How To Select A Target Audience For Your Online Survey

Selecting the correct survey target audience is one of the most crucial steps when you conduct a survey. After all, your respondents are the subjects of the research, the entity that your survey campaign is almost entirely based on.

As a researcher or a business owner, you certainly wouldn’t want to survey the wrong audience. This will render your entire market research campaign useless, as it does not pertain to your particular target population.

Thus, to create effective survey studies that allow you to glean relevant and actionable insights, you’ll need to ensure that you target the correct survey audience.

This may appear to be challenging at best if not intimidating, as there are many components to choosing the correct survey targets.

Don’t fret — with the right online survey platform and methods of identifying and choosing respondents, this process is clear-cut and doable.

This guide explains how to select the right survey target audience for your online survey study, including its importance, what to look for, how to apply targeting methods, and more.

How to Select a Survey Target Audience: Table of Contents

- The Importance of Selecting the Correct Survey Target Audience

- Confusion from Selecting the Wrong Survey Target Audience

- What Your Survey Target Audience Is and Isn’t

- How to Select the Right Survey Target Audience

- Understanding the makeup of your target market

- Conducting secondary research on your target market

- Conducting primary research on your target market

- Use market segmentation to uncover the segments of your target market

- Understanding your customer personas

- Finding who in your market segments and personas to survey

- Selecting the proper survey sample size

- Sample Size and the Disappearing Rate of Return

- Real Insights Come from Real Consumers

- Hit The Target on Your Target Audience

- Hitting a Bullseye on Your Survey Audience

The Importance of Selecting the Correct Survey Target Audience

The need to select the correct respondents for your survey campaign may seem self-evident, yet there are aspects to this need that are less apparent. At any rate, you should understand the importance that your respondents, particularly the correct ones, hold in all your research campaigns.

The following list covers the importance of selecting the correct survey target audience

- Your survey target audience is composed of the subjects of your market research; they make up its core — along with the topic and purpose of your market research survey, along with its overarching campaign.

- As such, the correct survey respondents will steer the entire campaign in the right direction and produce effective surveys for a variety of campaigns.

- Your survey campaign can only yield accurate results if it is conducted on the proper audience. No matter how strong your survey method is, its results are useless if they do not pertain to the correct survey subjects.

- By surveying the correct target audience, you’ll be able to understand and satisfy your target market. As such, you’ll be able to be customer-centric. Customer-centric companies are 60% more profitable compared to companies that don’t focus on the customer.

- 56% of customers are loyal to brands that understand them. Thus, surveying your customers with the right survey audience is critical, as it will help spawn loyalty to your business.

- Doing so will give you accurate and precise results, allowing you to take proper action and avoid business risks.

- Loyalty breeds repeat purchases and continuous business. 65% of a company’s business comes from existing customers.

- It grants you a competitive edge in your market. Not all businesses conduct market research and not all that do conduct surveys on the proper audience.

Confusion from Selecting the Wrong Survey Target Audience

Despite the importance of studying the right survey target audience, not all companies are doing this correctly.

One of the most common issues we hear from Pollfish users is confusion over selecting the right target audience for their survey.

Selecting the right survey target audience is critical for market research success. Still, many rely on outdated methods to collect and target respondents.

Most market research companies use survey panelists—paid survey-takers incentivized to complete surveys for cash or airline points.

The panelists open data up to a host of issues. These market research participants may experience unconscious bias and fatigue from taking, or rushing to complete, multiple surveys.

This bias can skew results and lower data quality, especially when using smaller, more narrowly targeted audiences.

We don’t have these issues with panelists, because our survey methodology doesn’t use them to complete surveys.

What Your Survey Target Audience Is and Isn’t

Once more, we enter a topic that seems patently clear but isn’t as obvious as it appears. While your survey audience may be geared toward understanding your target market, it is not synonymous with it.

It’s vital to separate your survey target market audience from your target market. Your target market is the aim of your marketing and advertising campaigns. It is also considered to be the broad range of people who are most likely to purchase from you. It can be separated into smaller, distinct segments.

The process of segmenting your target market into smaller, more distinct, and manageable groups is known as market segmentation. (More on that in one of the following sections).

A survey target audience, on the other hand, is a different kind of target population. This audience refers to the people targeted for partaking in a particular survey campaign and sometimes, for a particular survey.

For example, let’s say your target market consists of men and women between 18-50 who are employed. One segment of this market is adults who earn at least $50,000 per year, while another can be those between the ages of 18-22, whose parents earn enough money to purchase from you.

But your survey target audience is even more narrow. It would consist of a more exclusive category of people who are most suited for your market research study. For example, you may want to study the effect of a certain ad group. These ads are targeted at specific market segments.

Or, you may seek to study which product features are most necessary for certain customer personas. In this case, you would need to target those personas and have them already identified.

How to Select the Right Survey Target Audience

If you seek to properly select and target your survey audience, you’ll need to consider everything that is involved in this matter. This doesn’t solely include the survey respondents themselves, but specific mechanisms, tools, and aspects that define them.

The following list lays out all the aspects of identifying the correct survey audience:

- Understanding the makeup of your target market

- Conducting secondary research on your target market

- Conducting primary research on your target market

- Using market segmentation to uncover the segments of your target market

- Understanding your customer personas

- Finding who in your target market segments and personas to survey

- Reaching your survey target audience

- Selecting the proper survey sample size

This process involves various kinds of market research, from primary to secondary and from quantitative market research to qualitative market research. The proper online survey software will allow you to execute all primary research campaigns while being a strong aid to your secondary research.

Let’s explore all eight of these aspects in more depth. Consider each as a step part of a process designed to ensure you select the right survey target audience.

Understanding the makeup of your target market

First things, first. If you’re conducting market research, as opposed to general research, you’re going to be studying your customers. Your target market is the broad range of customers most likely to purchase from you, along with the group most marketing campaigns are designed for.

As such, it’s key to first identify your target market, in the process of uncovering your correct survey target audience, which, as explained earlier, are two different audiences.

When you begin a business, chances are, you already have your target market in mind. If you’ve done any sort of market research, you also likely have a grasp of who these consumers are.

But if you are early on in your research, have noticed a market shift or simply need more information about the makeup of your target market, you’ll need to take heed of it. There are many ways to research your consumer base, as there are all kinds of market research techniques.

The first thing you need to do is consult your knowledge and your objectives. Ask yourself:

- Who am I planning to sell my product/service to?

- Who are the people who typically need my product/service?

- Who is unlikely to buy from my company?

- Should I attempt to persuade those outside or close to my target market?

These are just some of the preliminary questions to jumpstart your survey target audience identification, as you’ll need to know your target market before reaching out to its different segments.

Conducting secondary research on your target market

Conducting secondary market research is a key step in understanding your target market and survey audience. After you’ve mulled over the questions raised in the prior section, along with those similar to them, it‘s time to find their answers through secondary sources.

There is a wealth of information available on the Internet, along with other places, such as in-person trade shows, conventions, and trade magazines. The non-digital sources are often also available in the digital space. For example, there are many online events, such as webinars that discuss your industry and its customers.

To understand who belongs in your wider target market, you can look to your competitors. Who are they marketing to? Who do they produce content for?

Content marketing is critical, as it oftentimes includes findings of a company’s customers that they share on their blog and other digital platforms. It also shows you how to tailor your voice and tone to your consumers.

To specifically learn about your consumers and their habits, you can turn to research associations to find the latest stats on your consumers. Many of these sites aren’t free but provide invaluable information. As such, it may be worth investing in. These include sites like Statista, IBISWorld, and many others, which include quantitative and qualitative findings on your sector’s customers.

It is also key to use government sources for secondary data. This includes The U.S. Department of Commerce, which delves into the makeup of all kinds of industries and provides economic and population insights, along with the Census Bureau, which shows a portrait of the American economy, market sizes, populations, demographics, and more.

You should also draw information from blogs, news sites, and content-oriented websites, those that are focused on specific industries. These provide extremely relevant information about your niche and its consumers. Unlike statistics websites, these sites pertain to your sector specifically, so you can always expect to find information on your target market.

Educational institutions and MarTech platforms can also grant you secondary information on your target market.

While all of these methods are useful starting points and early research methods, they do not provide the kind of relevance and depth that primary research does.

Conducting primary research on your target market

Primary research is a critical part of identifying your survey audience, as it is for all kinds of studies.

That is because, unlike secondary research, which can be dated and doesn’t fully address your specific concerns and questions, primary research allows you to gain the most precise insights.

This is because primary research is the kind of research you conduct yourself, as opposed to collecting from already conducted and available sources that the previous section touched upon.

Primary research puts you in charge of the direction of your research campaign. This is usually the case, however, there are a few exceptions. These involve instances in which you do not fully conduct the research yourself, such as in the case of syndicated research.

Whenever you undertake research from a third-party firm, it is semi-primary, or partially primary, as you do not wield full control over the research campaign, or at least the conducting of the research.

The following lists common primary market research routes you can take when narrowing down your survey audience:

- One-on-one Interviews:

- This is one of the more intimate methods, as it involves speaking with your subjects directly. Interviews can be managed over the phone or in person. This involves the place of your business, such as a store or diner.

- Focus Groups:

- A focus group is a larger kind of interview, in which a group of about 6-10 participants answers questions in a group setting.

- The researcher in this technique acts as a moderator that manages the discussion among the participants.

- Focus groups can study subject matter experts or average consumers.

- Focus groups rely on open-ended, broad, and qualitative research questions.

- Field Research:

- This is an observational method for people in their natural environments.

- The researchers in this technique observe their subjects as they exist, without interfering with the outcome or behavior of a situation.

- This technique involves direct observation of customers and their surroundings.

- For example, a home goods business that seeks to observe how customers interact with a new line of their products. The business may conduct field research on in-store customers to study them in action.

- Surveys:

- This is the most robust market research method, as it allows you to gain answers to specific questions speedily — depending on the polling software you use.

- You can also use surveys to study any topic, even those with sensitive survey questions.

- Enterprise survey software is also the best survey distribution method, as it deploys surveys in different ways, such as through a vast network of publishers, such as popular websites and apps, or to specific individuals, for example via email or social media.

- A strong survey tool will enable you to:

- Set granular demographic requirements

- Ask a wide style of questions (multiple-selection, single-selection, ratings, etc.).

- Use advanced skip logic, which routes respondents to relevant follow-up questions based on their previous answers.

- Add media files and use multiple audiences per survey.

- Surveys can take many forms, such as business surveys, consumer surveys, and employee feedback surveys.

- Test Marketing:

- This technique involves testing the usage and opinions of a new product by selling it to a small segment of your target market.

- For example, in-home use test businesses test a new product by sending it to a customer’s home rather than sending the customer to a facility to try the product.

- Another example, is software brands test their market by using the “beta” versions of new features/products on a small group of likely customers. This method helps predict how a new product will fare in a larger market.

Use market segmentation to uncover the segments of your target market

Market segmentation is a major first step to understanding your target market in more depth. After all, your target market is a broad category of people that includes various segments and customer personas.

In market segmentation, researchers divide their brand’s broader target audience into smaller segments or subsets. These are classified based on different criteria such as demographics, customer behavior, needs, opinions, interests, and other standards to better categorize your target market.

By segmenting your customers into smaller groups, you will understand the full makeup of your target market. In addition, you’ll be able to more effectively target customers for specific survey studies, other forms of market research, and business/marketing campaigns.

Segmenting your customers will therefore ensure you understand the specific needs and customer buying behavior of different groups of customers. What’s more, is that you’ll be able to create more personalized experiences for them.

There are 4 ways to conduct market segmentation:

- Demographic Segmentation

- This deals with grouping respondents based on their demographic traits.

- In demographic targeting, researchers classify respondents based on their gender, age, education, race, ethnicity, occupation, marital status, income level, and more.

- Demographics is the most widely used type of segmentation. The importance of demographics should not be understated, as they help inform and drive all kinds of campaigns, from marketing to product and beyond.

- Psychographic Segmentation

- This kind of segmentation gets to the heart of your customers, or rather, the brain, as it segments them by psychologically driven aspects of their behaviors.

- As such, it divides customers based on their opinions, mindsets, values, personalities, and inclinations.

- The importance of psychographic data is manifold, as it enables you to reach a survey target audience efficiently, by knowing what they enjoy, value, and find important.

- This knowledge can shape how and where you reach or acquire customers.

- Researchers can create surveys centered on all kinds of psychographic aspects to understand the intentions and feelings of any consumer group.

- This segmentation is especially useful for qualitative research, as it helps pinpoint trends in opinions and uncover the causes and motivations behind actions.

- Geographic Segmentation

- This method segments customers based on their geographic location.

- Researchers can segment customers by country, territory, state, county, city, zip code, and more.

- Although this kind of segmentation is labeled as a kind of demographic category, given that it is a major type of segmentation, it is also a stand-alone category.

- This segmentation is essential, as respondents within different geographical regions have their own sets of needs, preferences, desires, and limitations.

- Geographic segmentation is especially useful for real estate market research. It’s also a must for quantitative research, as you’ll need to make generalizations about customers in particular areas.

- Behavioral Segmentation

- This can be considered a kind of psychographic segmentation, one that focuses specifically on behaviors.

- As such, it involves dividing markets by behaviors and behavioral patterns.

- The focus is on actions such as consumer purchases, loyalty, lifestyle, usage of certain products/services in an industry, device preferences, and brand interactions.

- These behaviors are crucial to know so that you can create a more tailored marketing approach and better user experiences. That is because this segmentation allows you to understand how your customers make purchases and by how much.

- You can conduct this segmentation via an RFM analysis, which measures the recency, frequency, and monetary value of customers.

- Firmographic Segmentation

- This segmentation is used in B2B market research, a kind of research that studies other businesses, as opposed to consumers.

- Zeroing in on organizations, this is a kind of demographic segmentation.

- As such, this method studies aspects such as company industry, type, size, employee count, and age factors.

- Researchers can use it to aid competitive analysis along with understanding consumers from the perspective of their employment.

- This segmentation is chiefly crucial for B2B businesses, as it helps discover how to market to other companies.

- You can conduct this segmentation with B2B surveys.

Understanding your customer personas

Identifying your customer personas is similar to market segmentation, except it narrows customer groups down even further. Customer personas are granular versions of market segments, as they represent individuals.

These individuals are fictitious, but they represent common examples of people in your market segments. A customer persona is a detailed description of a member of a business’s target market. It possesses all the traits of a distinctly defined, granular target market grouping.

As such, personas are a kind of customer character. These can also be considered customer profiles, as each persona has its profile depicting its demographic, psychographic, and other traits.

The following lists the different categories factored into a customer persona:

- Demographics

- Psychographics

- Behaviors

- Pain Points

- Objectives

- Lifestyles

- Workstyle

- Personality

- Goals

- Information consumption

The above features some of the most critical factors of customer personas. Keep in mind that others can contribute to these personas.

Essentially, identifying your personas is a kind of hyper-segmentation. The biggest difference is that each persona is so narrowed down, that it represents a character, as opposed to a group.

Finding who in your market segments and personas to survey

After you’ve narrowed down your target market into segments and identified a few unique customer personas, it is time to decide who to survey.

As such, this step is the core of selecting a survey target audience.

Luckily, by this point, you’ve already identified the key players in your target market. When it comes to who to include in your online survey, you’ll need to consider your survey campaign at large.

Consider the following about your survey campaign/ business need to help you choose your survey target market:

- What is its purpose?

- What insights do you hope to gain from it?

- What part of your business will it serve? (Growing your subscriptions, defining product needs, etc).

- Is it tied to a specific location?

- This is where geographic segments and personas matter

- Will it require studying multiple customer segments?

- Will you need to zero in on your target market even further?

- How much research will you need? (A single survey or multiple iterations)

- What kind of research are you going to launch? (Longitudinal studies, cross-sectional studies, etc.)

- Are you looking to gather insights on new segments/personas or those you already have some information about?

- Are you seeking to branch out into new markets?

When you answer a few (or all) of these questions, you’ll be able to have a solid understanding of who is best to survey. Thus, you’ll know who to select for your survey target audience, which as you can tell by now, is a hyper-granular selection of your larger target market.

Selecting the proper survey sample size

Aside from knowing who to survey, another key consideration for any survey campaign is how many respondents to survey. That’s where the survey sampling size comes into play.

Also referred to as a sampling pool, this metric is usually determined concerning the estimated size of the entire population under study.

Before we dive in, there are a few key questions you’ll want to answer. If you aren’t sure, Pollfish has several handy tools that can help you along:

- What is your population size? Determine the entire set of people you want to understand. For example, if you wanted a random sample of students in a high school, your population size would be the total number of students attending that high school.

- What is your margin of error? An acceptable margin of error used by most survey researchers typically falls between 4% and 8% at the 95% confidence level. It is affected by sample size, population size, and percentage. Calculate the margin of error.

- What is your confidence level? This measures how certain you are that your sample accurately reflects your population of interest. A 95% confidence level is most commonly used. Calculate your sample size.

Before we approach the final step of the target audience selection process, which is reaching your audience, it’s important to understand the sample size and the disappearing rate of return,

Sample Size and the Disappearing Rate of Return

Your sample aims to provide a statistically accurate representation of the larger population so that assumptions can be made about that population based on the sample.

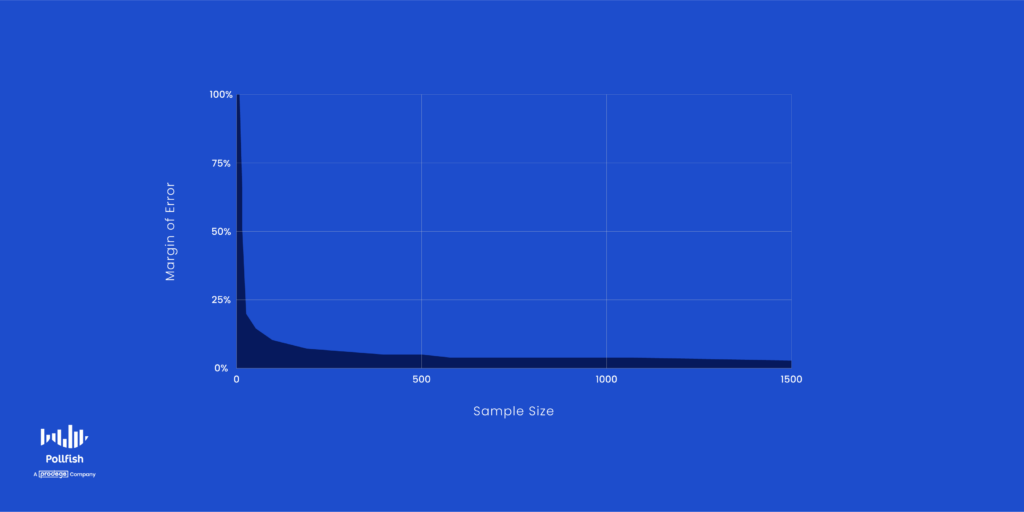

The key to choosing the correct sample size is reaching enough respondents for statistical accuracy and a lower margin of error. Typically, a larger sample size will deliver a lower margin of error up to a certain point.

The graph below shows where the relationship between margin of error and sample size turns into a diminishing rate of return.

Our Targeting page will help you by suggesting an increased number of responses if your sample size appears to be too low. Generally speaking, you should include a minimum of 400 responses to attain statistical accuracy.

In addition, our Targeting Tool will immediately show valuable information like total cost and estimated completion time to help you understand the full scope of your survey project.

Reaching your survey target audience

You learned how to select your survey target audience, composed of distinct segments, personas, and sample sizes. Now it’s showtime, that is, time to distribute your survey.

There are all kinds of survey distribution methods, from the aforementioned syndicated research to polling software. We suggest using the latter, particularly, an online survey platform that offers different options for deploying your survey.

It should allow you to survey specific people, such as via email, or whichever digital channel you seek to use, such as social media, landing pages, post-purchase, etc. As such, you ought to use a platform that offers the Distribution Link feature, which allows you to send surveys to specific individuals, or through digital channels of your choosing.

In addition, your survey software should allow you to reach a wide pool of people. This allows you to satisfy all your respondent requirements, which are going to be granular, and to do so in a quick period.

In addition, this allows you to conduct research via Random Device Engagement, which targets and gathers respondents where they voluntarily exist in different digital channels.

These methods grant you the flexibility and convenience to reach a wide swath of consumers at scale and speed.

As such, choose your online survey provider wisely.

Real insights come from real consumers

Pollfish is the brainchild of app developers who have built a massive, worldwide survey audience of engaged, mobile consumer respondents from over 160 countries.

Instead of panelists, we randomize the distribution of your survey to over 250 million mobile app and website users that fit your exact targeting criteria in exchange for a non-cash incentive set by our app publisher partners.

These can include anything from extra points in a game they are playing, to unlocking premium content from a news app.

The result is a survey experience that is seamless and non-disruptive to the user. They can opt-out at any time and continue using the app without issue.

If they do decide to cruise through the survey without reading or answering questions with responses that raise red flags, we remove them using our proprietary AI-based fraud protection.

And the best part is, because Pollfish grants you a direct line from your questions to the mobile phones of your most engaged customers, you don’t have to wait around for your survey provider. Just build your target audience, enter your questions, and get results back quickly.

Hit The Target on Your Target Audience

Once your sample size has been set, our targeting criteria make it easy to narrowly define your ideal target audience.

Use a selection of targeting parameters to define the ages and gender of your target audience.

We also offer quotas if you are looking to reach specific distribution surveys.

Our demographic and geolocation factors make it easy to be even more selective, allowing you to choose from over 160 countries, all the way down to the radius of the respondent in many cases.

Our demographic criteria include race, household income, occupation, marital status, and more.

Additionally, we are the only platform that can target mobile usage, as well as their carrier, OS Platform, or even which apps they may have installed on their devices.

To target users based on behavior, use our Screening Question feature. We offer up to 3 screening questions, so you can disqualify any respondents who aren’t meeting your exact population of interest.

Screening questions help determine:

- Who might be shopping with a competitor

- The frequency at which they perform a specific activity

- Other important behavioral questions for the most niche audience selection.

Hitting a Bullseye on Your Survey Audience

While selecting the most ideal survey target audience may seem long-winded and tiresome, it will all be worth it for your survey campaign, and most importantly, the purpose of your campaign, whether it is to increase revenue, create more brand awareness, etc.

But don’t worry, the right survey platform will simplify this process, leaving you with more time and energy to place into your survey campaign and your broader business campaigns.

As such, you ought to opt for the online survey platform that offers the aforesaid distribution methods. In addition, your online survey platform should be able to facilitate your entire survey process, from targeting to questionnaire building, filtering data, and more.

Ideally, it should provide various quality and technical checks to ward off survey fraud, offer a mobile-first survey environment, and allow you to survey anyone, not just via on-network through the RDE method (although this method is incredibly effective).

Remember, Pollfish offers 24/7 service and support. Just visit Pollfish.com and chat with our CX team today. They can guide you through setting up your survey, defining your perfect target audience, and launching your survey today.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $1 per complete. Launch your survey today.

Global GSK Shingles Survey Insights

Original Insights,The Pollfish Blog

February 24, 2024

Shingles misconceptions: new global survey commissioned and funded by GSK highlights widespread…

B2B Sales Emails: Are they Effective or a Nuisance?

Original Insights,The Pollfish Blog

September 6, 2022

Are B2B sales emails a thorn in your side? Do they drive you crazy? Virtually all white-collar…