Consumer Showrooming Behavior

The purpose of this consumer survey was to find out the patterns of consumer showrooming behavior and measure the effectiveness of suggestions made for retailers to take an advantage of this increasing trend.

This survey of retail demographics consists of 13 questions about demographic, showrooming behavior and ways to increase in-store and mobile sales.

There were 283 survey respondents with 141 males and 142 females. Teenagers, college students, and young adults make up about 70% of the respondents whereas older adults and baby boomers are roughly accountable for 30%.

Q1.Which retail stores do you shop at?

Being accountable for 32% of 10 retail stores, Wal-Mart was the retail store where most of the respondents shop followed by Target with 17%. Macy’s represents about 9%. The rest of the retail stores such as Bloomingdales, Dillard’s, Kohl’s, Neiman Marcus, Nordstrom, J.C. Penney, Saks Fifth Avenue, and Sears have less than 7%.

Q2.Which retail apps do you use?

The retail apps that the respondents mostly use are Wal-Mart, Target, and Macy’s. The rest of the retail apps have fragmented share of 8% or less.About 60% of the respondents answered that they think those retail apps provide personalized shopping experience while 30% said they are neutral and only 10% provided negative feedback.

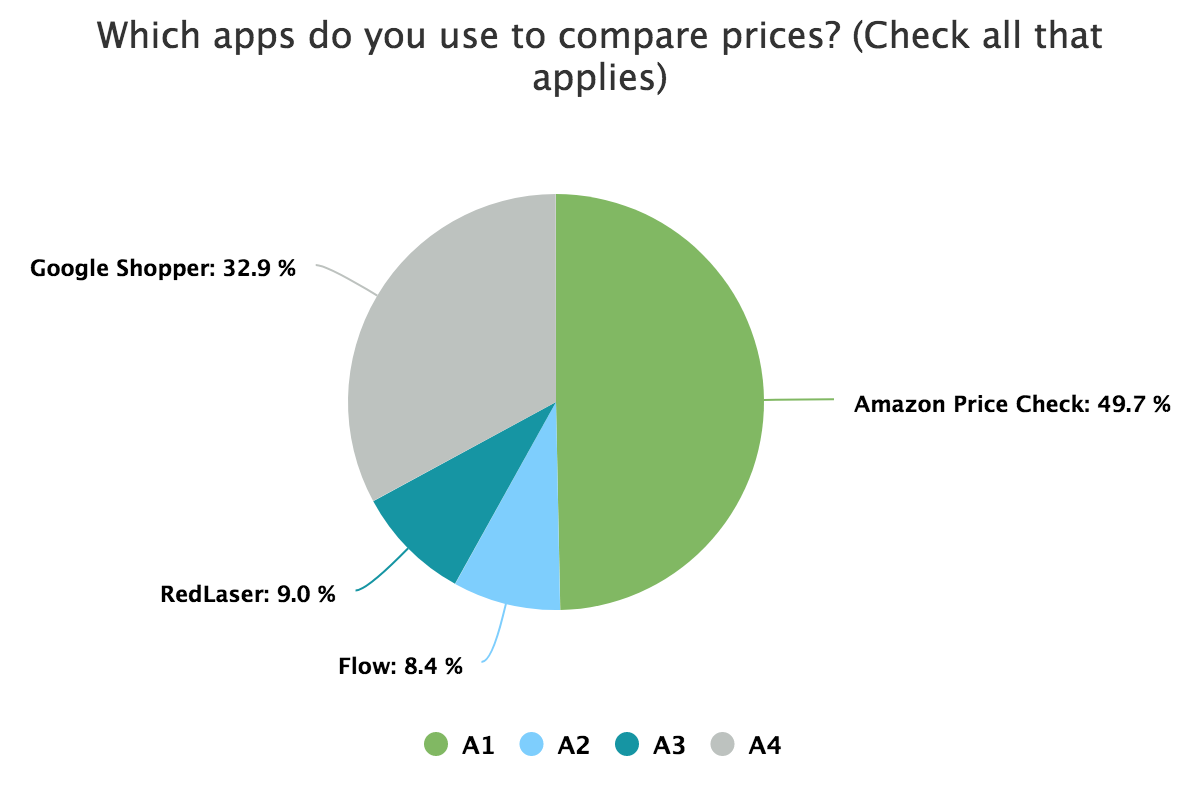

Q3.Which apps do you use to compare prices?

Nearly 80% of the respondents stated that they compare prices when shopping at retail stores. As seen in existing studies, the survey results indicated that showrooming is common across all age groups. Amazon Price Check and Google Shopper are the most frequently used apps for showrooming; these two apps account for about 73% while Flow represents 18% and RedLaser is accountable for 9%.

Conclusions

The survey results indicate that the consumers mostly shop at Wal-Mart, Target, and Macy’s using these retailers’ apps that provides satisfying personalized shopping experience. Most consumers use Amazon Price Check and Google Shopper to compare prices. Consumers’ willingness to switch to the Amazon’s Fire phone for its shopping feature shows that mobile shopping has become prevalent. The easy payment process is one of factors to increase sales via mobile, as the consumers frequently use the Amazon’s 1-Click Ordering. In order to drive in-store sales, it is suggested that retail stores keep the loyalty program, offer price matching, maintain good customer relationships, and provide good in-store mobile coupons.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…