Distribute a Survey with these 5 Survey Distribution Methods To Get More Respondents

You should distribute a survey in all research endeavors, as it grants you actionable data you can use to drive a number of business decisions. Survey distribution accounts for so much more than identifying a contact list of those to survey, aka, your survey respondents, and sending a survey to them.

By taking only this approach, you are gravely limiting your market research campaigns. While there are many market research techniques, few are as powerful and useful as survey campaigns, as they provide primary research that you can set up entirely to your liking.

More importantly, surveys are an excellent market research technique, as they let you get to the heart of your business — your customers. Despite claiming to be customer-centric, many businesses simply do not collect enough data about their customers.

In fact, only 14% of organizations have a 360-degree view of their customers, despite 82% of them aspiring to achieve this goal.

This blog post provides a thorough overview of survey distribution, including legacy and new methods, along with 5 tips, so that you can distribute a survey at ease and gain critical data.

Before we begin, if you are ready to get responses now, distribute your survey now via this registration link. You can instantly create and send your survey to a targeted audience in over 160 countries worldwide.

Distribute a Survey: Table of Contents

- Distribute a Survey: The Two Main Approaches

- Legacy Survey Distribution Methods (NOT Recommended)

- 5 Newer and Better Survey Distribution Methods

- Deciding on the Right Survey Distribution Method

- Legacy Survey Distribution Methods Are Fatally Flawed

- Distribute a Survey with 5 Better Survey Distribution Methods

- How Is Pollfish Different?

- Is Random Device Engagement Really That Much Better?

- Making the Most of Your Survey Campaigns

Distribute a Survey: The Two Main Approaches

There are various survey distribution methods, all of which can be categorized into two main kinds: legacy and newer survey distribution methods.

New survey distribution methods have been stepping up to replace the legacy methods, largely due to changes in technology and consumer behavior that allow for faster, better results and more opportunities to reach your target audience. Market research professionals are already taking advantage of these new methods, and you can too!.

Read on to see how to distribute your survey like a pro.

Legacy Survey Distribution Methods (NOT Recommended)

These involve the older, traditional methods used to distribute surveys. Most of them are outdated, or at least are outpaced by the usage of newer survey distribution methods. We suggest exercising caution if you decide to use any of these methods.

Most take too much time and effort, without offering the maximum results that newer, modern distribution methods have.

The following presents 5 legacy methods of distributing surveys:

- Telephone Surveys

- Although popular in the 1990s, this method has been on the wane since the early 2000s.

- Telephone survey response rates have declined sharply in the past 10 years.

- In-person Interviews

- This involves one-on-one interviews, along with focus groups and field research/ethnographic studies.

- Google Search Ads

- While this may be the only digital option, you’ll need to contend with the reality that most people, including site users, ignore ads.

- Survey panel sampling

- Market research panels enlist a group of pre-recruited participants to take part in a research campaign. This includes partaking in a survey.

- Survey panels refer specifically to survey campaigns.

- Market research panel

- As the previous method explained, this involves opting in respondents who are pre-recruited.

- This is the more general panel method, as it can apply to interviews, ethnography, focus groups and more.

- Snail Mail

- One of the oldest methods to survey participants in the modern age.

- This method is preceded by door-to-door visits and the punch card tabulator.

- You can read more about this machine and other survey methods, in our article, the history of surveys and survey platforms.

5 Newer and Better Survey Distribution Methods

Standing in direct contrast with legacy methods, modern survey distribution methods do not merely offer more technologically advanced solutions — but a more seamless survey distribution process.

This also allows you to improve your survey experience, depending on the method you choose. Additionally, it will depend on the service that you rely on, as part of your method, whether it is SaaS or an agency, to grant you the power to customize your survey experience.

The following lays out the newer and more effective means of distributing surveys:

- Random Device Engagement

- A kind of organic sampling, which catches respondents in their natural, aka, voluntary online spaces.

- Thus, users are already engaged in their digital environments and are more likely to pay attention to elements calling them out to take a survey.

- This method also avoids the phenomenon of panel fatigue, which occurs when the willingness to partake in a survey declines due to constant survey participation.

- Assisted Crowdsourcing

- Crowdsourcing is the practice of obtaining needed services, ideas or content by soliciting contributions from a large group of people.

- In the context of market research, this method involves soliciting research participants.

- This method gains respondents through social media. It can have huge penetration, yielding a lot of data.

- But biases can be introduced by quota sampling, which can lead to serious polling errors

- This can be done with the DIstribution Link feature, in which you send your survey your way.

- This can mean sending it via social media, a landing page, email, or whichever method you choose.

- Hire a market research agency

- This may involve using a SaaS company that offers an online survey platform, or using syndicated research, in which the research is published and sold by a market research firm.

- The firm is usually industry-specific and is funded by several companies within a particular industry.

- Send surveys to a list of respondents via email

- This typically depends on having a list of the emails of consumers or prospective respondents.

- As such, it involves already having identified respondents by their emails at the very least.

- This can also be done via the Distribution Link feature.

Almost all of the above involve using the digital space for acquiring survey results — and for good reason.

Aside from the fact that we are in the digital age, most respondents prefer taking part in market research digitally. In fact, 71.6% of respondents prefer to answer a survey via online. That’s why it’s key to use the proper survey distribution method aside from just creating a good survey.

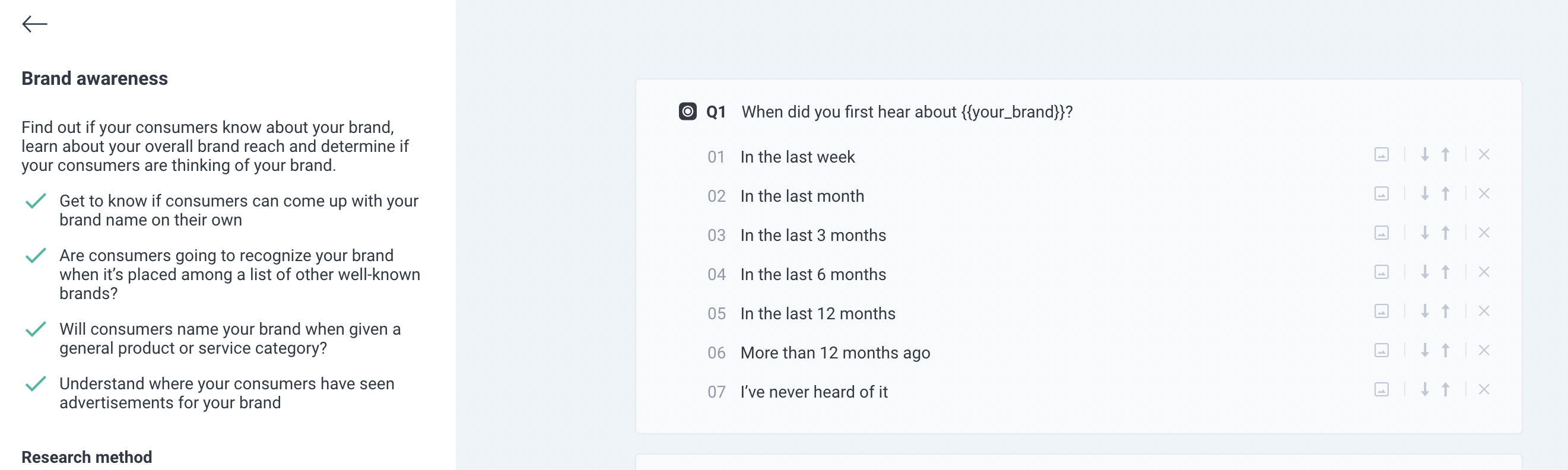

Deciding on the Right Survey Distribution Method

Once you’ve created your survey, or have decided to use a third party for your market research endeavors, you’ll need to consider the survey distribution methods to reap the most respondents — and in a timely manner.

After you’ve put effort into writing great survey questions and selected the perfect survey methodology, your survey is almost ready to go.

Only one problem—how do you choose the survey distribution method that lets you reach the right survey audience?

In order to get the data you want, you’ll need to ensure that you’re reaching the correct audience. As such, you’ll need to use survey targeting and gain enough responses to tell you what you need to know.

The truth is, there are as many ways to distribute surveys as there are to promote any other type of content.

At this point, you need to select the best way to distribute your survey to more respondents faster, and for less, without sacrificing data quality.

Let’s take a look at some of these available methods and how you may be able to find a better way.

Legacy Survey Distribution Methods Are Fatally Flawed

There are several methods to distribute your survey that have been in use for decades.

But changing times call for changing methods. The old ways of conducting surveys, while still in use among market research agencies and companies alike, are slow and prone to data quality issues.

Here are just a few of the issues with legacy survey distribution solutions:

Telephone Surveys

With so few people actually answering calls from unfamiliar numbers, there is diminishing effectiveness for this method in the digital age.

According to a 2017 study from the US Department of Health, 50.8 percent of American households are now smartphone-only, which only adds to the problem for phone surveyors.

In-person Interviews

These are time-consuming but can be effective for qualitative research. You can get in-depth responses and measure reactions and body language, but this limits your exposure to wide audiences.

Your survey may also be subject to interviewer bias. This method is also costly, as you have to pay for an interviewer’s time and convene an in-person panel.

Google Search Ads

You can advertise your survey via AdWords, but this can get expensive, as there is no guarantee that people who click the ad will finish the survey.

You also have to be really good at ad creation to get people to click the ad, not to mention needing to outrank anyone else for similar keywords.

But the biggest downside to this method for many researchers is AdWords doesn’t offer the level of demographic or psychographic filtering to make sure they are targeting the right audience.

Imagine you are a fisherman dropping a line in a river where a lot of fish are swimming. You have no idea the quality or type of fish you may find, and you may not catch anything at all. That’s why this method — using paid search ads or other web banners — is often called river sampling.

Panel Sampling

Recruiting members from an affiliate site to be a part of an ongoing market research panel is a tried-and-true method of getting survey respondents, and one of the most common legacy methodologies in use today.

It works because survey takers are constantly available, researchers can select and filter respondents by a variety of criteria and the cost is not typically prohibitive. But with people spending more and more time on their smartphones, researchers have begun to wonder if they can do better.

Panels are often fraught with data quality issues—professional survey takers rushing through surveys to get the incentives offered and get on to the next survey. They are also plagued with other issues. From acquiescence bias, to response bias, to panel conditioning, panels tend to have many forms of survey bias.

This is often due to less anonymity, panel fatigue and the fact that panels are not randomly established.

The latter is the cause of responses bias, which occurs when there is either an under or an overrepresentation of a certain segment of your survey target audience, as only certain types of respondents have been recruited to take part.

In addition, ask yourself the following: if you tap the same people to take surveys over and over, are you really getting a representative sample?

Distribute a Survey with 5 Better Survey Distribution Methods

Now that we’ve cleared up that the so-called “legacy” methods can’t be trusted, you’re naturally left to wonder. how can researchers go about getting more respondents for their surveys? What methods are the best alternatives?

A variety of newer survey sampling methods have been stepping up to challenge these legacy methods as the market research industry evolves. How do they hold up? Will they work for you? The answer to these questions is not merely a matter of preference, but the direction of your survey campaign.

For example, those who want to survey random respondents, those who they don’t have the contact information to, ought to leverage random device engagement. This will grant you more survey respondents and access to a vast sea of people who qualify as members of your target market.

Those who are active on social media and tend to engage with their consumers in this way will most benefit from sharing their surveys on their social media pages.

Researchers who don’t mind not wielding full control of their research study and seek to hand it over to a firm would best acclimate to hiring a market research agency, also known as conducting syndicated research.

As such, when considering the modern survey distribution methods lined out below, heed your preference, research style, work mannerisms, conveniences and your own experience.

Random Device Engagement

By far, the best way to distribute surveys is through a method called Random Device Engagement (RDE). This allows you to deliver surveys inside mobile apps, where consumers are engaged and can be easily incentivized non-monetarily. This eliminates the issues that arise when using professional panelists.

Panelists are not taking a survey in their natural environments; instead, they are pre-recruited, which means they are not fully anonymous. Thus, they may feel compelled to answer surveys in a particular way, which diminishes the accuracy of the survey study.

They are also prone to panel fatigue from constantly taking surveys. Moreover, they become influenced by certain questions, which then affect how they answer future ones. This is known as panel conditioning.

Random Device Engagement, a kind of random organic sampling, is the complete opposite approach, as it reaches and recruits respondents where they naturally frequent in the digital space. This means participation is completely voluntary, anonymous and randomized.

Because of these circumstances, respondents are more likely to answer accurately and avoid survey fatigue. After all, respondents’ identities are anonymous, as they have not been pre-recruited and vetted through interviews and the like.

What’s more is that RDE allows you to reach a wider scope of people and target market segments. This is because it is run (at least on Pollfish) across a wide network of site and app publishers that deploy your surveys.

The following explains how Pollfish distributes your survey to respondents using the RDE method.

By partnering with mobile app publishers, Pollfish has created a network of over 250 million potential survey respondents. Using information provided to app publishers, Pollfish allows you to create, target and deploy mobile-optimized surveys to consumers in minutes.

In exchange for taking your survey, app publishers may offer non-monetary in-app incentives (think an extra life in a game). Because these are not paid panelists, our 250 + million+ respondents create a truly representative sample of people not simply rushing through to move on to their next payday, and the savings are passed on to you.

In order to further prevent issues with false completes, Pollfish developed its own proprietary machine learning technology that screens out low-quality responses, leaving you with fast, high-quality consumer insights.

Share your survey on social media

Another online method of survey distribution looking to replace legacy methods is called Assisted Crowdsourcing. This method has benefits and some serious downsides, but is a fast, organic way of creating survey samples at scale.

Assisted crowdsourcing uses social media ads to target based on quota sampling criteria and creates a sample from ad respondents.

Because Facebook is an organic environment—people go there for the community aspect, not to take a survey—you eliminate the paid-survey-participant problem which is common among panelists.

Facebook collects so much demographic data that it is relatively inexpensive to target down to very small sample sizes. However, this method is not without flaws.

Because Facebook’s algorithm is built to show your ad to the person most likely to click on it, your sample is not truly randomized. The same goes for other platforms like Twitter and Instagram.

Thus, you are most likely to get respondents who already have a great deal of familiarity with the topic your survey covers based on past Facebook engagement. Because of this, respondents from this channel are likely to be biased rather than an impartial source of data.

Share your survey on your website or blog

If you have enough traffic and are interested in hearing mainly from people who are in-market for your service, sharing your survey on your website or blog could be a good option.

Because you own the channel, you can get a detailed look into the people who choose to fill out your survey. You can manage the elimination of survey bias, you can ask screening questions to target responses, and you can get as many responses as you are able to drive to your webpage or blog post.

This is the best option for businesses and organizations who only want to survey those who visit their websites and other digital properties (think mobile apps and gated content). As such, this segment of your target market is made up of people who are usually well-acquainted with your business.

You don’t need to wonder or jockey for their attention and awareness of your brand, as they are already visiting it online.

Keep in mind that this segment of your target market is not merely comprised of paying customers. Some site visitors may be doing digital window-shopping, making judgments on whether to use your products/services in the near future.

Other site visitors may be completely new to your business and are exploring it for the first time, whether it is due to finding you organically or getting recommended by their friends and family.

At any rate, sharing your survey across your digital platforms provides you with a strong means of tapping into the minds of people who are interested in your business.

Hire a Market Research Agency

Market research agencies with a background in statistical analysis have committed to randomly selecting people from a carefully crafted population that fits their client’s needs and reaching out to them. This ensures that the panel selected for the survey is truly representative.

Also referred to as syndicated research, the firms in this research method will use a variety of methods to collect survey responses at scale, but will carefully manage the selection process and eliminate bogus responses once the survey has concluded.

The best part about this is you can keep in touch with respondents after the survey has concluded.

But you are also at the mercy of big agencies, which, with their large rosters of clients, may take a while to get this all done.

In addition, in syndicated research, aka, using a firm to conduct your research for you, you do not own the data.

In fact, you will be hard-pressed to be the first to have access the data, as it will be shared with other proprietary actors, such as the other people and organizations involved in a research project.

Moreover, you will not be in charge of the research project. Instead, the research firm and the companies that fund the project will have complete say over its direction and course. In addition, the firm conducting the study won’t ask your specific questions or cover concerns specific to your business.

While it may deal with a similar topic in your line of research or even a close subject that you intend to study, the course of its research is ultimately up to the research firm.

Not only that, but the research firm may also send the research results to your competitors.

All in all, hiring a research agency, aka, taking the syndicated research route may be a good option for some, but not all.

We suggest you don’t use this form of research, as it is not proprietary to you, thereby granting you little control over how it is run and the kind of data you will get to keep.

Send Surveys Via Email

If you want to survey your target market, one of the best ways is by leveraging your existing client base.

You can survey your clients on a whole host of issues and topics. For example, you can email them to discover why they chose your company over others. You can also survey them on their thoughts about your latest product.

This is especially relevant since the reason many businesses have their customers’ emails is due to the customers having made an online purchase. Such purchases almost always involve using an email address, even when customers buy as guests.

Email surveys also grant you the option of creating a referral incentive program. In such a program, you can ask your existing client base to forward your survey to their friends and family. In turn, you would them an incentive for their help and what is essentially word-of-mouth marketing for your survey campaign.

However, be aware of the GDPR. If you buy a list to send your survey to, you may be in violation of Europe’s privacy laws.

How Is Pollfish Different?

We take a slightly different approach to reaching survey respondents in the Pollfish methodology, as we value the respondent experience aside from the data and the distribution method alone. In this way, the Pollfish platform goes beyond a bare-bones market research approach, making the entire experience enjoyable for both the respondent and the researcher.

- We have a 100% opt-in audience network, we don’t recruit or pay panelists.

- We distribute surveys through our vetted app-publishing partnerships, not through paid channels like Social Media, Google Ads, or Affiliates.

- We don’t force people to answer a survey to unlock premium content.

- We use alternative incentives to compensate respondents, rather than pay per survey or referral.

- Our surveys are optimized to be mobile-first, making for a good mobile experience that won’t agitate or bore respondents.

We have over 250 million respondents in our Audience Survey Network that we access through both site and mobile invitations. Our global reach extends to over 160 countries on over 140,000 app partners.

We do this by directly partnering with trusted app publishers, who are able to incentivize a respondent for participating in one of two ways:

- Publishers can provide in-app rewards for participation

- Survey respondents are prompted and are entered into a random drawing

Respondents must be in-app and match the targeting criteria set for your survey to be invited to participate, ensuring the right audience and rapid response times you need.

In addition, we use AI-driven fraud prevention technology to detect and remove responses that are suspicious or low-quality, ensuring that you’re only paying for responses that help your research project get the data you need.

You set the demographic criteria to reach your desired target audience on the platform, create your questionnaire, and we handle the rest.

Is Random Device Engagement Really That Much Better?

There are various ways that prove RDE is the superior survey distribution method, both for researchers and respondents alike. We have found that, by using this method,

- We get better survey respondents — they’re engaged in the app and generate higher survey response rates since they aren’t distracted by other outside influences. Because they’re not on a payroll, they’re less likely to rush through a survey to obtain the reward. If the subject matter isn’t appealing, they simply opt out of it and return to their app.

- We get faster response times, oftentimes in only a few hours, due to the large number of potential respondents engaged at any time.

- We provide a better survey respondent experience, since respondents can take a survey at their convenience, and are engaging with a survey designed for mobile devices that improves response rates and minimizes confusion.

There are many survey distribution methods, but only one that can give you access to over 250 million consumers for rapid, better data and insights on your survey topic.

Making the Most of Your Survey Campaigns

Surveys provide the gateway into a wealth of information, whether it is for market research or general research.

When it comes to the former, you can craft virtually any kind of survey and run any sort of business campaign — whether you need to establish emotional marketing, run PR surveys or increase your customer retention rate. You’ll just need to use the right online survey platform.

You should choose a platform that relies on random device engagement (RDE) sampling, which, to recap, permits you to reach consumers in their natural digital environments, instead of having to pre-recruit them. This removes social pressures and will cut back on biases.

You should also use a mobile-first platform, since mobile use dominates the digital space and no one wants to partake in a difficult mobile experience.

Also, the platform you select should offer artificial intelligence and machine learning to remove low-quality data, offer a broad range of survey and question types and disqualify unattentive respondents.

Finally, it should allow you to survey anyone. To do this, you’ll need a platform with a reach to millions of consumers, along with one that offers the aforementioned Distribution Link feature.

This allows you to send your survey to specific customers, instead of solely being able to deploy them across a network.

When you use an online survey platform offering all of these capabilities, you’ll never have to worry about how to distribute a survey again; the platform will do all the heavy lifting for you.

Random device engagement, coupled with an iterative distribution mechanism will obtain any respondent requirements and quotas that you assigned to your survey.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…