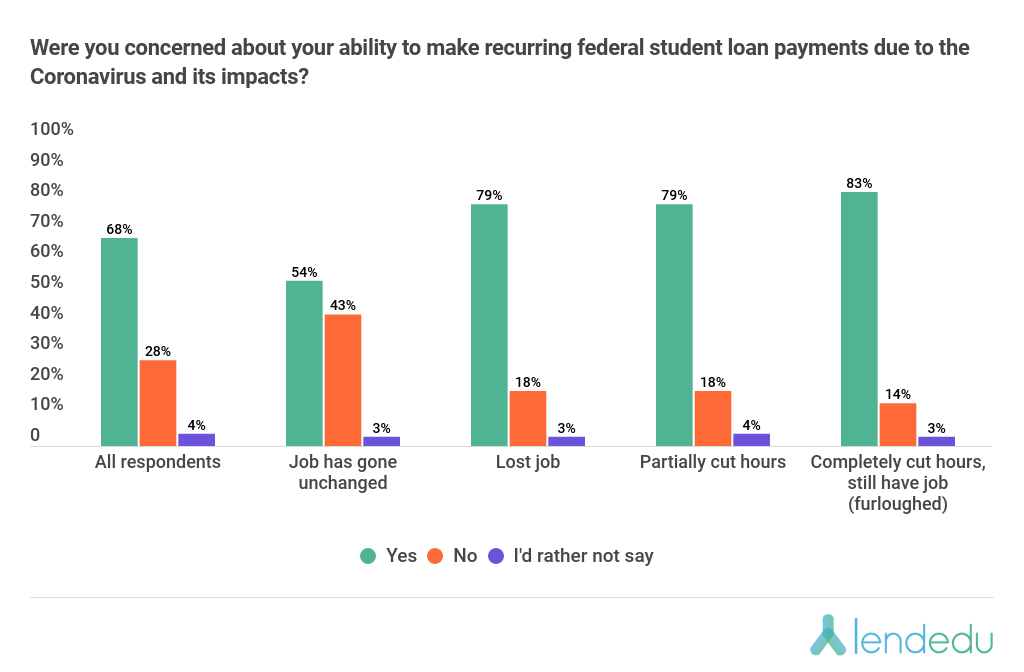

LendEDU found that 68% of federal student loan borrowers were unsure if they would have been able to continually make federal student loan payments had the CARES Act not been passed. This percentage includes 79% of borrowers that have lost their job due to the pandemic.

LendEDU found that 68% of federal student loan borrowers were unsure if they would have been able to continually make federal student loan payments had the CARES Act not been passed. This percentage includes 79% of borrowers that have lost their job due to the pandemic.

LendEDU also found that 54% of borrowers would not have been able to make their very next federal student loan payment, including 61% of those who have been laid off. Further, 78% of borrowers were unsure if they could make payments on private student loans, including 83% of those who have lost their jobs.

While private student loan borrowers have not been granted the same forbearance as federal borrowers, there are a number of private student loan lenders that are willing to agree on a solution with the borrower to reduce the stress of repayment.

But for those that are still able to make federal student loan payments during this unprecedented time, they can really make serious headway on their federal student loan debt since no interest is accruing.

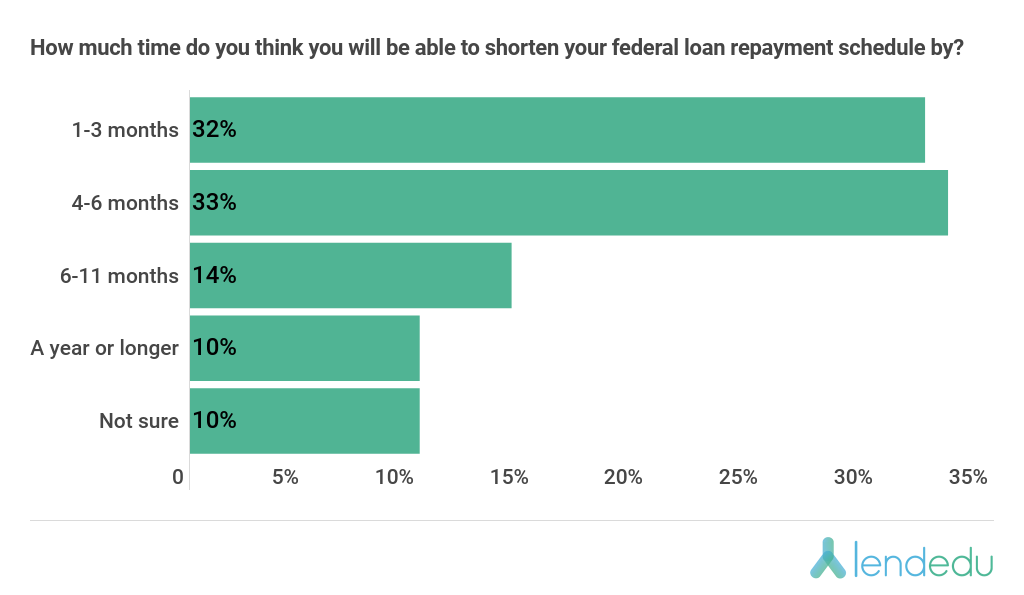

Amongst those that will continue to make federal student loan payments, LendEDU found that 32% think they can shave one to three months off their repayment timeline, while 33% think they can reduce their timeline by four to six months. Another 14% think they can take between six and 11 months off their repayment timeline by continuing to make payments during the pandemic.

Amongst those that will continue to make federal student loan payments, LendEDU found that 32% think they can shave one to three months off their repayment timeline, while 33% think they can reduce their timeline by four to six months. Another 14% think they can take between six and 11 months off their repayment timeline by continuing to make payments during the pandemic.

In response to COVID-19, Pollfish has been offering 50% off of surveys to help businesses gather original data to understand consumer sentiment, develop insightful reports, and offer solutions to their customer base that are right for them at this time. To learn more about this offer, contact customer support and create an account to begin gaining your own insights.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…